Stocks Start December Mixed As "Fear Gauge" Cools

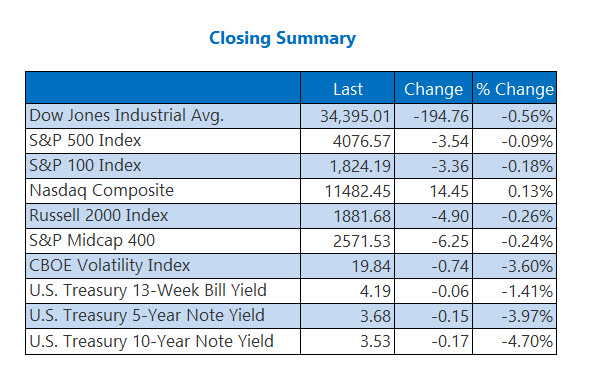

Stocks were all over the place to kick off the final month of 2022. Investors unpacked a host of economic data throughout the day, though Wall Street remains heavily fixated on tomorrow's jobs data. The Dow finished with a 194-point loss, the S&P 500 pared steeper losses but ultimately finished lower, and the Nasdaq finished with a marginal gain. Elsewhere, Costco (COST) weighed on the retail sector today after sales slowed in November, while the Cboe Volatility Index (VIX) closed below 20 for the first time since Aug. 18.

The Dow Jones Industrial Average (DJI - 34.395.01) lost 194.8 points or 0.6% for the day. Nike (NKE) paced the gainers with a 1.3% win. Salesforce.com (CRM) dragged the blue-chip index with an 8.3% loss.

The S&P 500 Index (SPX - 4,076.57) dipped 3.5 points, or 0.09% for the day, while the Nasdaq Composite Index (IXIC - 11,482.45) rose 14.5 points, or 0.1%.

Lastly, the Cboe Volatility Index (VIX - 19.84) shed 0.7 points or 3.6%.

GOLD NABS BIGGEST GAIN IN OVER 2 YEARS

Oil prices rose for the second straight day, amid hesitantly upbeat inflation sentiment and the loosening of Covid restrictions in China. West Texas Intermediate (WTI) crude for January delivery rose 67 cents, or 0.8%, to settle at $81.22 a barrel -- the highest close for the front-month contract in two weeks.

Gold futures posted their largest one-day gain since April 2020, with February-dated gold adding $55.30, or 3.1%, to settle at $1,815.20 an ounce. This marks the first time gold has settled above the psychologically significant $1,800 level in nearly four months.

More By This Author:

Major Indexes Falter Amid Busy Week For Economic Data

Dow Reverses Course For 737-Point Win Amid Renewed Fed Optimism

Economic Data In The Spotlight Ahead Of Fed Minutes