The Last Time This Happened, The Price Of Silver Surged 150%

Image Source: Pixabay

Silver Prices Setting Up to Skyrocket?

If you like silver, you need to pay extra attention right now. The price of silver is doing something that shouldn’t be ignored or brushed aside.

In fact, a massive move to the upside could be in the making. The last time this happened, the price of silver soared 150%.

What the Silver Chart’s Saying

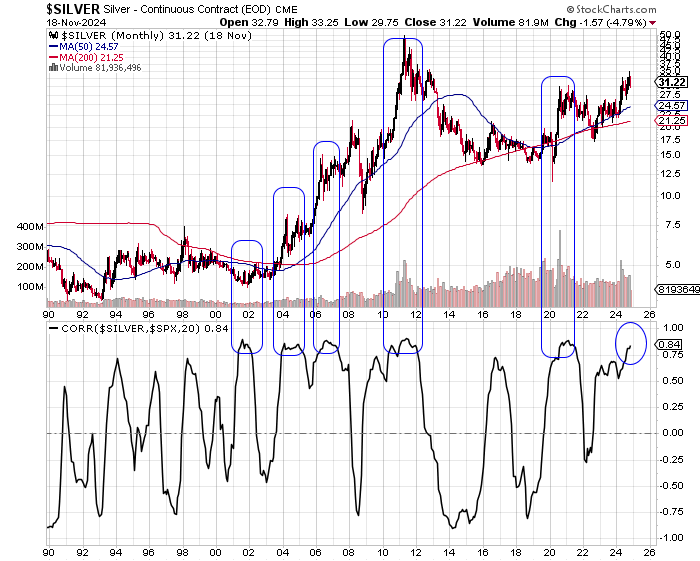

Take a look at the SILVER chart below that plots the prices of the precious metal. At the bottom of the chart, the correlation between the S&P 500 and silver prices is shown.

You see, whenever the correlation between the silver and the S&P 500 crosses 0.75 (essentially meaning that they are highly correlated), there’s also a very strong performance by the gray precious metal. This pattern has repeated over and over again.

Chart Courtesy of StockCharts.com

Price of Silver Jumped as Much as 233%

First, let’s go back to between late 2000 and early 2002, when the correlation between the price of silver and the S&P 500 crossed 0.75. From the lows to the highs during this period, silver jumped roughly 30%.

Fast forward to between late 2003 and early 2005 and the correlation crosses the 0.75 mark again.

Guess what?

This time, silver soared over 70%.

Mind you, had an investor just held the precious metal from late 2000 to early 2005, they’d have generated a return of 100%.

Then, between 2006 and 2008, the pattern repeated itself. This time around, silver rallied roughly around $10.00 an ounce to $20.00 an ounce, gaining 100% very quickly.

The 2010 to 2011 period represented a truly amazing couple of years for silver investors. During that time, the correlation between the S&P 500 and the price of silver was at work, too. However, the gains this time were much more robust.

Silver prices skyrocketed from around $15.00 an ounce to $50.00 by middle of 2011. This represents an increase of over 233%.

Once again, in 2020, the correlation between the price of silver and the S&P 500 crossed the 0.75 threshold. This time, the gray precious metal made a very sharp turn, going from around $12.00 an ounce to well above $30.00 an ounce. This represents an increase of 150%.

Why the Price of Silver Could Go Beyond $50.00/Oz

Now, dear reader, the correlation between the price of silver and the S&P 500 has crossed above the 0.75 mark once again. This happened around August 2024. Since then, the price of the precious metal has increased about 10%.

Given how silver has acted before, it’s not an out-of-the-world idea to think that a lot more upside could be ahead. If we just take the average return of silver prices when the precious metal become highly correlated with S&P 500, it’s around 116%. This means, we could be looking at silver prices in excess of $50.00 an ounce much sooner than later.

How to Speculate When Silver Surges

How can investors play this stellar increase in the price of silver?

Silver bullion could be a good starting point, but for those who are seeking leveraged returns and are willing to take some risk, silver miners could be the place to be.

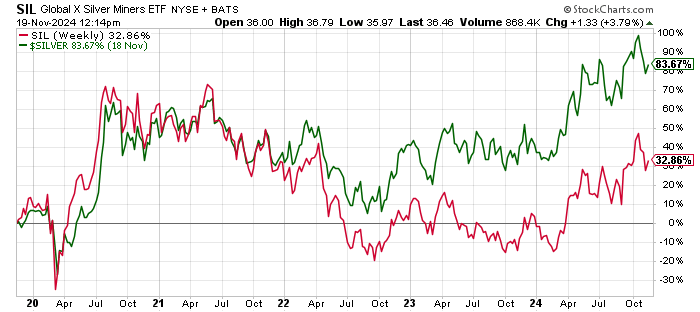

I will leave you with the chart below. It plots the performance of silver prices and Global X Silver Miners ETF (NYSEARCA: SIL), an exchange-traded fund (ETF) that hold silver miner stocks.

Chart Courtesy of StockCharts.com

Over the past five years, silver miners have really lagged behind the price of the precious metal. As the price of silver has soared close to 84%, miners have only gone up around 33%.

If silver price surges past $50.00 an ounce, will miners continue to lag?

I think they could actually provide colossal returns.

More By This Author:

Is Warren Buffett Expecting A Stock Market Crash?

Outlook On Price Of Gold: 30% Downside A Blessing In Disguise?

U.S. Inflation Rate’s Down… But for How Long?

Disclaimer: There is no magic formula to getting rich. Success in investment vehicles with the best prospects for price appreciation can only be achieved through proper and rigorous research and ...

more