USD/JPY Bulls Eye A Continuation As The US Dollar Bounces Back To Life

- USD/JPY is biased to the upside as a resurgence in the US Dollar is underway.

- 134.50 is a line on the sand and the market has a bullish bias towards 137.50 while above it.

USD/JPY is pressing higher despite the technicals that have been biased to the downside, at least for the meanwhile move into the length that had been piling up in the market over the past several days. Instead, the bulls stay in control and have homed in on the 135 area as volume return to the forex space.

At the time of writing, USD/JPY is trading at 134.98 and has traveled between a low of 134.14 and a high of 135.22 so far. The US Dollar has been offering good two-way business on the day in volatile trading. However, the dominant theme remains an inflationary one and that is fueling the bid in the middle of the US session following yet more positive US economic data.

US Treasury yields hit new highs on Tuesday on the confirmation in the US data that both the services and manufacturing sectors have been robust in the month of February with S&P Global PMIs beating both prior and estimates. Investors are setting up for a longer-than-anticipated stiff monetary policy stance by the Federal Reserve following a slew of strong economic data. ''This process still has a ways to go, in our view,'' analysts at Brown Brothers Harriman explained.

The analysts noted that the WIRP suggests 25 bp hikes in March, May, and June that takes Fed Funds to 5.25-5.50%. ''Given how strong the data have been recent, we see growing risks of a fourth 25 bp hike that takes us up to 5.50-5.75%, though that is not being priced in yet. This should eventually change,'' the analysts said.

''Strangely enough, an easing cycle is still expected to begin in Q4 but at much lower odds. Eventually, it should be totally priced out into 2024 in the next stage of Fed repricing.''

The next major catalyst will be the Federal Reserve's release of the minutes of its last meeting on Wednesday, which will give traders a glimpse of how high officials are projecting interest rates will go following this impressive run of recent data for the first months of the year including stronger than expected jobs and inflation numbers.

USD/JPY & DXY technical analysis

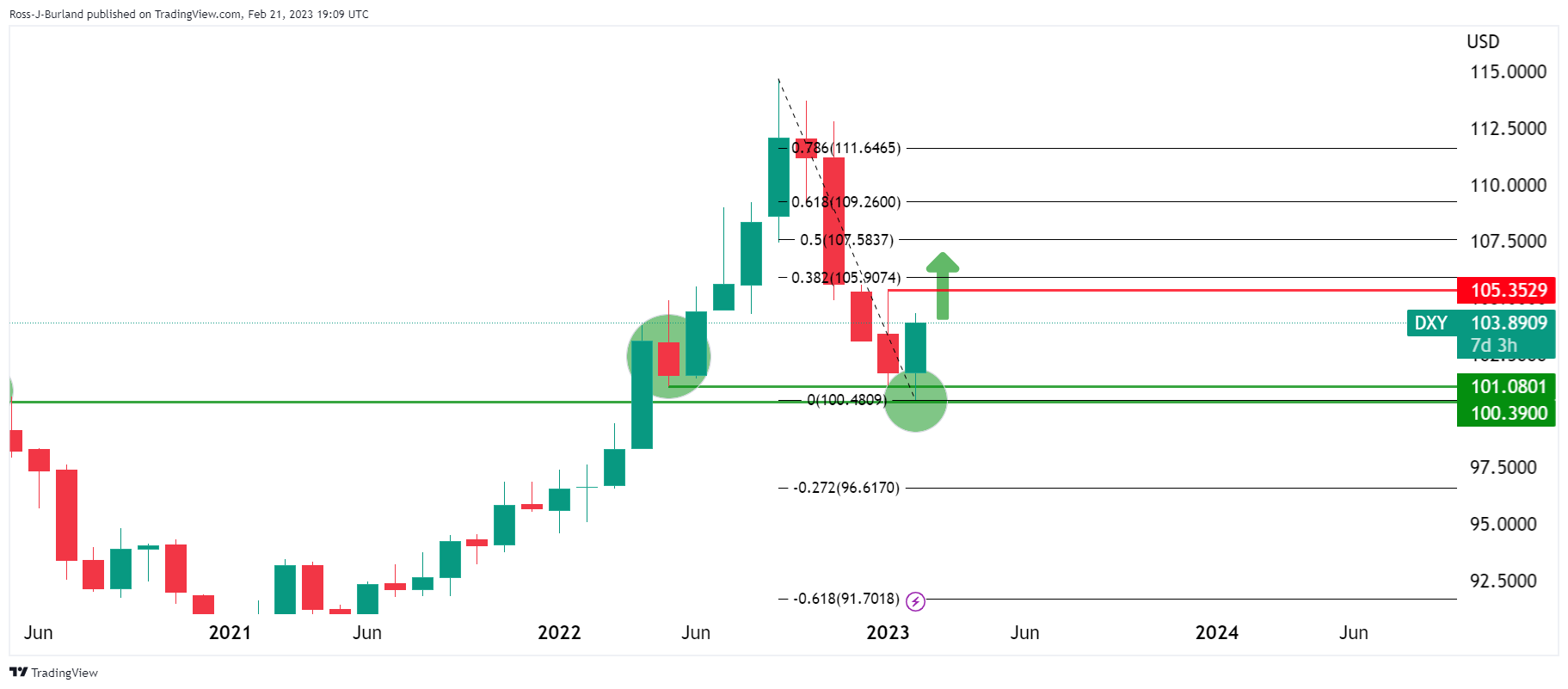

In all of the above, it will be interesting to see how much further the US Dollar, DXY, can go:

(Click on image to enlarge)

We have seen a number of reactions from the recent lows over many months of history in the DXY index as the above illustrates, so why would it be any different this time around? 101.00 is a strong level of support so the thesis is higher from here, in the meanwhile at least.

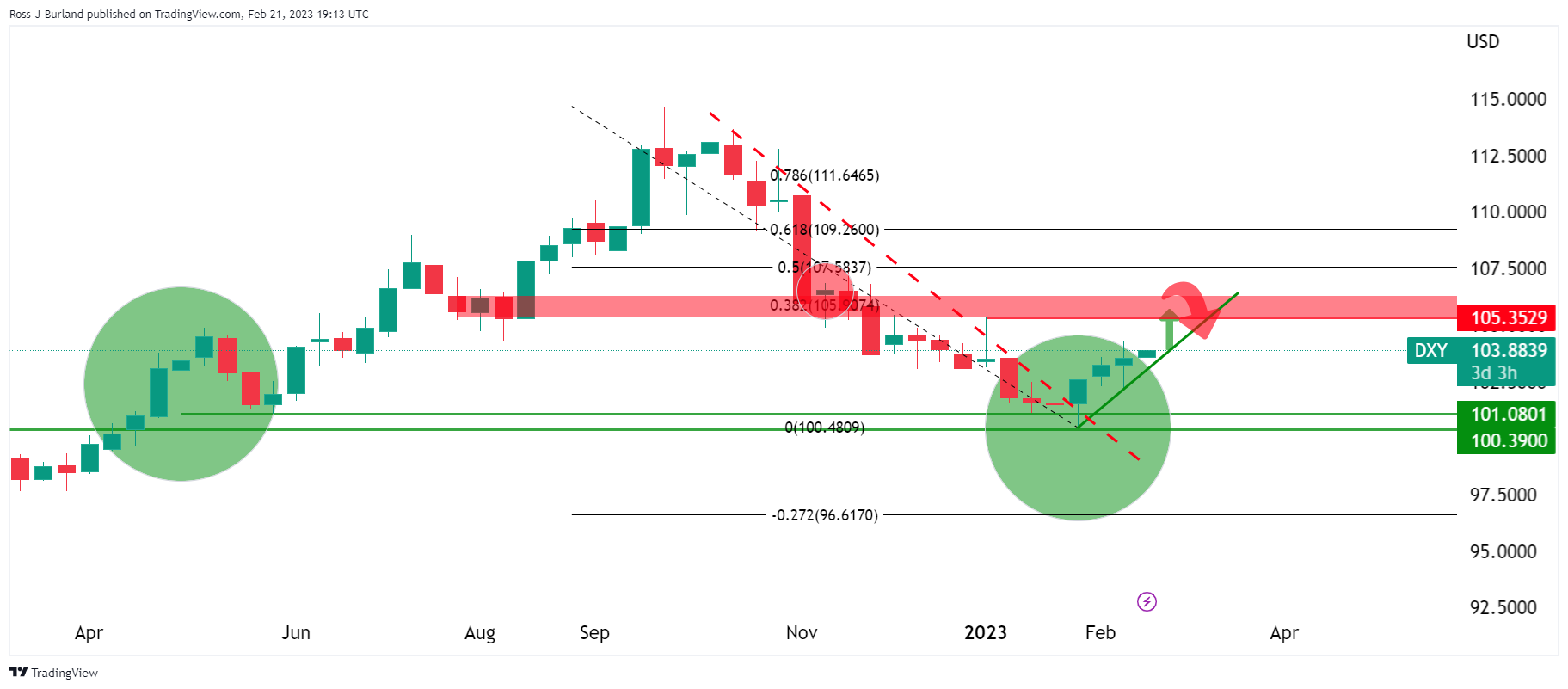

(Click on image to enlarge)

The 38.2% Fibonacci retracement is eyed as the first target near 106.00 on a break of the prior month's highs of 105.35.

Down on the weekly chart, 106 is a clear target and resistance area:

(Click on image to enlarge)

From a daily perspective, the 104.30s were pinned but there is room to go on the upside following the correction into old resistance that is now acting as a support structure. A continuation, therefore, can be anticipated to breach the space between today's highs and all the way to the start of the year's highs near 105.35:

(Click on image to enlarge)

USD/JPY technical analysis

(Click on image to enlarge)

This leaves a bullish bias on the US Dollar pairs and the Yen would be expected to weaken into the overhead USD/JPY four-hour resistance in the coming days.

Zoomed in ...

(Click on image to enlarge)

134.50 is a line on the sand and the market has a bullish bias towards 137.50 while above it.

More By This Author:

WTI Erases Its Monday’s Gains, Back Below $77.00GBP/USD Oscilates In Low Volumes Around Friday's High But Bears Are Lurking

Gold Price Forecast: XAU/USD Rises Toward $1,840s Despite Renewed Fed Hawkish Comments, US Inflation Data

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more