The Case For Gold Now II

We’re hitting peak inflation and yet the dollar remains as strong as it is. That doesn’t point to a meaningful recovery for gold prices – Shannon Saccocia, Chief Investment Officer SVB Private (quoted in WSJ)

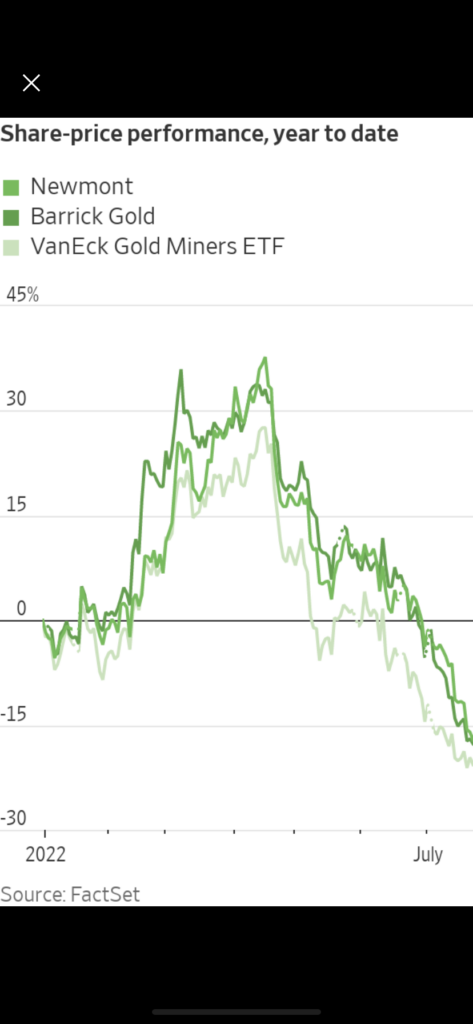

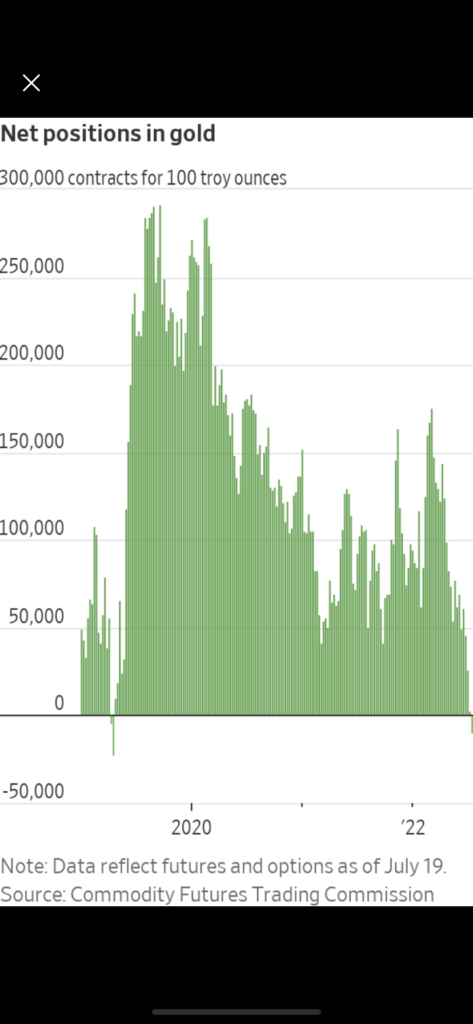

It’s been a long, miserable trip for gold investors. Everybody loves to make fun of gold bugs. And now – even with inflation at 40-year highs – gold can’t catch a break. An article in Monday’s WSJ – “Gold Prices Hit By Higher Yields, Stronger Dollar” – made it clear to me how hated gold is right now. For example – as you can see in the chart above – futures traders are net bearish on the gold price for the first time in three years. While there have been a number of false starts – including one at the beginning of this year – and I wrote: “The Case For Gold Now” (April 9, 2021) more than a year ago I’m back to take another swing.

(Click on image to enlarge)

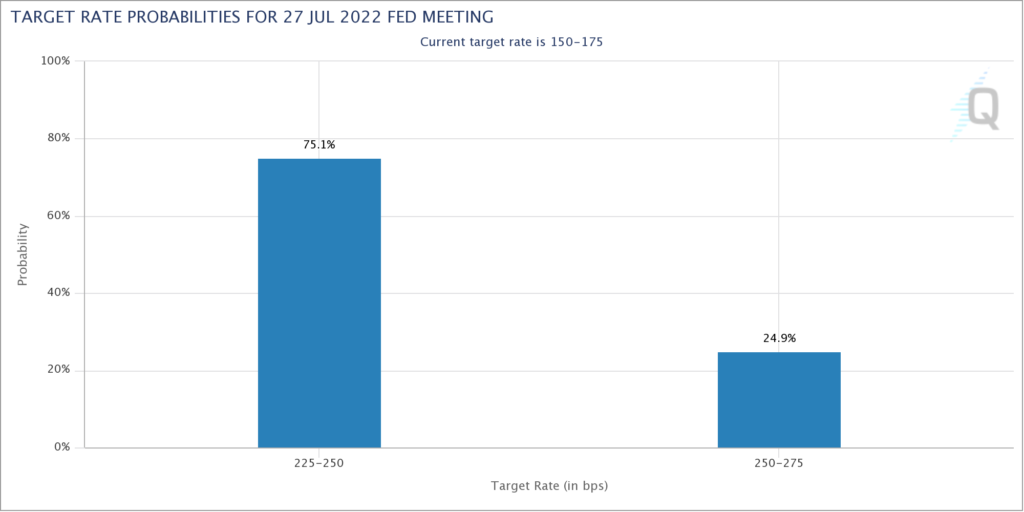

The consensus view is that we’ve passed through Peak Inflation as the Fed has shown its willingness to do whatever it takes to crush it. However, I’m sensing a slight pivot in the Fed’s stance. After the hot June CPI Report two weeks ago, investors started thinking the Fed would raise 100 basis points this Wednesday – but the Fed very quickly started walking that back. The clear consensus now is for 75 basis points. And my feeling is that after another 50 basis point hike in September which would take the Fed Funds rate to 2.75%-3.00%, the Fed might be ready to pause and see if it has already done enough on the inflation front.

If inflation proves stickier than expected as in the 1970s – which is my view – now just might be the perfect moment to buy the precious metals and their equities. It’s been relatively easy for the Fed to raise interest rates so far as they have political support. But the “critical junctures” i.e. hard decisions are still ahead of them if inflation does prove sticky – and Powell hasn’t yet proven that he’s Volcker 2.0. If we are indeed in for a 1970s redux, the current shakeout in the precious metals has been a nasty one but gold bugs will have the last laugh.

More By This Author:

Oh SNAP!

Commodity Stocks Will Rally If The Fed Stays In Line

Will The Fed Please Shut Up