Technical Tuesday: Gold Outlook, Copper, AUD/NZD, USD/CAD

Image Source: Unsplash

In this week’s report, we are getting technical on the gold outlook, as well as the copper, AUD/NZD, and USD/CAD outlook.

- Gold outlook: XAUUSD defends bullish trend for now

- Copper outlook: Metal bounces off the long-term trend line

- USD/CAD outlook: Loonie poised for a potential breakdown

- AUD/NZD outlook turns bullish as RBA surprises with a hike

Welcome to Technical Tuesday, a weekly report where we highlight some of the most interesting markets that will hopefully appease technical analysts and traders alike.

Gold Outlook

Thanks to the dovish re-pricing of the Fed rate hike expectations on the back of a weak U.S. ISM Services PMI, the technical gold outlook has brightened somewhat.

Gold bounced right where it needed to on Monday to keep the Bulls happy. The precious metal held its bullish trend line after an earlier dip was bought, resulting in the formation of a hammer-like candle around the $1935/40 support area.

What we want to see next from a bullish point of view is some upside follow-through now to scare away the bears. If the bulls can manage to reclaim $1980 then this would further boost the technical appeal of gold.

However, if the trend line breaks first then this could pave the way for a deeper retracement, although it won’t necessarily be the end of the long-term bullish trend.

(Click on image to enlarge)

Source: TradingView.com

Copper outlook

The long-term chart of copper looks bullish. It shows prices have bounced off the beautiful trend line on the weekly time frame, where we also have the 200-week moving average coming into play. On the daily time frame (see inset), we can see a small higher high, thus confirming the bullish reversal. This could be a significant technical development in a commodity that has great long-term upside potential, owing to the ongoing drive towards electric cars and greener energy. But in the short term, it will face a bumpy road, reflecting a weak, inflation-hit, global economy.

(Click on image to enlarge)

Source: TradingView.com

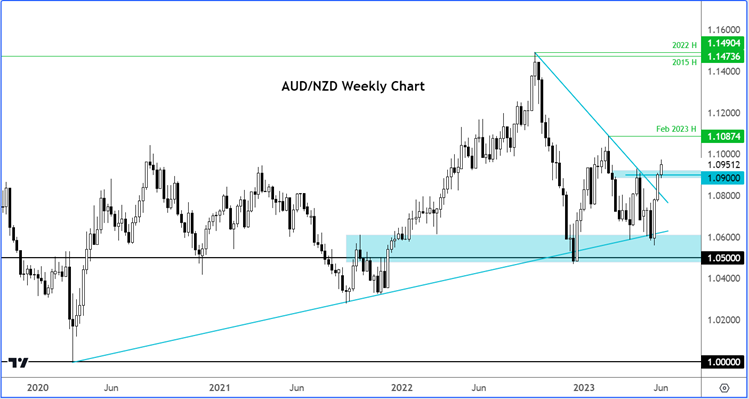

AUD outlook, NZD outlook

The Reserve Bank of Australia decided to hike interest rates once more overnight and lifted the cash rate by another 25bp to a 13-year high of 4.1%. This caught some traders by surprise and thus lifted the AUD sharply higher. With the RBA likely to maintain a contractionary policy in place for longer, as it battles to tame inflation, this could lift the AUD/NZD a lot further, especially with rates having broken above the bearish trend line and resistance circa 1.09. The technical breakout means the path of least resistance is now to the upside. Momentum-chasing traders may add further fuel to the rally. Thus, we would favor fading the dips back to support this FX pair.

(Click on image to enlarge)

Source: TradingView.com

USD/CAD outlook

Will the Bank of Canada do what the RBA did and hike interest rates, against market expectations of a hold? If it does, the USD/CAD could drop like a rock. The USD/CAD could also drop if it proves to be more hawkish than anticipated. But at the time of writing, it was coming noticeably off its earlier lows as oil prices continued to fall despite the latest pledge by Saudi to cut its oil production by 1m bpd in July and OPEC+ deciding to extend their existing agreement of output cuts through to the end of 2024.

Still, the USD/CAD outlook is clearly bearish, from a technical standpoint anyway. The breakout above the trend line couldn’t hold last week, which means we now have a failed breakout scenario to provide an overall bearish bias on the USD/CAD outlook from a technical point of view. This implies that the USD/CAD is most likely heading to levels where trapped traders’ stops would be resting. One of those levels was below 1.3500, the base of the previous breakout that ultimately failed. This area has now been cleared. The bigger liquidity pools are likely to be below 1.33 and 1.32, given the multi-month higher lows that have been created between these levels.

Previous support levels such as 1.3450, 1.3500, or 1.3550 could turn into resistance. Among these levels, 1.3500 is perhaps the most important one, as we have the 200-day average and the underside of the broken trend line also converging there.

On the flip side, this bearish technical setup will become weak should rates go on to climb back above 1.3550 resistance in the coming days. And a potential move above last week’s high and next resistance at 1.3650 would mark a significant turning point, as that would completely invalidate the bearish setup.

(Click on image to enlarge)

Source: TradingView.com

More By This Author:

Currency Pair Of The Week - USD/CADUS Dollar Extends Losses Ahead Of NFP

EUR/USD Analysis: Cooler Inflation Fails To Shift ECB Hike Bets

Disclaimer: The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such ...

more