Commodity Stocks Will Rally If The Fed Stays In Line

(Click on image to enlarge)

(Click on image to enlarge)

Subjective Chart of Interest - Copper. pic.twitter.com/VeUjZSCU7b

— Nautilus Research (@NautilusCap) July 20, 2022

It’s been an extremely volatile year for commodity stock bulls like myself. During the first quarter, the stocks marched relentlessly higher along with inflation and commodity prices while the second quarter was the mirror image of the first as the Fed became increasingly hawkish about bringing down inflation. However, I’ve stuck with my positions out of the conviction that inflation won’t be so easy to tame and I believe they’re ready to rally again if the Fed stays in line.

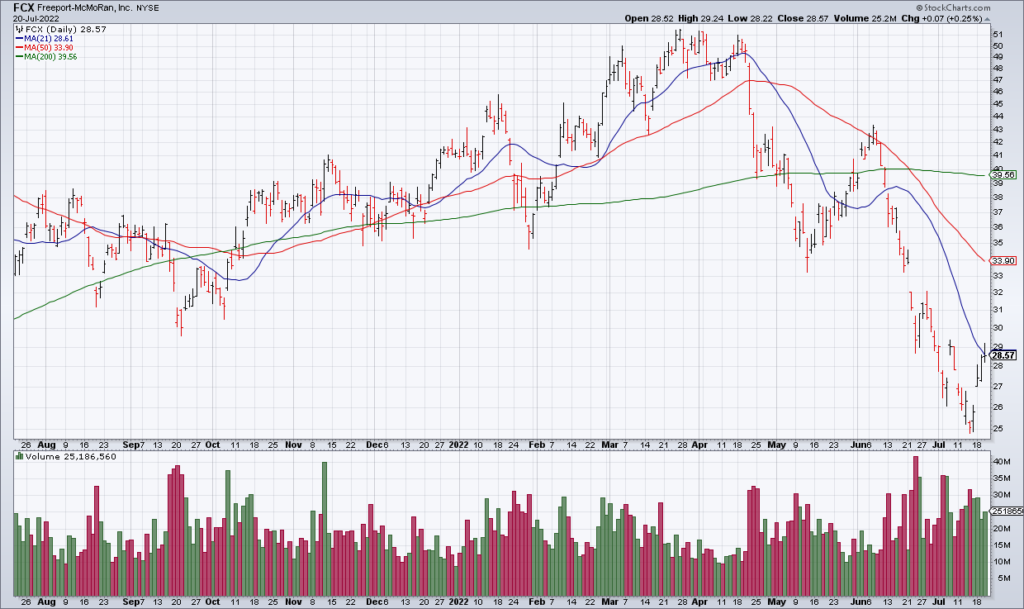

Two of my positions – copper producer Freeport McMoran (FCX) and steel producer Steel Dynamics (STLD) – reported earnings yesterday afternoon and the results look fine to me. FCX’s copper and gold production were excellent and while prices for both metals have obviously come down significantly FCX’s average selling prices held up well. I see FCX earning at least $2.50/share this year which means the stock is trading for a max of 11x current year earnings.

STLD also executed well as steel production and shipments were strong even though pricing came off its highs. I see STLD earnings $20/share this year which means it’s trading for ~3.5x current year earnings.

As you can see in the charts at the top of this blog both stocks have suffered brutal drawdowns in recent months. But if the Fed stays in line – by which I mean a 75 point hike next week and 75 or 50 in September – I think these stocks have bottomed. And if inflation proves sticky as I expect, the long term secular commodities bull market is still intact.

More By This Author:

Will The Fed Please Shut UpTimiraos: Fed Wary Of Repeating 1970s Error

Recession Fears Seep Into Fed Expectations