Screaming Silver

Image Source: Pixabay

Silver broke out last Thursday, soaring through the seemingly impenetrable resistance at $35.

The bloggersphere and social media were suddenly flooded with alerts and memes headlined “Hi Ho Silver!”

The move in silver has been quite dramatic, and the price has continued to rise since Thursday’s breakout. As I write, it’s up another $0.65 (1.85%) today. And today’s move in silver has been so great that it’s actually pulling gold up with it!

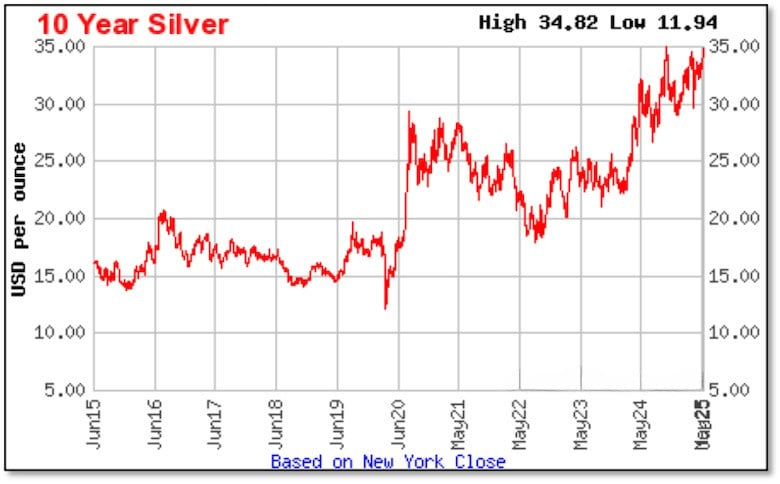

That Alert I sent to subscribers last Thursday noted that the $35 level was so important that the 10-year silver chart on Kitco didn’t even bother to draw the Y axis above $35!

Here’s the chart I showed last week:

(Click on image to enlarge)

I noted last week that the charts would have to be redrawn now. And to give you an idea of the near-term potential for gold’s poorer cousin, take a look at what’s posted now at Kitco:

(Click on image to enlarge)

In truth, the medium-term objective now for silver is $40. Many silver watchers, even mainstream Wall Street analysts, are calling for $50 silver at some point next year.

I think silver could hit that $50 mark — the record nominal high hit in 1980 and 2011 — by the end of this year.

So what should you do about it?

In addition to physical silver, which I’ve been recommending for years, the silver stocks can provide extraordinary leverage to silver. The good news is that this sector is finally moving...and outperforming silver itself.

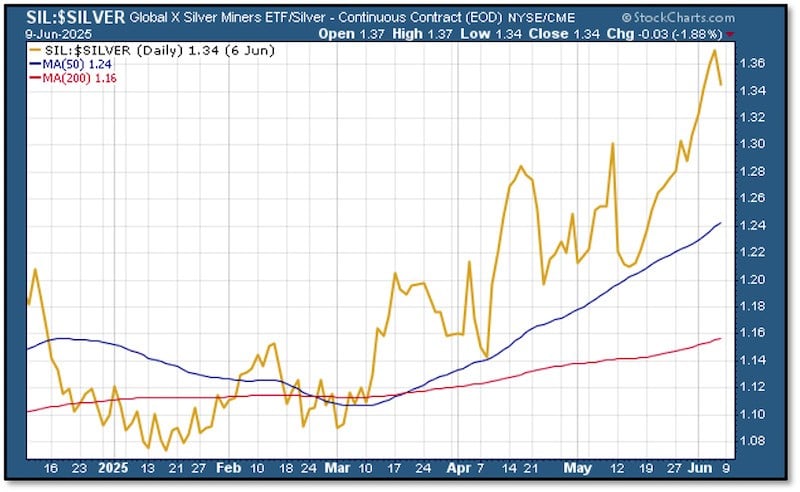

Consider this chart of the SIL silver stock ETF/silver ratio:

(Click on image to enlarge)

As you can see, the ratio shows that silver stocks have been leveraging silver itself since the beginning of March, and the outperformance has been gaining momentum in recent days.

The last time I saw this setup was in mid-December of 2015. I alerted my Gold Newsletter subscribers to the opportunity, and over the next six months, our silver stock recommendations multiplied as much as four times over...and more.

If this move is like what we saw in 2016, the potential short-term gains could be extraordinary.

More By This Author:

Consumer Debt Unexpectedly Surged In AprilGold’s Current Consolidation: Driven By Tariffs And Global Uncertainty

Gold ETF Momentum Eased In May With Modest Outflows