Stocks Finish Higher As Chip, Bank Stocks Drive Optimism

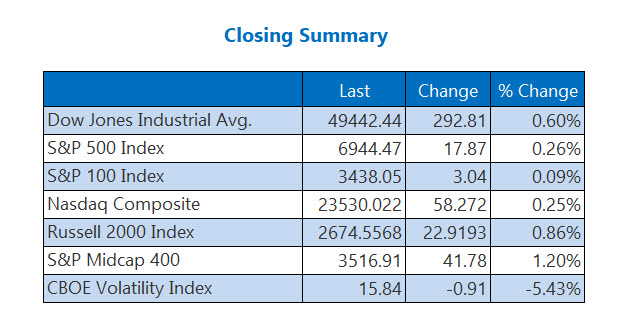

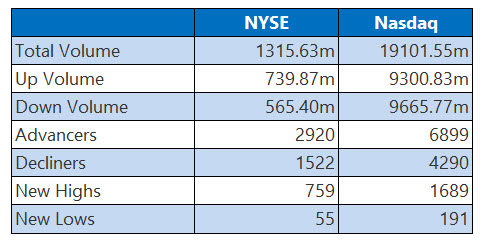

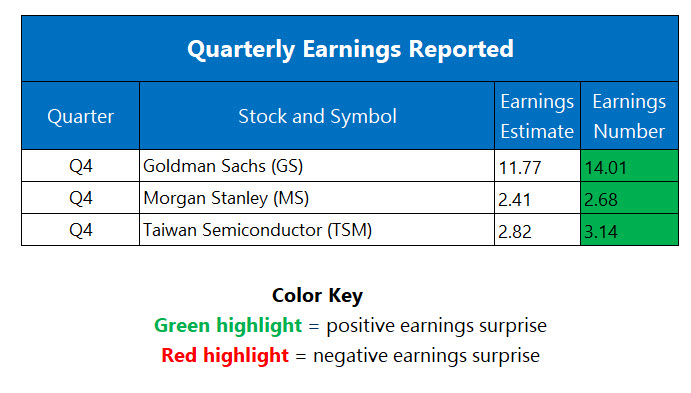

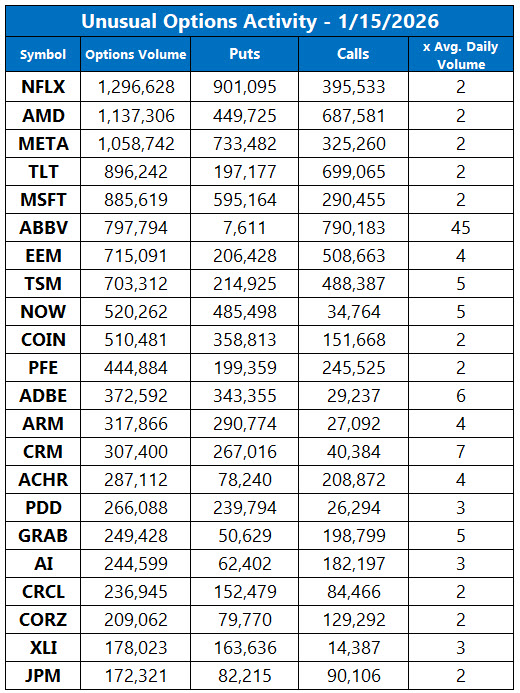

Stocks charged higher on Thursday, with strong results from Taiwan Semiconductor Manufacturing (TSM) and Morgan Stanley (MS) driving gains in the semiconductor and bank sectors. Plus, the Department of Commerce announced a $250 billion investment from Taiwan to build chips and chip factories in the U.S. as part of a new trade deal. The Dow rose triple digits, while the Nasdaq and S&P 500 finished firmly higher as well. Also contributing to today's optimism was jobs data, which pointed to a resilient labor market.

GOLD, OIL PRICES IN RETREAT MODE

Oil prices slipped on Thursday, as a potential U.S. attack on Iran seemed less likely. Front-month West Texas Intermediate (WTI) crude fell to $2.83, or 4.6%, to settle at $59.19 per barrel.

Gold prices cooled off as well, as investors unpacked jobs data, a stronger U.S. dollar, and geopolitical tensions. February-dated gold futures shed 0.3% to settle at $4,623.70.

More By This Author:

Semiconductor Surge Sends Dow Over 400 Points Higher

Stocks Slide As Tech Chips Away At Broader Market

Fed Concerns Pressure Dow, Nasdaq Down Triple Digits