Silver Breaks $58, But Then Just Keeps Surging

Image Source: Pixabay

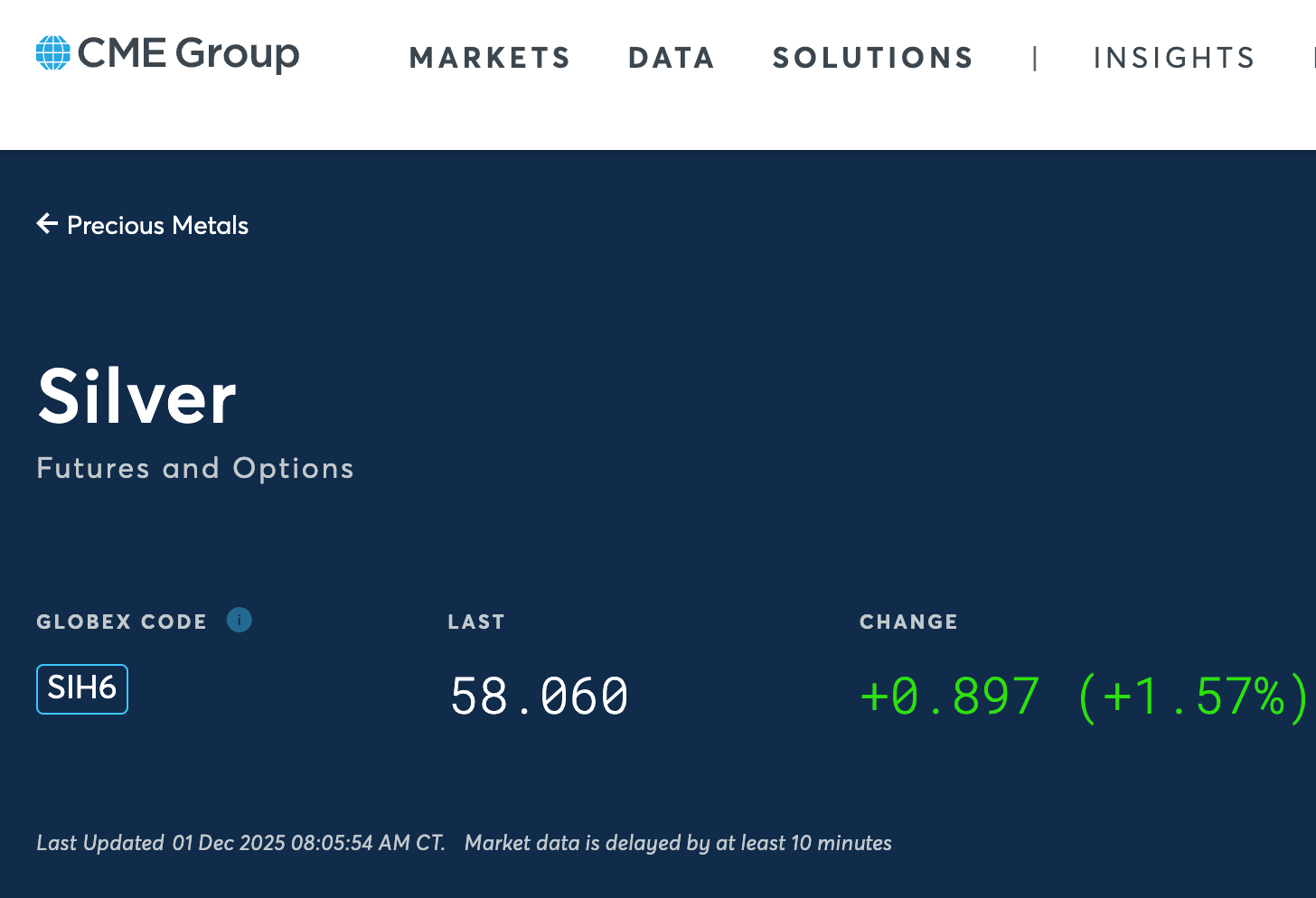

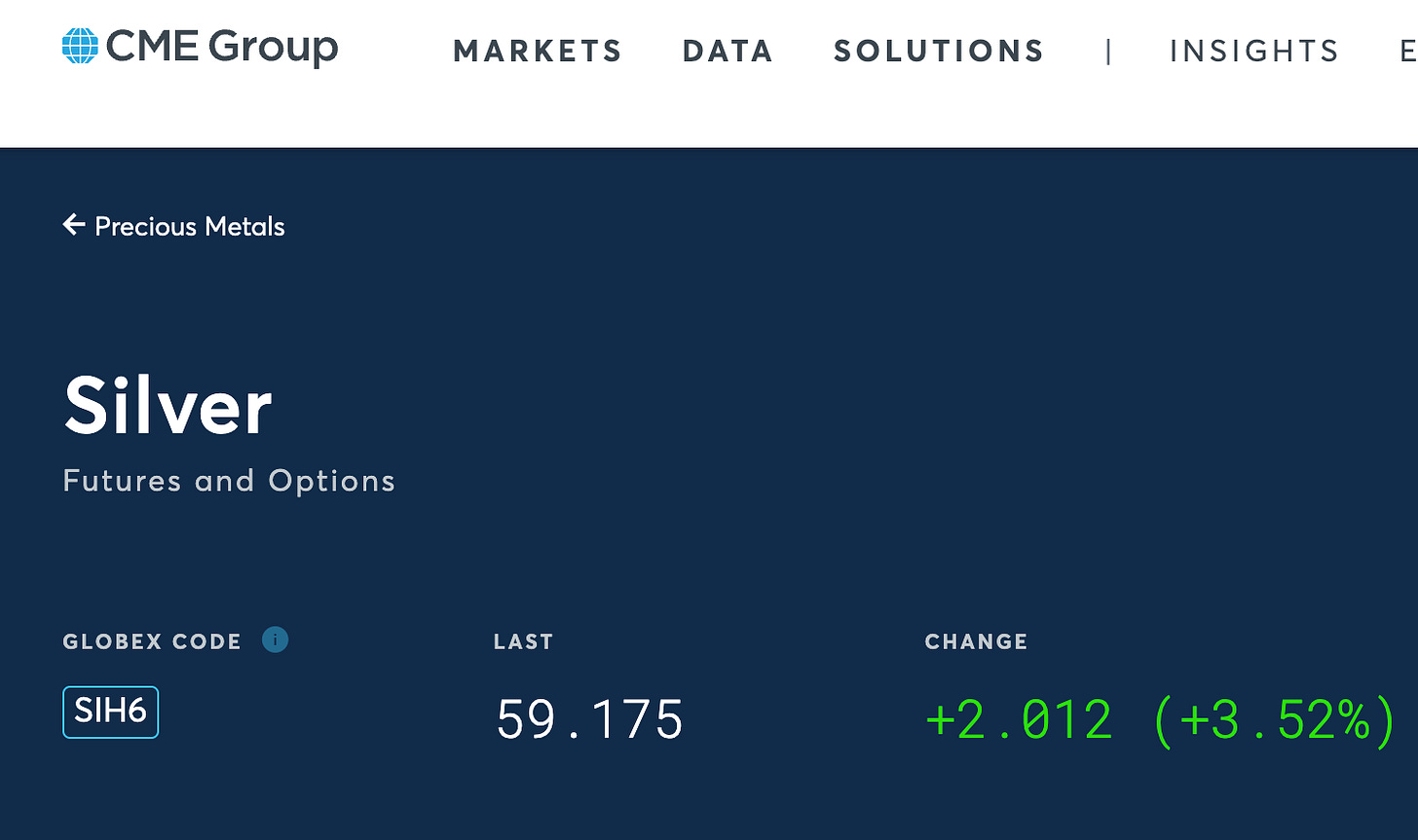

In case you thought Friday’s $3.50 silver rally to send the price to a new all-time record high above the $57 level was exciting, hopefully that means your week is off to a good start, as the silver futures have rallied again, and just crossed the $58 level this morning.

Correction…. I started writing this column earlier, but had to attend a one-hour call, and now the price is already on the verge of breaking through the $59 level.

Truly stunning, and maybe what we’ve seen over the past two months makes all of the waiting and sell-offs worth it. It actually even reminded me of what it was like being a Red Sox fan in 2004. And what else can one say at this point...except that the past two sessions have just been truly spectacular to observe.

(Note - while I normally use the Investing.com price feeds, ever since the COMEX went down last Friday they’ve been slightly off from what I’ve been seeing elsewhere. So in case you do happen to need correct and accurate information for a trade, please do check a few price feeds right now).

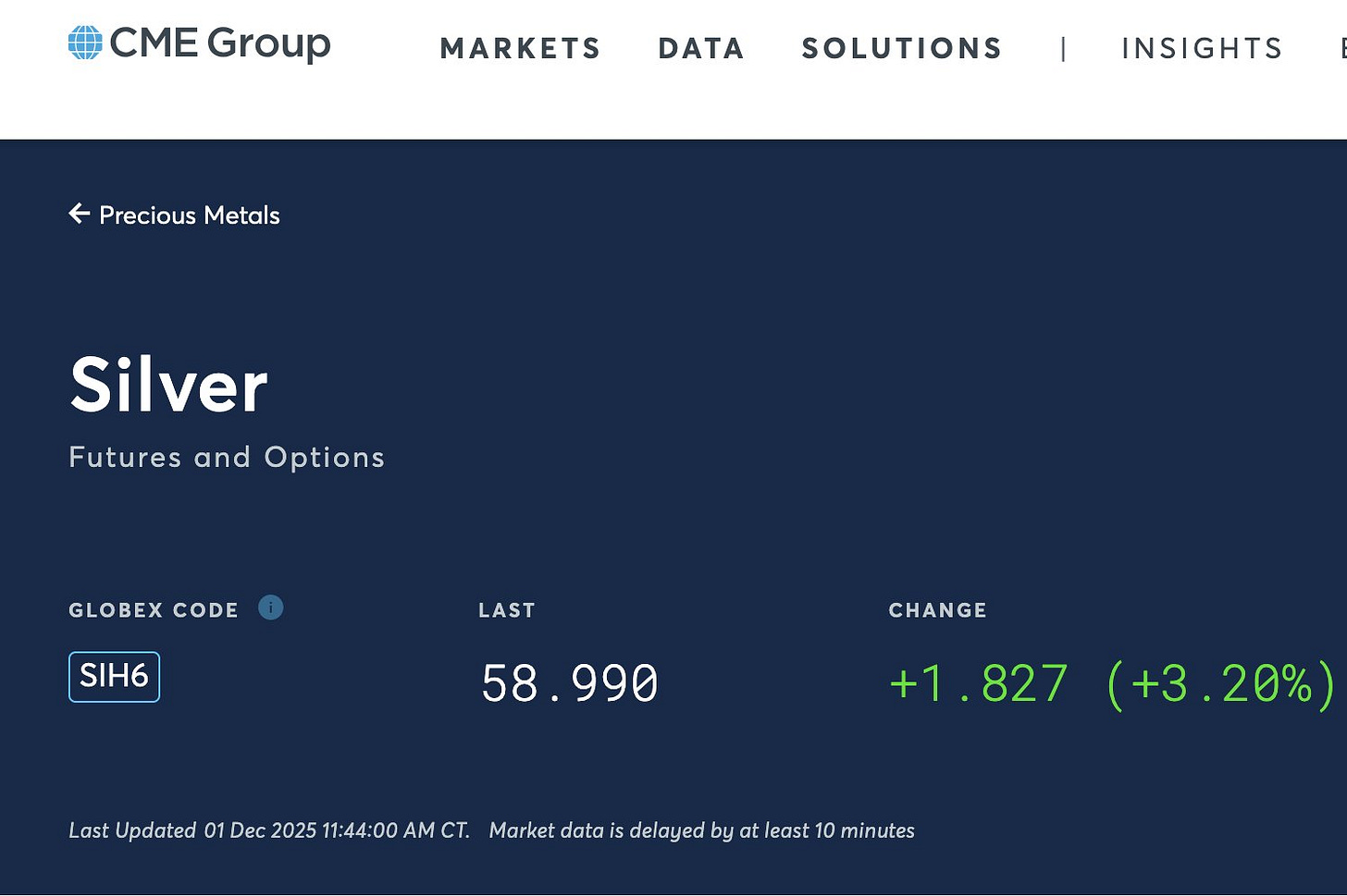

Also of note is that we’ve seen a big move in the New York/London silver spread, as after almost two solid months of backwardation, the market has normalized, with the futures currently trading 50 cents over the spot price.

(Click on image to enlarge)

As you could expect, Bloomberg has had a few articles out about the latest leg of the silver rally, and they had a few worthwhile notes to pass along.

(Click on image to enlarge)

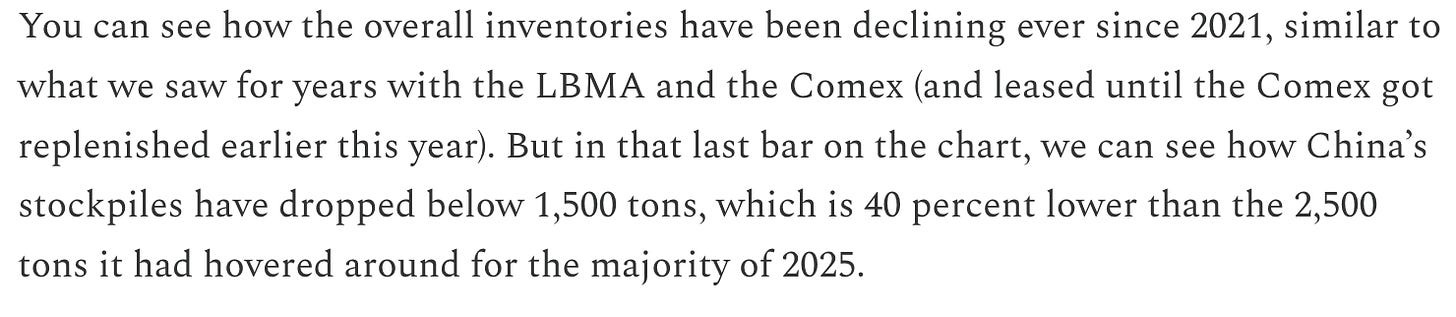

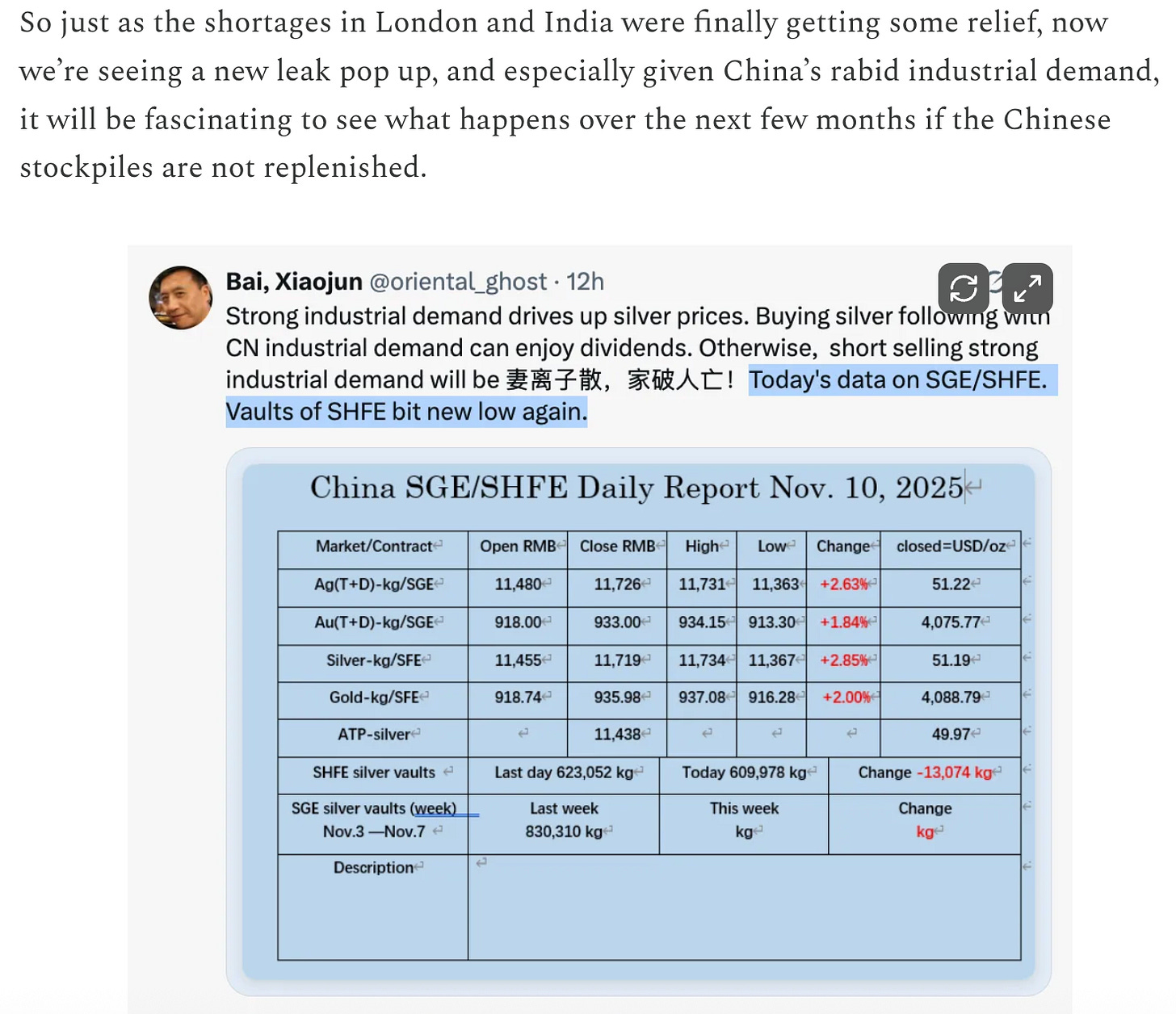

Silver’s new high comes just over a month after a severe supply squeeze in the dominant silver trading hub in London last month, which sent prices soaring above levels in Shanghai and New York. While the arrival of nearly 54 million troy ounces has eased that squeeze, the market still remains markedly tight with the cost of borrowing the metal over one month hovering above its normal level.

Following today’s extension of the rally, it was intriguing to see their latest headline, which confirms what we’ve been saying in this column since last month’s crisis ‘seemingly’ died down.

(Click on image to enlarge)

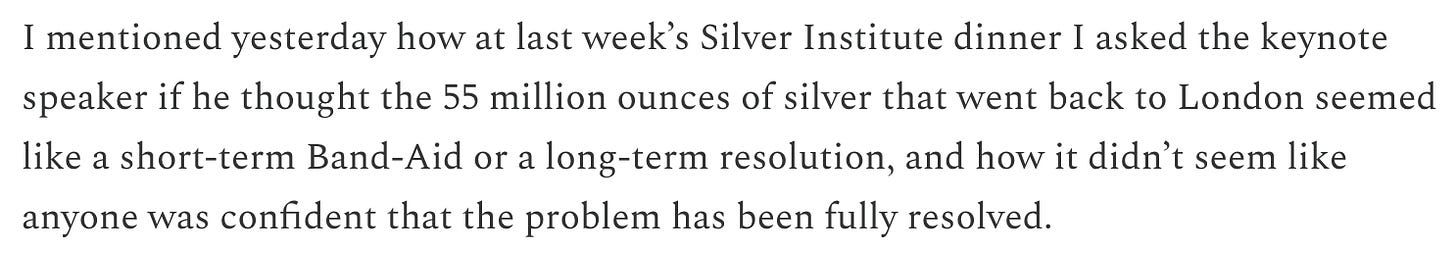

The fact that we’re hearing about a tight global silver supply again should not come as a complete shock, and here’s a comment from our column back on November 18:

In terms of the Bloomberg article, here was a note about what they’re currently seeing regarding the silver supply.

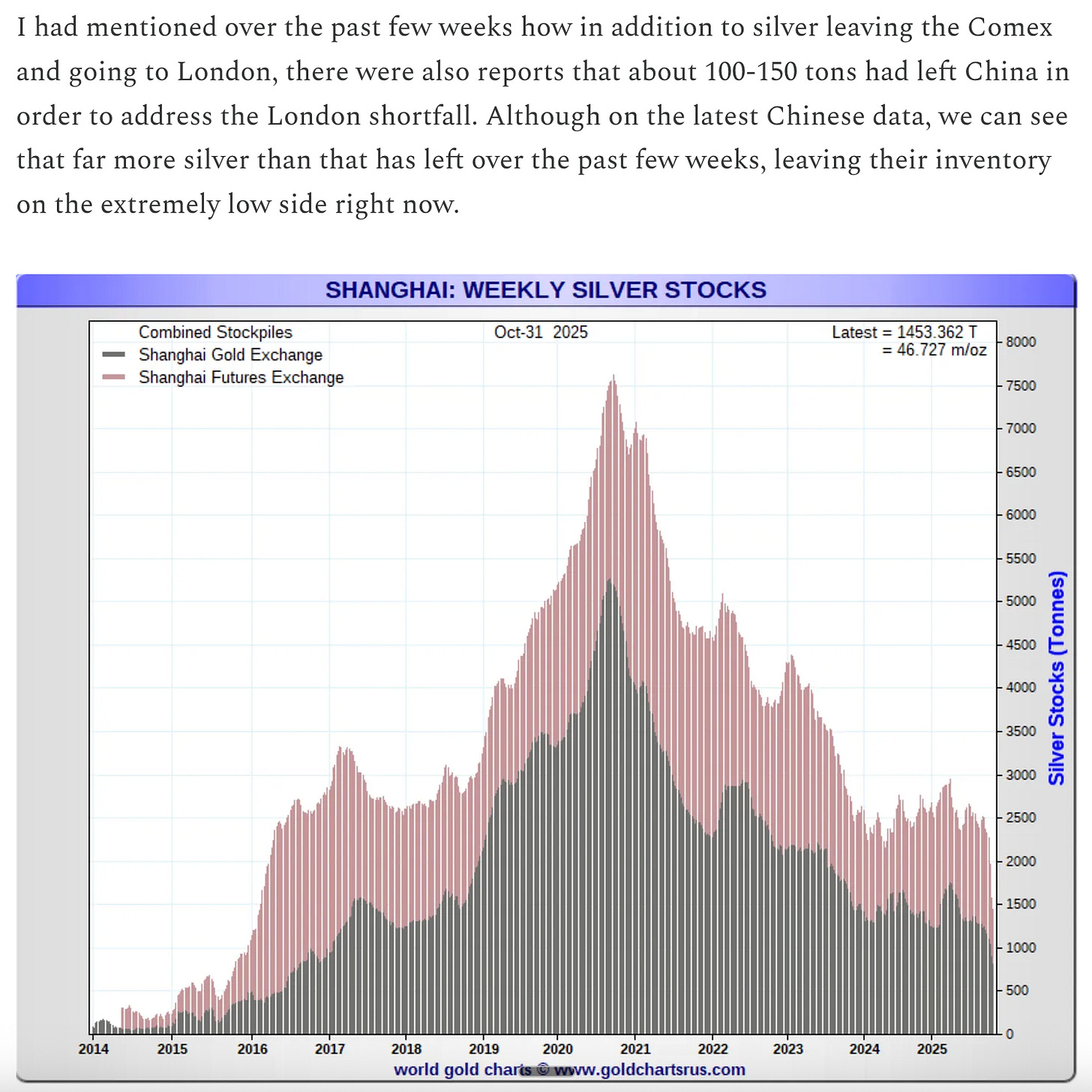

A record amount of silver flowed into London in October to ease a historic squeeze in the world’s biggest trading hub for the metal, but this has put other centers, including in China, under pressure.

Inventories in warehouses linked to the Shanghai Futures Exchange recently hit the lowest level since 2015, and the cost of borrowing the metal over one month remains elevated.

We discussed this last month too when we talked about how after silver came out of China to address the London shortage, then China started running into supply concerns.

Additionally, if you did not already see this piece from back on November 11 where we examined whether the amount of silver that went over to London would be enough to stem the crisis, you can see how that was far less than likely to be the case, which we are now seeing confirmed.

Back to the latest Bloomberg article, they also acknowledged that we have not seen the end of the current saga.

“Shortages in the global market as a result of the recent squeeze in London are still being felt,” said Daniel Hynes, a commodity strategist from ANZ Group Holdings Ltd. “With gold taking a breather, it appears investors have turned their attention to silver.”

Also, in case you have not yet heard, the silver market is still awaiting the government Section 232 report, which would finally determine the tariff status of silver now that it’s been added as a critical mineral. Of course, it seems beyond insane that if they’re saying it’s a strategic resource that needs to be secured, that they would put a tariff on it. But we are talking about government.

Traders are also monitoring any potential tariff on silver after the precious metal was added to the US Geological Survey list of critical minerals last month. Fear of a sudden premium in America has made some traders hesitant about sending the metal out of the country, offering little prospect of relief should the global market tighten further.

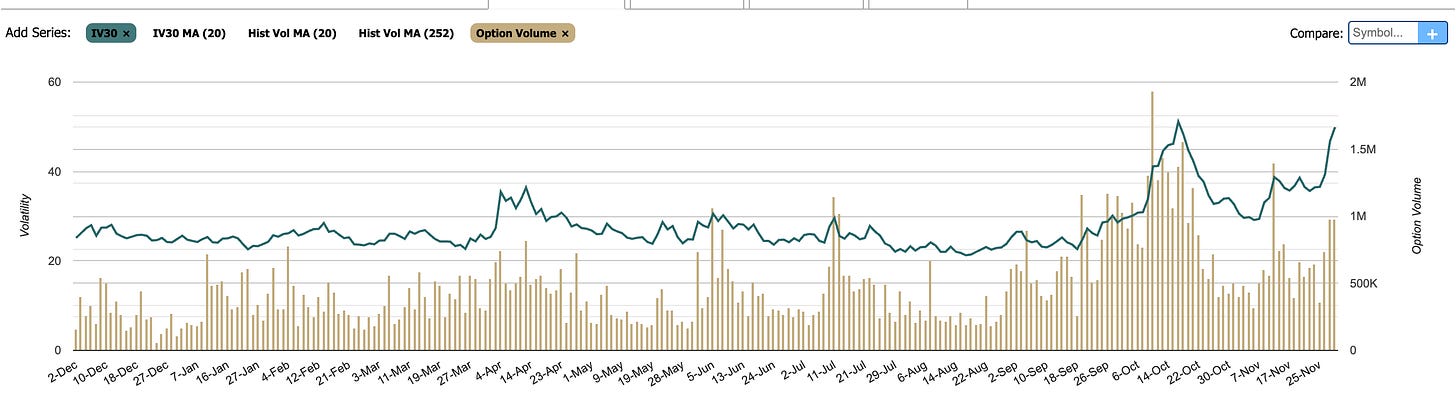

Lastly, for you option traders out there, not shockingly, the call skew has gotten absolutely jacked today.

Next, you can see (thanks to the fantastic options trading site Market Chameleon) the volatility has spiked again, just like last month.

(Click on image to enlarge)

So that’s all for today, although as I’m finishing up, the silver futures have just broken through the $59 level.

We’ll see if I can get this spell-checked and edited before the price jumps again, but especially if you’re a long-time silver investor, hopefully you’re just sitting back in awe and smiling.

More By This Author:

Silver Surges $3 And Breaks $57 After COMEX ShutdownCOMEX Goes Down & Sparks Gold & Silver Flash-Crash

Silver Shortage In London Now Sparks Shortage In China