Seadrill Partners' Recent Price Action Makes No Sense, Buy On The Dip

In the past few weeks, units of offshore drilling contractor Seadrill Partners (SDLP) have fallen precipitously from their highs, which were set on August 25, 2014. On that date, units of Seadrill Partners closed at $35.10. These units trade for $30.12 today, a decline of nearly 14.2%.

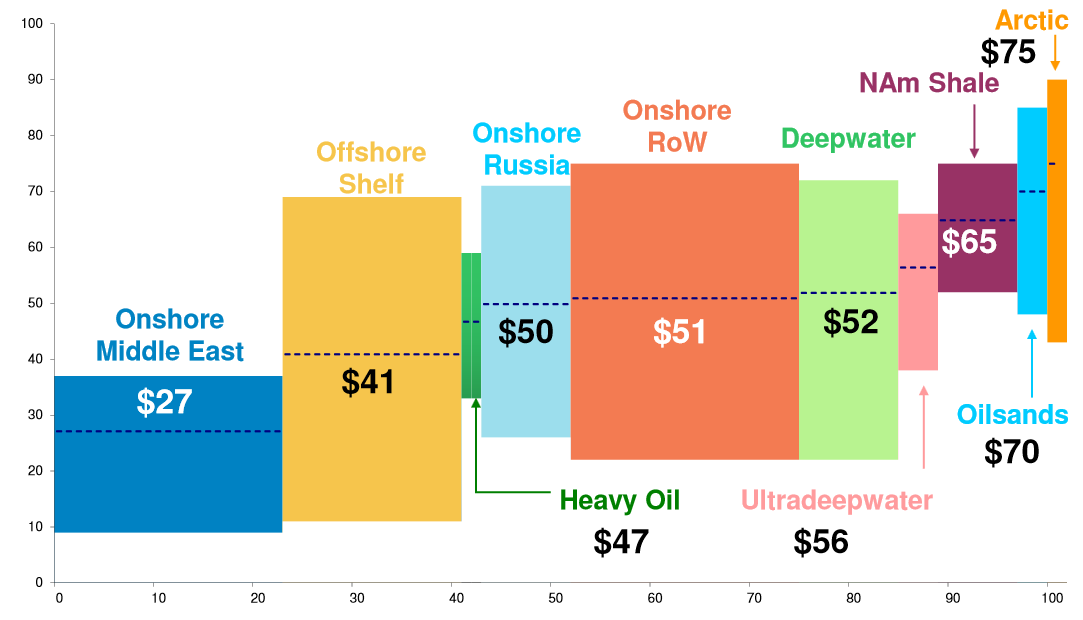

There are two likely reasons for this decline, neither of which should worry investors. The first reason is that over the past few weeks, several analysts have made public statements regarding the challenging conditions that are currently present in the offshore drilling industry. Towards the end of last year, several major oil and gas companies began to reduce spending on their exploration programs because rising costs of producing in areas such as North America’s various shale plays combined with relatively high dividend payouts and large share buyback programs (in some cases) caused several of these companies to become free cash flow negative. This reduction in spending on their respective exploration programs reduced demand for offshore drilling rigs since these rigs are most commonly used in such programs. This reduction in exploration spending most affected the ultra-deep water environment (defined as drilling in water depths of 7500 ft. or greater) as opposed to the shallow-water environment (defined as drilling in water depths of 400 ft. or less). One reason for this is cost. This chart, which Seadrill Partners’ parent company Seadrill (SDRL) sourced from Morgan Stanley Equity Research, shows the approximate cost of producing one barrel of oil in each of several different environments.

Source: Seadrill, Morgan Stanley Equity Research

As the chart shows, it costs approximately $56 per barrel to produce one barrel of oil in an ultra-deepwater environment. Meanwhile, it costs an average of $41 per barrel to produce one barrel of oil in an offshore shelf (shallow-water) region. Thus, exploration and production companies would prioritize exploring their shallow-water leases for oil as part of the budgeting process due to these constrained cash flows.

In addition to the reduction in demand for ultra-deepwater rigs, the supply of these rigs has been steadily increasing. This is because the offshore drilling industry as a whole was in a favorable position for the past several years up until 2013 and this prompted many drilling contractors to begin construction on new rigs to take advantage of this surplus demand. Unfortunately, it takes about two years to construct an ultra-deepwater rig. Therefore, many of these rigs are just now leaving the shipyard and entering the market. Thus, the supply has gone up and the demand has gone down. This has resulted in the very competitive conditions that we see in the market today. However, as I discuss here, it has been primarily the older rigs that are still in the market that have been most affected by this. Overall, dayrates for sixth-generation rigs (the most modern ones) have proven much more resilient and utilization rates for sixth-generation rigs remain at 100%.

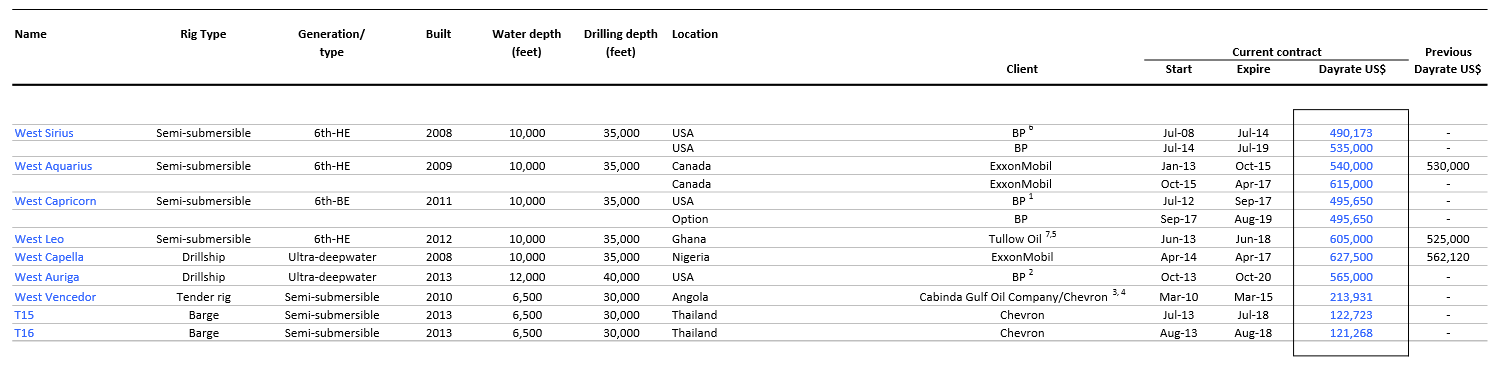

However, Seadrill Partners will not be affected by the challenging conditions currently present in the market. This is due to its business model. Offshore drilling rigs are contracted to exploration and production companies to work for a specified period of time for a specified rate. Historically, this specified period of time is usually several years in the case of ultra-deep water rigs. Lately, E&P companies have been contracting rigs for shorter periods of time but Seadrill Partners still has its rigs contracted out exclusively under long-term contracts. This chart shows every rig in Seadrill Partners’ fleet along with their respective contracts:

Source: Seadrill Partners

As this chart shows, the only rig in the company’s fleet that comes off contract before 2017 is the tender rig West Vencedor. The rest of the company’s fleet will continue to generate revenue and cash flow at their present levels until 2017 due to these contracts. The expiration of the West Vencedor contract is not a significant concern for two reasons:

- The West Vencedor is a semi-tender rig and the market for these rigs has remained stable despite the weakness in ultra-deepwater.

- The West Vencedor has a dayrate of $213,913, which is relatively low compared to the rest of the fleet. Thus, this rig is responsible for a relatively small portion of Seadrill Partners’ revenue and cash flow.

The second thing that is likely to have driven Seadrill Partners’ unit price down is that one of the members of Seadrill Partners’ Board of Directors, Tor Olav Trøeim, resigned from his position late last week. Some investors may have seen this as a signal that Mr. Trøeim has lost confidence in the company. This is not actually the case. Mr. Trøeim actually sat on the Boards of several companies in which Cypriot billionaire John Fredriksen is a significant investor, including the Seadrill family and Golar LNG (GLNG), a natural gas shipping company. Mr. Fredriksen and Mr. Trøeim disagreed about the path that Golar LNG was to take going forward and Mr. Trøeim left Seadrill and its related companies to focus on building up Golar LNG. Mr. Trøeim still retains a significant ownership interest in Seadrill and its associated companies, which he undoubtedly would not if he had lost faith in the company. Thus, I do not believe that this is as big of a concern as some market participants seem to believe.

Finally, on Tuesday, September 23, Seadrill Partners announced that it will be issuing eight million common units in an equity offering. This will dilute the existing equity owners. At the end of the second quarter, Seadrill Partners had 67.278 million common units and 16.543 subordinated units outstanding. This, this equity offering will increase the company’s total share count by 9.54%. However, as I stated here, Seadrill Partners may use some of this money to buy West Jupiter from Seadrill as the company did explicitly state that one possible use of the money raised by this equity offering could be used for acquisitions. This would be accretive to growth should the company opt to take this route. In addition, this equity offering is already priced into the stock at this point.

Thus, Seadrill Partners could offer an interesting opportunity to investors at its present levels. While there is a possibility that we will see further share price weakness, fundamentally the company is quite strong. The company’s strong, long-term contract position ensures that it can ride out the current market weakness and the possible acquisition of West Jupiter provides forward growth potential. The company will also reward investors with a 7.20% distribution while waiting for the offshore drilling market to recover.

Disclosure: I am long SDRL at the time of writing.

Well done analysis, I fully agree with your assessment.