Silver Price Analysis: XAG/USD Struggles Near-Six Month Low, At Around $20.60, Amid Bearish Bias

Image Source: Pixabay

Silver price (XAG/USD) remained heavy on Wednesday after last week’s more than 6% losses, which witnessed the white metal traveling from around $ 23.30, to a new six-month low of $20.69. However, a downtick in US Treasury bond yields saw XAG/USD trimming some of its losses, exchanging hands at $20.85, down 1.55%.

From a daily chart perspective, the XAG/USD is set to extend its losses, also exacerbated by the break of a ten-month-old upslope support trendline at around $21.65, which opened the door for a fall toward $20.69. If XAG/USD remains below $21.00, that could put into play a re-test of the daily low of $20.69, followed by a drop to the year-to-date (YTD) low of $19.92. Conversely, if Silver's price, climbs past $21.65, the $22.00 figure would be up for grabs.

Short-term, the XAG/USD is consolidating at around the $20.69 - $21.00 area, as seen by the contraction of the Bollinger bands, while price action remains capped on the upside by the 20-day Exponential Moving Average (EMA), and the bottom band on the downside. If Silver buyers lift prices past $21.00, the next stop would be the upper band at $21.28, followed by the October 3 high at $21.39. Conversely, if the non-yielding metal drops below $20.69, immediate support would be in the $20.50 area.

XAG/USD Price Action – Hourly chart

(Click on image to enlarge)

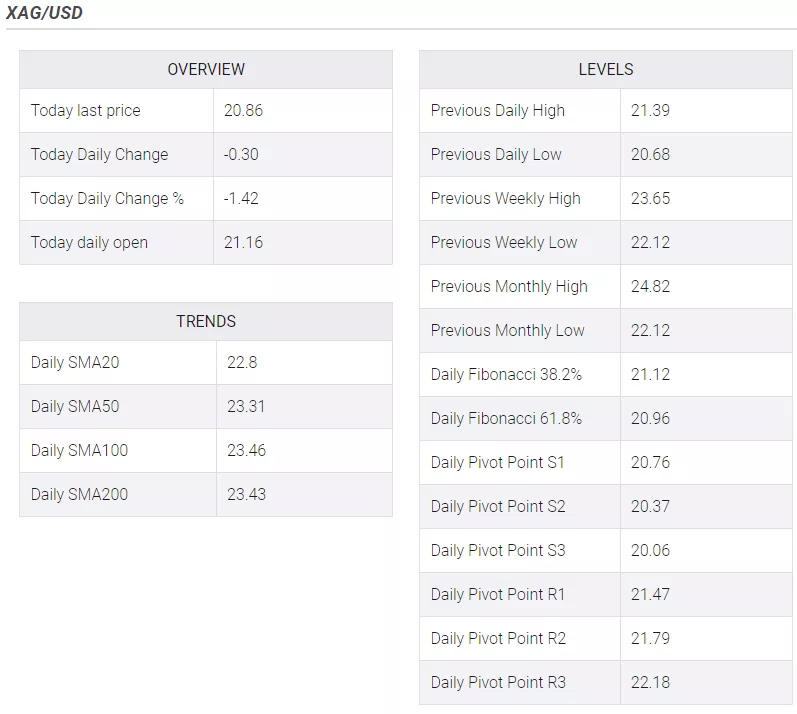

XAG/USD Key Technical Levels

More By This Author:

USD/JPY Struggles Post-Plunge Due To Mixed US Data, Intervention Concerns

US Private Sector Employment Rises 89,000 In September Vs. 153,000 Expected

Silver Price Analysis: XAG/USD Seems Poised To Retest Sub-$20.00 Levels

Disclosure: Information on this article contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes ...

more