Dow Reverses Course For 737-Point Win Amid Renewed Fed Optimism

Wall Street kept a close eye on Federal Reserve Chair Jerome Powell's speech at the Brookings Institution in Washington, D.C. today, and the central bank leader's comments seemed to be just what markets wanted to hear, after signaling smaller rate hikes in the future. Powell in his address said "it makes sense to moderate the pace of outrate increases as we approach the level of restraint that will be sufficient in bringing inflation down."

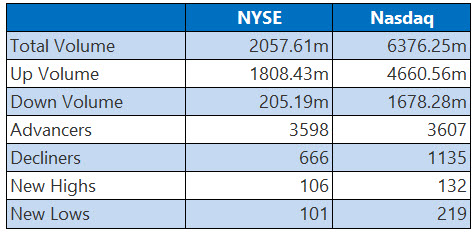

In response, stocks roared to life, with the Dow reversing its midday losses to log a 737-point win, while the S&P 500 and Nasdaq both surged as well. Additionally, all three indexes logged their second-straight monthly wins. Meanwhile, bond yields dropped in response to the news, with the 10-year Treasury yield falling below 3.712%.

The Dow Jones Industrial Average (DJI - 34.589.8) added 737.3 points or 2.2% for the day. Microsoft (MSFT) paced the gainers with a 6.2% win. Walmart (WMT) led the laggards with a 0.4% loss. It added 5.7% in November.

The S&P 500 Index (SPX - 4,080.11) gained 122.5 points, or 3.1% for the day, while the Nasdaq Composite Index (IXIC - 11,468.00) rose 484.22 points or 4.4%. The former added 5.3% for the month, and the latter enjoyed a 4.3% monthly pop.

Lastly, the Cboe Volatility Index (VIX - 20.58) shed 1.3 points or 6% for the session. It lost 20.4% for the month.

GOLD NABS FIRST MONTHLY POP SINCE MARCH

Oil prices rose for the day, thanks to a sharp drop in U.S. crude inventories. However, the tension surrounding China's Covid-zero policy, among other indicators, sent the commodity to a monthly loss. The front-month, January-dated crude added $2.35 cents, or 3%, to trade at $80.55 per barrel, though it shed 6.9% for the month.

Gold dropped for the day, as prices settled around the same time as Powell's speech. However, the precious metal logged its first monthly pop since March amid relative weakness of the U.S. dollar and slipping Treasury yields. The now most-active, February-dated gold fell $3.80 or roughly 0.2%, to settle at $1,759.90 an ounce, for the month, it gained 7.3%.

More By This Author:

Economic Data In The Spotlight Ahead Of Fed Minutes

Stocks Settle Mostly Lower Despite Reprieve In China Unrest

Stocks Fall Midday Despite Sentiment Shift Overseas