The Ethereum Merge And Energy Markets

One thing that the energy crisis has made clear is that energy is the common denominator into everything. Energy is literally what keeps us alive - many, many moons ago it was fire, the release of energy through combustion, and of course, now our energy comes in the form of electricity, central heating, gasoline, etc.

Energy is also the common denominator to crypto (if you’re a crypto skeptic and huff at the mere mention of the word - just hang on).

There are two big things happening in the world right now, surrounding *both* energy and monetary policy - Central bank decision making and the Ethereum Merge.

-

The goal of both the central banks and Ethereum is to influence an underlying economic system.

-

The merge will change how Ethereum operates, as it shifts from Proof-of-Work (PoW) to Proof-of-Stake (PoS), and central bank’s monetary policy decisions will influence how their domestic - and the international - economy functions.

What is the Merge?

Ethereum will finalize the merge from Proof-of-Work (PoW) to Proof-of-Stake (PoS) on September 15th, which basically means the main Ethereum blockchain is merging with something called the Beacon Chain, a PoS blockchain. Bankless has a good write up on what it means, but the main thing is that this will make Ethereum more scalable, sustainable, and secure.

What’s the difference?

-

Proof-of-Work: Miners compete to solve cryptographic problems in order to earn the right to add a new block onto the blockchain and are awarded with tokens.

-

Proof-of-Stake: Users "stake" tokens to earn the right to become a validator of the blockchain and are chosen to become validators pseudo-randomly, depending on a set of factors (size of stake, age of stake).

Proof-of-Stake will use 99.95% less energy than Proof-of-Work and rely on capital rather than computing power for security and execution. PoS is much more energy efficient, but money itself is energy, in a way.

The Importance of Energy in Crypto and in Policy

Energy is still the common denominator. And it gets everyone into trouble.

-

One thing that Ethereum’s move to PoS highlights is how *important* energy is - the energy intensiveness of PoW is what helps to keep Bitcoin secure but it’s also getting it into trouble with the U.S. government.

Energy also gets *governments* into trouble.

I published a full YouTube on what’s going on right in energy markets, but the oversimplified version is -

-

How did we get here? European energy policy was designed to *really* focus on renewables at the cost of stability and independence, with resulted in over-reliance on Russian gas (despite huge red flags, like Russia annexing Crimea in 2014) which got us to where we are now, with Russia invading Ukraine and still having an energy lever of life-or-death over the EU.

Recently, the G7 nations discussed putting a price cap on Russian gas to meet their goal of “putting downward pressure on global energy prices while denying Putin revenue”

-

Russia did not like that, and said that they were going to close Nord Stream 1 indefinitely, which is the main gas pipeline between them and Europe. This isn’t great because it will impact how much energy Europe can store for the winter.

-

But no one really wins here.

-

Russia is trying to price out various deals with China (ruble-yuan gas payments) and offering discounts to other countries but their infrastructure is largely designed to go *into* Europe. They are constrained by their pipes and sanctions are having an impact.

-

But the Nord Stream cut off could reduce any wiggle room that EU might have had going into colder seasons, especially if the weather is extreme like it was over the summer. They have energy constraints, and weather is a variable that they cannot control.

Within the forces of weather and supply and demand, all they can manage is the latter.

Controlling Supply

-

Money talks: Europe is going to have to pay a lot for energy on the global markets. Right now, they can buy energy from China because China has a relative abundance from their rotating lockdowns but of course, the irony there is “as Europe attempts to wrestle out of its dependence on Russia for energy, the irony is that it is becoming more dependent on China”

-

But actual supply is even more important: It will also be important to ensure that supply is able to be up and running - over the summer, French nuclear plants were shut for maintenance, there wasn’t enough wind, and there were droughts, so no hydropower.

-

And solutions primarily revolve around price: Germany is now forced to lock in LNG contracts for the next 15-20 years (from the U.S., who is the largest exporter of LNG to the bloc now). To manage supply gaps, they plan to cap revenue of energy producers, a potential cap on gas prices, and some put in some supply and demand targets

This also leads to reliance on supply alternatives, like coal - which China is heavily rotating into, but that has its own problems such as workers raising alarm bells over aging equipment and falling safety standards. In oil markets, OPEC has cut production over worries over a global economic slowdown. So supply is becoming increasingly shaky - leading to the only other real lever, which is demand control.

Controlling Demand

There are three things that Europe has to manage here -

-

Ensuring markets don’t implode because of margin calls and liquidity issues

-

That people are able to stay warm and keep their businesses open

-

That energy companies still produce energy

Of course, it’s more complicated than that (especially across 27 states with varying climates) but they need solutions. Germany has said that partial rationing will likely be needed in the winter. The U.K. has decided to freeze gas and electricity bills for the next two years, which is good from the sense that households need support right now, but also not great for incentives.

Source: Matthew Pines

The only way to control demand is to really be like “hey stop” and that is politically very unpopular. This gets into crypto.

Proof-of-Stake in Energy Markets

As I mentioned earlier, one of the supply levers that Europe has been able to use to get energy is various deals with China.

-

China is going in and out of lockdown, and as the top energy importer in the world, they have a surplus of natural gas right now - so of course they are going to enter into a deal with Europe.

-

Europe has also been outbidding the rest of the planet, putting countries such as Pakistan and India in tough spots as they try to find their own energy sources (hint, it circles back to Russia).

What’s interesting about this model is that it’s *sort of* similar to how Proof-of-Stake (PoS) works - those that can pay the most win the game1 which is what Europe has excelled at. And of course, that’s really how all markets work - it’s a game of chess, sure, but money knocks all the pieces off the board. In the EU right now, the “the wholesale electricity price is set by the last power plant needed to meet overall demand” meaning that the most expensive source of energy (gas) often sets the price of electricity.

-

This sort of works how PoS does - validators are chosen randomly, but size and age of stake are core parts of being selected.

-

The outcome is a bit different thought - Europe’s system is meant to benefit renewables because they will theoretically have a higher profit margin here

But zooming out again (that was a lot of tangentials) - there is #stakefromhome that shows people staking Ethereum from home. There is a potential market mechanic lesson in there for energy markets too - encouraging more individual action on energy markets - not just from controlling demand (stop using energy) but from controlling supply (produce your own energy) too.

Of course, this is a little pie-in-the-sky idea, and these sorts of systems and credits are already in place - but encouraging solar panel usage, rain barrel collection, etc., etc. - where everyone can participate in the broader system similar to #stakefromhome might be a good thing.

The Psychological Impact of Gas Prices

Back to the anchor of reality - gas prices. For both Ethereum and the macroeconomy, gas prices set the vibes. They are a core input into consumption, and determine how much people use a product - using DeFi protocols or driving around.

-

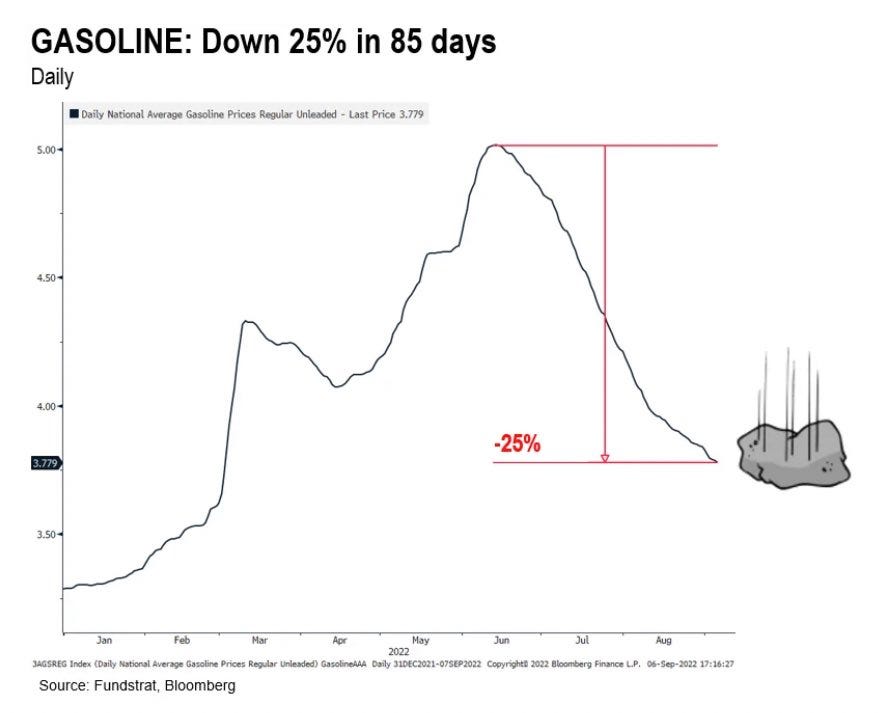

Real gas prices have been cratering. When gas prices are low, everyone feels better because you no longer have to see $6.50 A GALLON blaring on every street corner.

Source: Carl Quintanilla

It changes how people feel about politics too. Essentially if you can modify the sticker price of what people spend a lot of money on (or see the most often) their outlook is going to change.

Of course, OPEC is not a fan of the current oil situation, leading them to cut production, but falling gas prices really impact consumer sentiment. It’s a psychological hack of sorts - the lower the price, the more ‘wealthy’ people probably feel on the margin, which has a compounding effect.

The Power of the U.S. Dollar

The U.S. (despite what people might say!) is doing okay. Tighter monetary policy and the relative strength of the U.S. economy has provided some upward pressure to the dollar, giving it that coveted safe haven status.

-

The August ISM services PMI came in strong2, initial jobless claims came in lower than expected, gas prices are falling, used car prices are falling, the unemployment rate ticked up because of more people entering the workforce, not layoffs - it's looking generally okay in the U.S.

But as Claudia Sahm points out -

Fed rate hikes causing the dollar to skyrocket should be half of the questions to Jay at the next presser. The US is spending billions of dollars to support the war effort Ukraine, while our monetary policy is crushing Europe and emerging markets.

A stronger dollar puts pressure on emerging markets AND developed nations.

The Fed made it pretty clear that they are going to hike rates by 75 bps at their next meeting, with Powell not really addressing it at his Cato speech (meaning implicit permission for 75, I LOVE the games) which likely means more dollar strength - and strain on other economies - moving forward.

Final Thoughts

Everything is intertwined. The dollar impacts energy, energy impacts policy, policy impacts consumption, consumption impacts production, etc etc. It’s a system, and some parts are fraying a little bit right now.

What’s interesting about all of this is that liquidity is key - that’s one of the concerns as the Fed begins to really shrink their balance sheet - who is going to buy stuff? The Bank of America was like “we are seriously concerned about the liquidity in the Treasury market and it gives us major 2008 vibes” which is not good.

There are liquid molecules - gas, oil, nuclear - and then there is liquid money. You can’t have one without the other and both are wobbling a bit.

One thing that I sincerely like about crypto is that it dares to ask the question - “what if our systems *were* different?” - which is a really important to think about! It’s really easy to get lost in ZeroHedgeism which only bemoans the Current Thing versus actively proposing a change for a Future Thing.

But constraints are really hard to visualize. The energy crisis that is happening in Europe (really, the world) is scary mostly because it challenges status quo without a super clear solution. The innovation sometimes outpaces the inputs, and we seem to be headed towards that direction.

But in positive news and outlook, Tsung Xu3 has a series of really excellent articles, and at the end of his clean energy transition piece he talked about what his vision for 2045 looked like. Some select pieces -

-

All electrons are generated from renewables in all wealthier countries, and most middle income ones and most existing industries are electrified, all are low-carbon

-

Batteries serve as the primary connective tissue for energy.

-

CO2 from the air is a key commodity

I think there are reasons to be optimistic about our energy future, but it requires looking at the world a bit differently (perhaps learning some lessons from crypto!), recognizing our current constraints, and continuing to build towards something better.

More By This Author:

Everyone Is Impacted By The Energy Crisis

Quiet Quitting Is Actually Quite Loud

Hypertakeflation and the Sportification of the Fed

Disclaimer: These views are not investment advice, and should not be interpreted as such. These views are my own, and do not represent my employer. Trading has risk. Big risk. Make sure that you can ...

more