Silver Price Analysis: XAG/USD Struggles At The 200-DMA And Drops Below $21.70

Image Source: Pixabay

Silver price battles at the 200-day Exponential Moving Average (EMA) at $21.93 though it failed to crack the latter and retraced towards Tuesday’s lows as the North American session progressed. Investors awaiting the latest FOMC minutes sought safety in the US Dollar (USD), a headwind for the white metal. At the time of typing, the XAG/USD is trading at $21.62, down 0.70% in the day.

From a daily chart perspective, XAG/USD remains neutral to downward biased, as the white metal stays beneath the important 200-day EMA. Wednesday’s price action remains negative, while the Relative Strength Index (RSI) and the Rate of Change (RoC) indicate that sellers are gathering momentum.

The XAG/USD 4-hour chart portrays the white metal as neutral to downward on an intraday bias. As of typing, Silver has breached the daily pivot point at $21.81, followed by the S1 pivot at $21.66. A bearish continuation is the most probable scenario due to several reasons. The Relative Strength Index (RSI) dived below the 50-mid line, a signal to go short, while the Rate of Change (RoC) is aiming aggressively downwards.

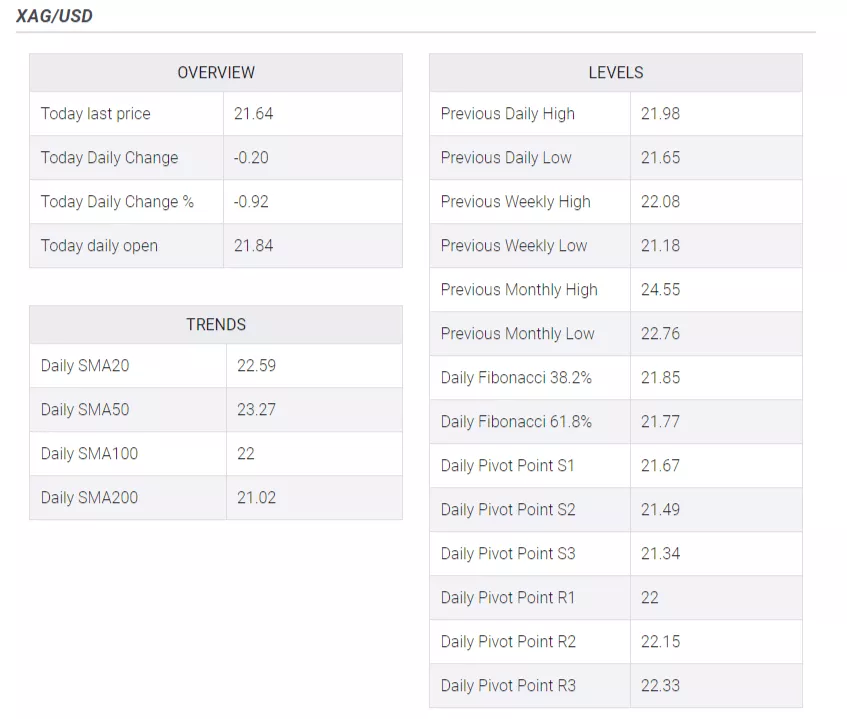

Therefore, the XAG/USD first support would be the S2 pivot point at $21.50. A breach of the latter will expose the S3 daily pivot at $21.35, ahead of the YTD low of $21.18. As an alternate scenario, XAG/USD reclaims the 200-day EMA could pave the way toward $22.00.

XAG/USD 4-hour chart

(Click on image to enlarge)

XAG/USD Key technical levels

More By This Author:

USD/JPY Bulls Eye A Continuation As The US Dollar Bounces Back To Life

WTI Erases Its Monday’s Gains, Back Below $77.00

GBP/USD Oscilates In Low Volumes Around Friday's High But Bears Are Lurking

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more