Silver Price Forecast: XAG/USD Tanks Toward $23.20s Ahead Of U.S. Nonfarm Payrolls

Silver price extended its losses for the second consecutive day after hitting a nine-month high around $24.54 on Tuesday, plunging more than 2%. Robust labor market data in the United States (US) increased speculations for further tightening by the Federal Reserve (Fed), as shown by US Treasury yields rising. Therefore, the XAG/USD is trading at $23.20 after hitting a daily high of $23.91.

US employment data dampened traders’ mood. Private hiring increased in December, as the ADP Employment Change report showed the US economy added 2345K jobs crushing estimates. Some minutes following the release, the US Department of Labor (DoL) revealed that Initial Jobless Claims for the last week fell to their lowest level since late September, at 204Kvs. 225K estimated. The same report flashed Continuing Claims contracting to 1.694M less than the 1.708M expected.

At the same time, the US Department of Commerce (DoC) revealed that the US Trade Balance for December shrank its deficit, printing $-61.51B against the $-73.0B foreseen.

Moving aside from the releases of US data, the XAG/USD extended its losses after opening on the back foot since the Asian session. During the European session, Silver dropped to its daily low at 23.18 though it bounced back to the $23.60 area. Nevertheless, once American traders got to their desks, the US Dollar (USD) resumed its uptrend, to the detriment of dollar-denominated commodities.

The US Dollar Index (DXY), which tracks the value of the American Dollar against a basket of six currencies, is gaining 0.86%, back above the 105.000 mark, one factor that keeps the precious metals pressured. In the same tone, US Treasury bond yields are recovering some ground, with the US 10-year benchmark note rate up five bps at 3.739%, a headwind for the white metal.

Elsewhere, US Fed officials Esther George and Raphael Bostic had crossed the newswires. Kansas City Fed President Esther George said that high inflation requires Fed action, while his colleague, Atlanta’s Fed President Raphael Bostic, added that inflation is the biggest headwind for the US economy.

Ahead into the week, the US economy docket will feature the US Nonfarm Payrolls report, with most bank analysts estimating an increase of just 200K in December. Investors should be aware that the latest Fed Summary of Economic Projections (SEP) forecasts a growth in the Unemployment Rate to 4.6%, but December estimates surround the 3.7%. Misses to the downside should be viewed as positive for the USD, as it will suggest further rate hikes are needed.

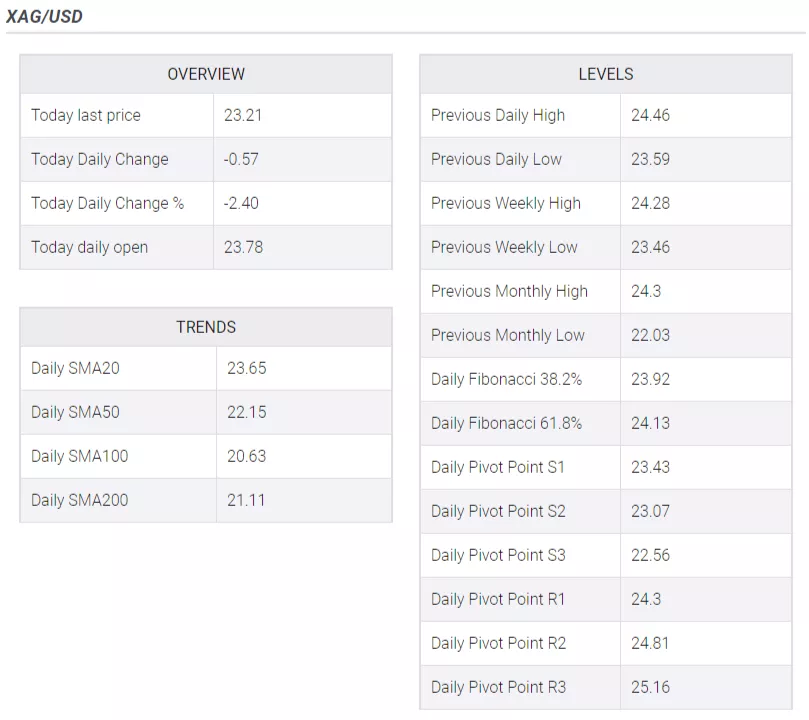

Silver Key Technical Levels

More By This Author:

AUD/USD Stalls At The 200-DMA And Drops Below 0.6800

EUR/USD recovers sharply to near 1.0680 as US Dollar Index drops, German Inflation eyed

GBP/JPY Price Analysis: Falls To 4-Month Lows Around 157.40s

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more