That '70s Show Redux

The 1970s Bear Market Analog

On Saturday, ZeroHedge reported that Wall Street's most accurate analyst, Bank of America's chief investment strategist Michael Hartnett, sees a strong parallel between our current market environment and the bear market that occurred during the 1970s:

Hartnett next echoes what we said yesterday in our discussion of the BOE's shocking decision, which we said confirms the worst stagflationary case for the economy. According to the BofA strategist, the BoE projected UK CPI >10% by Oct'22, cut '23 GDP forecast 150bps to -0.25%; in other words, 10% inflation, 0% growth the living definition of stagflation.

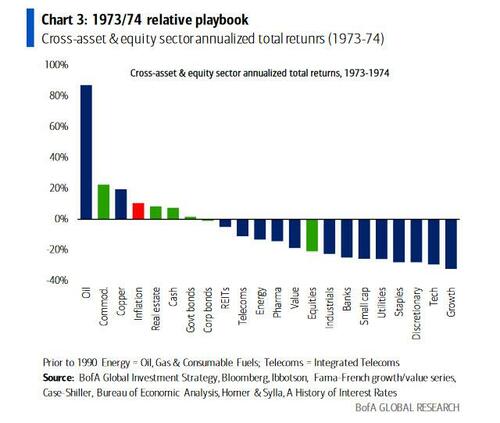

It's why to Hartnett, the correct relative playbook is 1973/74 and it shows that cash and commodities beat bonds & stocks (esp consumer & tech; note Big Tech starting to ape Nifty 50 crash).

Take a look at the chart above and note that the best performing sector in 1973/74 was oil, and the second-worst was tech (at the time, the Arab oil embargo in the wake of the Yom Kippur War played a similar role in limiting supply that Western sanctions on Russia have in the wake of the Ukraine War).

Positioned For An Early '70s Redux

As I've mentioned before, Portfolio Armor's system doesn't consider the macro picture when selecting its top names. Instead, it gauges underlying securities and options market sentiment to estimate which names are likely to perform the best over the next six months. Nevertheless, that bottoms-up approach often reflects a macro picture, and the picture our system painted with Friday's top ten names bears a striking resemblance to Hartnett's '73-'74 analog:

Screen capture via Portfolio Armor on 5/6/2022.

Recall that oil was the top performing sector during the '70s bear market. On Friday, four of our top ten names were oil names: ProShares Ultra Bloomberg Crude Oil (UCO), United States Brent Oil Fund LP (BNO), United States Oil Fund LP (USO), and VanEck Vectors Oil Services (OIH). Three of our other long names were in energy, ProShares Ultra Bloomberg Natural Gas (BOIL), United States Natural Gas Fund LP (UNG), and Peabody Energy Corp. (BTU); our eighth long name was in fertilizer, The Mosaic Co. (MOS); and our top ten was rounded out with two short names, ProShares Short Russell2000 (RWM), and Direxion Daily Technology Bear 3x Shares (TECS).

So, to recap: four of our ten top names were long oil, the best performing sector during the early '70s bear market, and one of our top ten names was a levered bet against technology, the second-worst performing sector during the '70s bear market. It's nice to see our top names were so closely aligned with the predictions of Wall Street's most accurate analyst.

An Important Way Today Is Worse Than The 1970s

Reading Michael Hartnett's parallels between today's market environment and the 1970s, I am struck by a jarring difference between then and today. The early '70s were a period of Détente, a relaxing of tensions between the United States and its largest geopolitical rivals, the Soviet Union and China. In 1972, President Nixon visited both Beijing and Moscow. History.com recounts the results of Nixon's diplomacy with Moscow:

He and Brezhnev signed seven agreements covering the prevention of accidental military clashes; arms control, as recommended by the recent Strategic Arms Limitation Talks (salt); cooperative research in a variety of areas, including space exploration; and expanded commerce. The salt treaty was approved by Congress later that summer, as was a three-year agreement on the sale of grain to the Soviets. In June 1973, Brezhnev visited the United States for Summit II; this meeting added few new agreements, but did symbolize the two countries’ continuing commitment to peace.

The contrast between then and now is striking. Today, the United States is in a proxy war with Russia in Ukraine, while unnamed U.S. officials are leaking to the New York Times that U.S. intelligence helped kill Russian generals and leaking to NBC News that U.S. intelligence helped sink Russia's flagship in the Black Sea.

At the same time, the United States State Department is poking the Chinese dragon over Taiwan.

Very worrying sign of the direction the US is taking.

— Arnaud Bertrand (@RnaudBertrand) May 8, 2022

The State Dpt removed from their website the fact they recognize that Taiwan is part of China (under PRC gvt) and that they don't support Taiwan independence.

Left: 3rd May. Right: today, 8th May (https://t.co/OxeRgdSq7h) pic.twitter.com/ktlxBGTdoU

Essentially, we have the World War III risk of the early 1960s (Cuban Missile Crisis) with the stagflation of the 1970s. Let's hope cooler heads prevail.