Silver Futures Come Within 35 Cents Of $60 Level

Image Source: Pixabay

The precious metals markets are rallying again today, and the silver futures have even come within 35 cents of the $60 level.

Here’s the chart, which is somewhat volatile as you might expect, and you can see how the high of the day is $59.65.

(Click on image to enlarge)

In the next image you can see how the London/New York silver spread remains in contango (normalized), with the March futures trading 56 cents over the London spot price.

(Click on image to enlarge)

Meanwhile, the gold futures are up $33 to $4,254, only $144 away from the $4,398 high set earlier this year.

(Click on image to enlarge)

In terms of some of the stunning things that are going on behind the scenes of this historic rally, if you did not already see Vince Lanci’s video on the Arcadia channel this morning where he talked about how JPMorgan transferred 13.4 million ounces of silver from the registered to eligible categories during the CME shutdown, I’d highly recommend taking a look at that.

In terms of some of the specific technicals explaining what’s going on with the wide swings we’ve seen in the London/New York silver spread, here’s what former JPMorgan precious metals managing director Robert Gottlieb shared yesterday.

Two months ago we saw metal get shipped from the COMEX over to London to address the shortage there. But now the spread has swung back in the other direction, and in Robert’s post he even introduces the possibility of metal getting shipped back from London to New York again. And remember that this has happened before, even aside from what happened earlier this year, back in 2020 when the EFP crisis emerged after COVID broke out.

Here’s an excerpt from the LBMA’s 2021 silver report that explains what happened in 2020, and how that resulted in silver going from London to New York:

I would suggest it’s premature to say that now that the spread has surged to a similar level, that we will definitely start seeing metal leave London. But multiple alarms are going off, and I would say there’s at least some tail risk, and that it’s appropriate to price in some probability of that actually occurring. And of course it’s a silver bull’s wet dream to imagine what would happen if London then goes back into the danger zone even more quickly than most would have imagined (somebody really will have to make a movie out of this one day!).

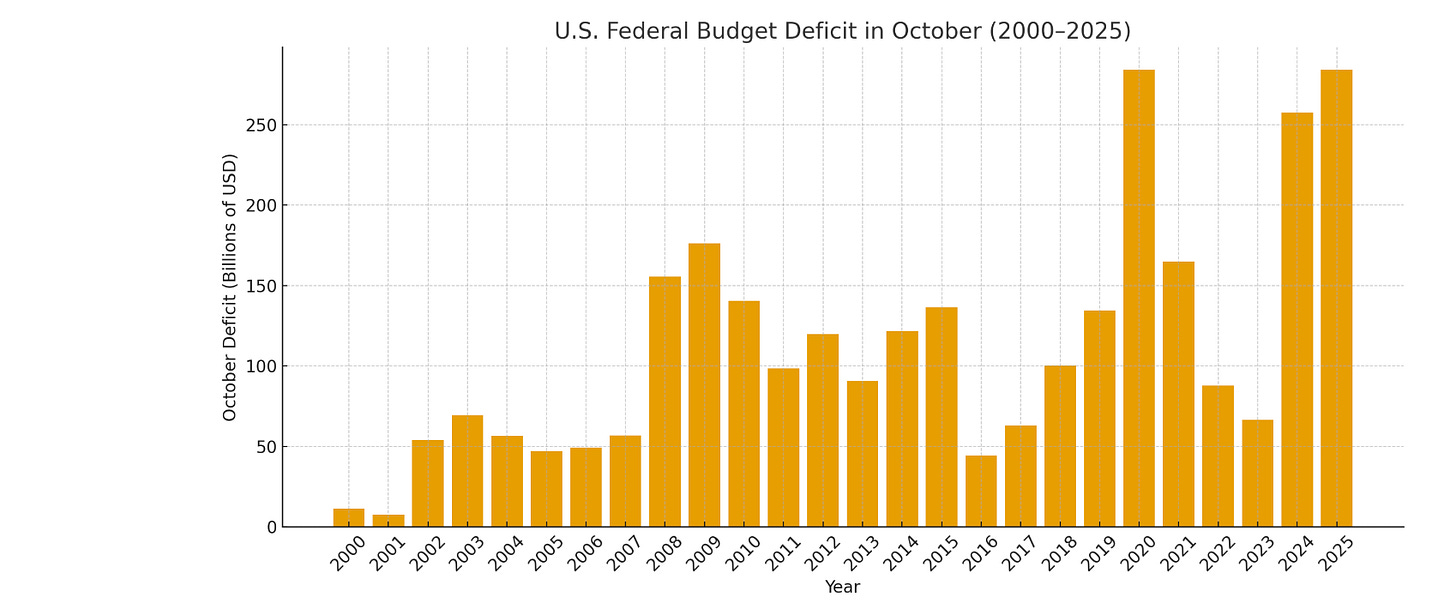

While all this is happening, the federal government also just ran the biggest October budget deficit in history, which surely isn’t helping the matter.

The Federal government took in a record amount of tariff revenue in October. It also ran the highest October budget deficit on record.

The Trump administration spent $284.35 billion more than it took in to kick off fiscal 2026. That was about 10 percent higher than last year’s October deficit and about $200 million more than the previous October record set in 2020 during the pandemic lockdown era.

(Click on image to enlarge)

The deficit was inflated by the shifting of some November benefit payments back into October. If we factor out those calendar effects, the deficit would have been $180 billion. While a 29 percent reduction from last year’s October deficit, it would still rank in the top four highest October shortfalls on record.

Keep in mind that Uncle Sam ran this massive deficit while the government was “closed.”

I’m not sure what that says for Trump’s plan to repay the national debt by sending out $2,000 stimulus checks from tariff money, that could still be reversed if the courts rule against the Trump administration.

A possibility that apparently is realistic enough that Treasury Secretary Bessent is already looking for workarounds if they should lose.

More By This Author:

Silver Breaks $58, But Then Just Keeps Surging

Silver Surges $3 And Breaks $57 After COMEX Shutdown

COMEX Goes Down & Sparks Gold & Silver Flash-Crash