Is Warren Buffett Expecting A Stock Market Crash?

Image Source: Pexels

Americans All-in: A Stock Market Crash Looming?

Warren Buffett is known for saying, “…we simply attempt to be fearful when others are greedy and to be greedy only when others are fearful.”

The idea behind this is very simple: when everyone wants to buy stocks, it might be time to pause and reflect, as a stock market crash could be around the corner. When you notice investors panic-selling, a great opportunity could be in the making.

Here’s something worrisome to consider: we may be getting to a point where investors are way too greedy these days, and are just “all-in” on stocks. Sadly, mainstream financial media isn’t doing a good job at documenting this.

How can one tell this is happening?

Well, the data are loud and clear…

Consider this: 62% of Americans own stocks—this is a 20-year-high.

Looking deeper into the numbers: 87% of upper-income Americans, 65% of middle-income Americans, and 25% of lower-income Americans own stocks. (Source: “Charted: American Stock Ownership Back at All-Time Highs,” Visual Capitalist, August 8, 2024.)

Stock Market Ownership Through the Roof…

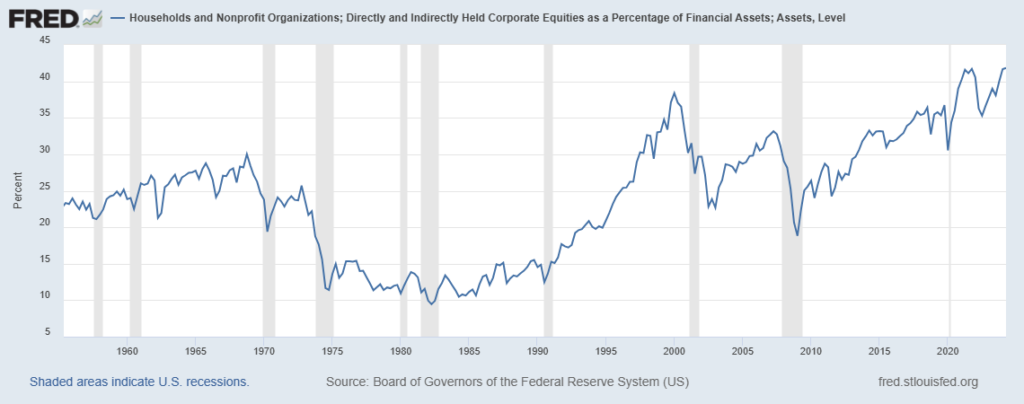

As a percentage of total assets, U.S. households and non-profits held 41.8% in stocks as of the second quarter of 2024. This is the highest percentage on record. Prior to this, it was around 41.7% in 2021 and a little over 38% in early 2000. Take a look at the chart below to get a better idea.

(Click on image to enlarge)

(Source: “Households and Nonprofit Organizations; Directly and Indirectly Held Corporate Equities as a Percentage of Financial Assets; Assets, Level,” Federal Reserve Bank of St. Louis, last accessed November 6, 2024.)

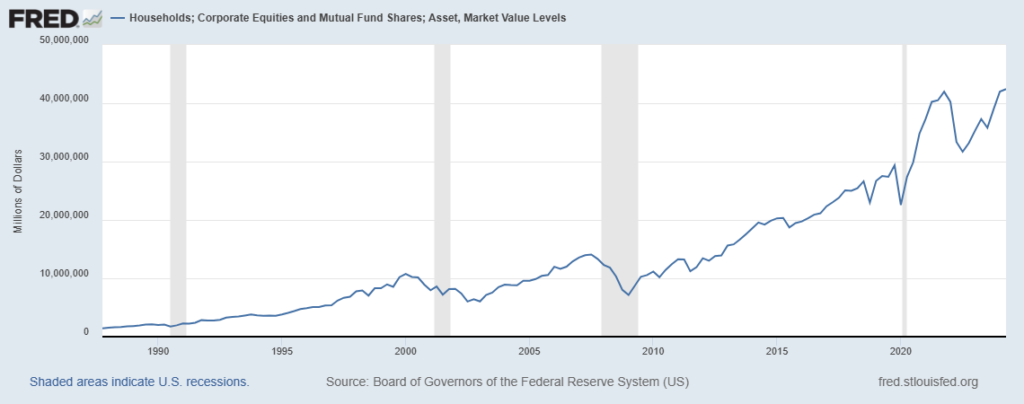

And the amount of stock ownership is immense, too. As of the second quarter of 2024, U.S. household stock and mutual fund ownership hit $42.4 trillion. That’s the highest on record.

See this other chart below to get a good idea of what it looks like.

(Click on image to enlarge)

(Source: “Households; Corporate Equities and Mutual Fund Shares; Asset, Market Value Levels,” Federal Reserve Bank of St. Louis, last accessed November 6, 2024.)

Is Buffett Expecting a Stock Market Crash?

Americans remain highly invested in the stock market. Sentiment indicators also suggest that investors love stocks and have no problem owning them even when valuations are sky-high and fundamentals are deteriorating a bit.

With all this happening, what do you think Warren Buffett is doing?

In its more recent quarter, Berkshire Hathaway Inc (NYSE: BRK-A), a multinational conglomerate led by the legendary investor, reported a cash position of $325.2 billion. This is the most cash Buffett’s firm has ever held. Berkshire Hathaway is really holding back on major acquisitions and cutting some of its biggest stock positions, like Apple Inc (Nasdaq: AAPL).(Source: “Berkshire Hathaway’s Cash Pile Reaches Record $325.2 Billion,” Yahoo! Finance, November 2, 2024.)

Dear reader, everything I’ve just discussed today doesn’t represent a recommendation to sell everything and to go all-cash. That’s certainly not my point.

On the contrary, one makes money by remaining in the stock market for the long term. However, there are times when stocks are riskier, so extreme caution should be practiced.

It may not be a bad idea to follow in the footsteps of Buffett and focus on capital preservation and being selective when it comes to allocating capital. As rosy as everything looks, a stock market crash could still in the works.

More By This Author:

Outlook On Price Of Gold: 30% Downside A Blessing In Disguise?

U.S. Inflation Rate’s Down… But for How Long?

Gold Prices Outlook: $4,000-An-Ounce Gold Could Be In Play Sooner

Disclaimer: There is no magic formula to getting rich. Success in investment vehicles with the best prospects for price appreciation can only be achieved through proper and rigorous research and ...

more