The Cross Of Silver

The Cross of Silver

One hundred twenty five years ago, William Jennings Bryan gave his famous "Cross of Gold" speech, arguing that the gold standard was metaphorically crucifying farmers and workers, who would benefit from a less deflationary silver standard. Looking at silver returns this year, one might say precious metals investors are being metaphorically crucified on a cross of silver.

Silver Skull (Matthis Volquardsen/Pexels).

Unfortunate First Half Silver Picks

Our system hasn't been unscathed by silver this year either. Each day the market is open, it gauges stock and options market sentiment to rank thousands of securities by its estimates of their potential returns over the next six months. On May 27th, three silver names made our system's top ten: First Majestic Silver (AG), the iShares Silver Trust (SLV), and ProShares Ultra Silver (AGQ) (Silvergate Capital (SI), despite its name, isn't in the silver business; it's a crypto bank).

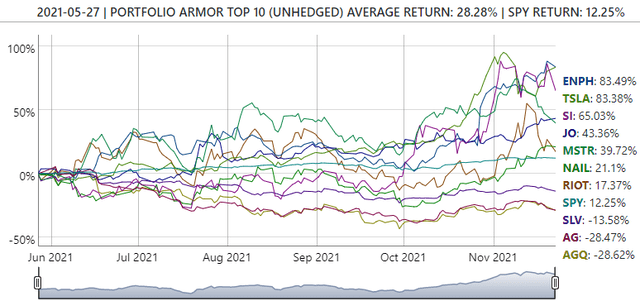

Screen capture via Portfolio Armor on 5/27/2021.

Silver Sinks

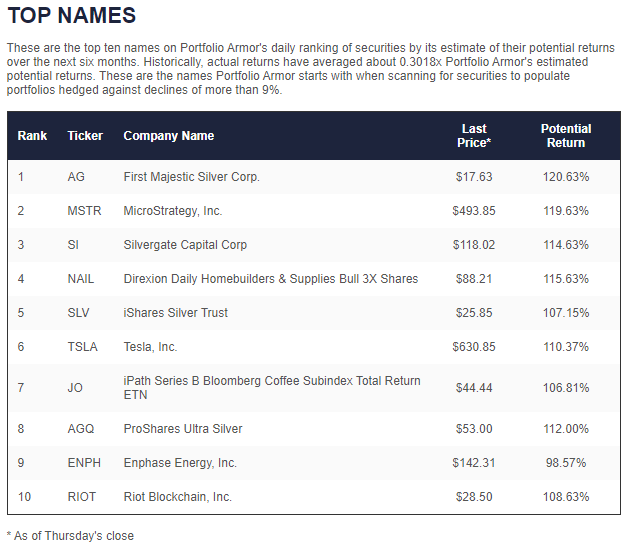

As you can see below, all three silver names have sunk since.

SLV was down 13.58% as of Monday, AG was down 28.47%, and AGQ was down 28.62%.

Succeeding Despite Silver

Despite those three silver names sinking double digits since May 27th, our top ten names from then were up 28.28% as of Monday's close, more than double SPY's return of 12.25% over the same time frame, thanks to the performance of names like Tesla (TSLA) and Enphase Energy (ENPH). Still, having three silver names out of ten has been a big headwind for us.

How has holding silver hindered your performance this year?

Disclaimer: The Portfolio Armor system is a potentially useful tool but like all tools, it is not designed to replace the services of a licensed financial advisor or your own independent ...

more