Stocks And Precious Metals Charts - A Managed Unwinding Of Bubble Assets

Today was a risk off day, with the commensurate flight to safety that occurs sometimes when the dawn of reason breaks through the fog of the mispricing of risk.

VIX surprisingly did very little. This to me is a strong sign that this, at least for now, is a managed unwinding of bubble assets by a select group of relative insiders.

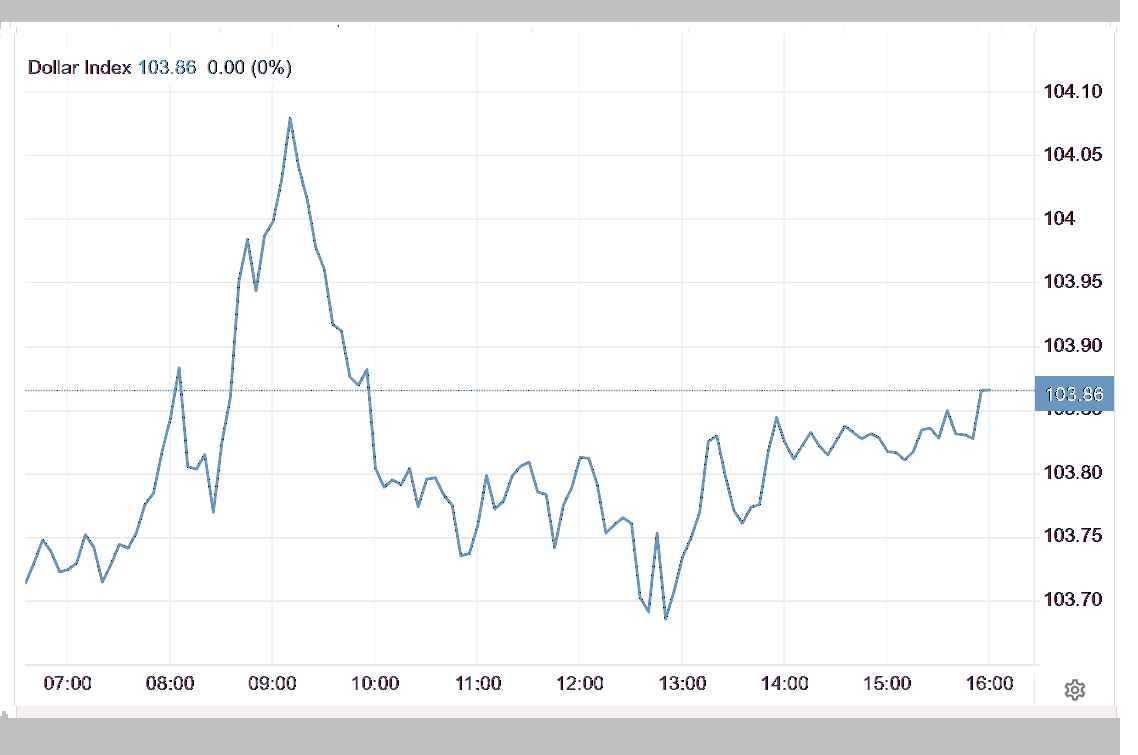

The Dollar rose.

Gold and silver soared.

Gold futures continuous contract tagged the 2999.7 level today before close a few dollars lower.

Silver took out the prior managed resistance and just thrashed it with some authority.

That Gibraltar of safe havens, Bitcoin, fell back down to the 80,000 level.

Like fools, a new meme coin seems to be born every minute, severely diluting the hot money crowd.

Stocks are hitting some 'must hold' levels. The slow managed decline suggests that we may not be done with this unwinding, flash relief rallies notwithstanding.

Have a pleasant evening.

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

More By This Author:

Stocks And Precious Metals Charts - A Small RallyStocks And Precious Metals Charts - Gold And Silver Bounced

Stocks And Precious Metals Charts - The Selloff Continued