Roubini Is Betting On A Resumption Of Inflation Expectations And Forecasts Gold At $3,000

In a recent interview, Nouriel Roubini discussed the ten "mega-threats" facing the world: war, public and private debt crises, and the demographic bomb... all of which will cause investors to rush towards gold, leading to an increase in the metal's price to $3,000 by 2028. The famous economist predicts a 10% rise per year over five years, for an overall return of 60%.

Roubini, also known as "Dr. Doom" for his gloomy economic forecasts, is one of the few forecasters to have predicted the 2008 financial crisis months in advance. He now predicts that a stagflationary depression will begin in 2023 and that it will cause stocks and bonds to fall. According to him, gold will outperform these markets because it is a bet against inflation, financial instability, but also against social, political and geopolitical instability.

On the geopolitical front, Roubini believes that "revisionist" powers such as China, Russia, Iran, and North Korea will challenge the dominance of the United States and Europe in the coming years. He cites the case of Taiwan, a U.S. ally, as an example. Drawing on a statement by U.S. Navy Chief Michael Gilday, Roubini warns of a possible Chinese attack on Taiwan as early as 2023, an event that would exacerbate Sino-American tensions. He warns that such a conflict could escalate into an "fully nuclear war between the United States and China." Roubini points out that the loss of Taiwan would have consequences for U.S. hegemonic power in Asia and affect the credibility of the U.S. commitment to defend its allies like South Korea, Japan, Australia and other Asian countries.

When he talks about monetary policy, Roubini does not mince his words, either. According to him, to fight inflation, the Fed would need to raise interest rates to at least 6%, but this is unlikely because of the risks of a "severe" recession and the implosion of the debt. In the face of the economic and financial crisis, the Fed and other central banks will have to forego raising interest rates. This monetary policy decision will certainly lead to a stalling of inflation expectations and result in inflation of at least 5-6% in the medium term. Since the public sector does not have the capacity to raise taxes or reduce government spending, the inflation tax will logically be used to deal with the excess private and public debt.

This is the context for his very bullish forecast for gold.

Let's look at the recent movement of the yellow metal:

(Click on image to enlarge)

Since September 28, 2022, gold has been staging a rather impressive rebound, and without any visible catalyst.

On that day, the Bank of England saved the British pension funds by abruptly reversing its monetary policy.

In my October article, I wrote:

“The ongoing bond crisis almost caused a panic in England last Wednesday. Without the intervention of the Bank of England in extremis, many pension funds would have bit the dust. As usual, we discover at the last minute the fragility of the arrangements used by these funds, which used very risky financial engineering to ensure a decent return by means of highly leveraged derivatives. With negative rates, it was almost impossible to offer a sufficient return. The monetary policy of the last twenty years, which has been to suppress the cost of money, has forced these funds to take on more and more risk. And when rates rise sharply, as they have today, these derivatives explode in flight, forcing these same funds to sell assets in violent margin calls. These massive sales accelerate the fall of the markets and push more and more funds into even more severe margin calls.”

In the event of a market panic, a central bank will always choose to print money. This was the signal sent to gold and the markets that day.

This decision reinforced Roubini's prediction: between the onset of a debt crisis and the inflationary solution, central banks will always choose the path of monetary devaluation.

The degradation of our purchasing power will continue to be the result of the inability of central banks to face the consequences of their accommodating policies, but also of the mismanagement of the governments they protect.

The inflationary era we have entered will not end as long as the easy way out is chosen.

In this context, the slowdown in price increases expected in the coming months may be short-lived.

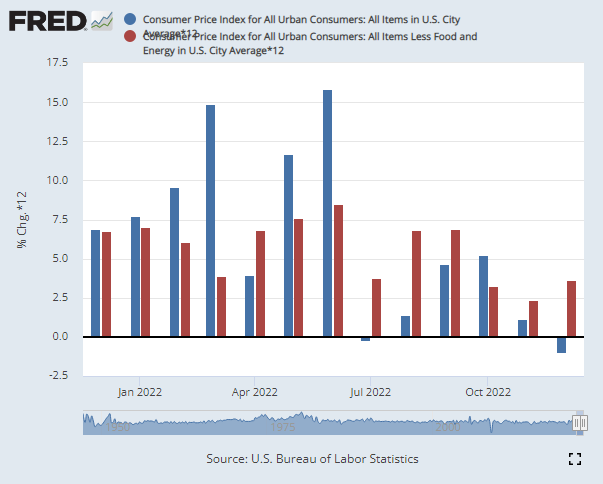

The US Consumer Price Index (CPI) is down, thanks in part to lower energy prices (oil and natural gas):

On the other hand, core inflation is on the rise again.

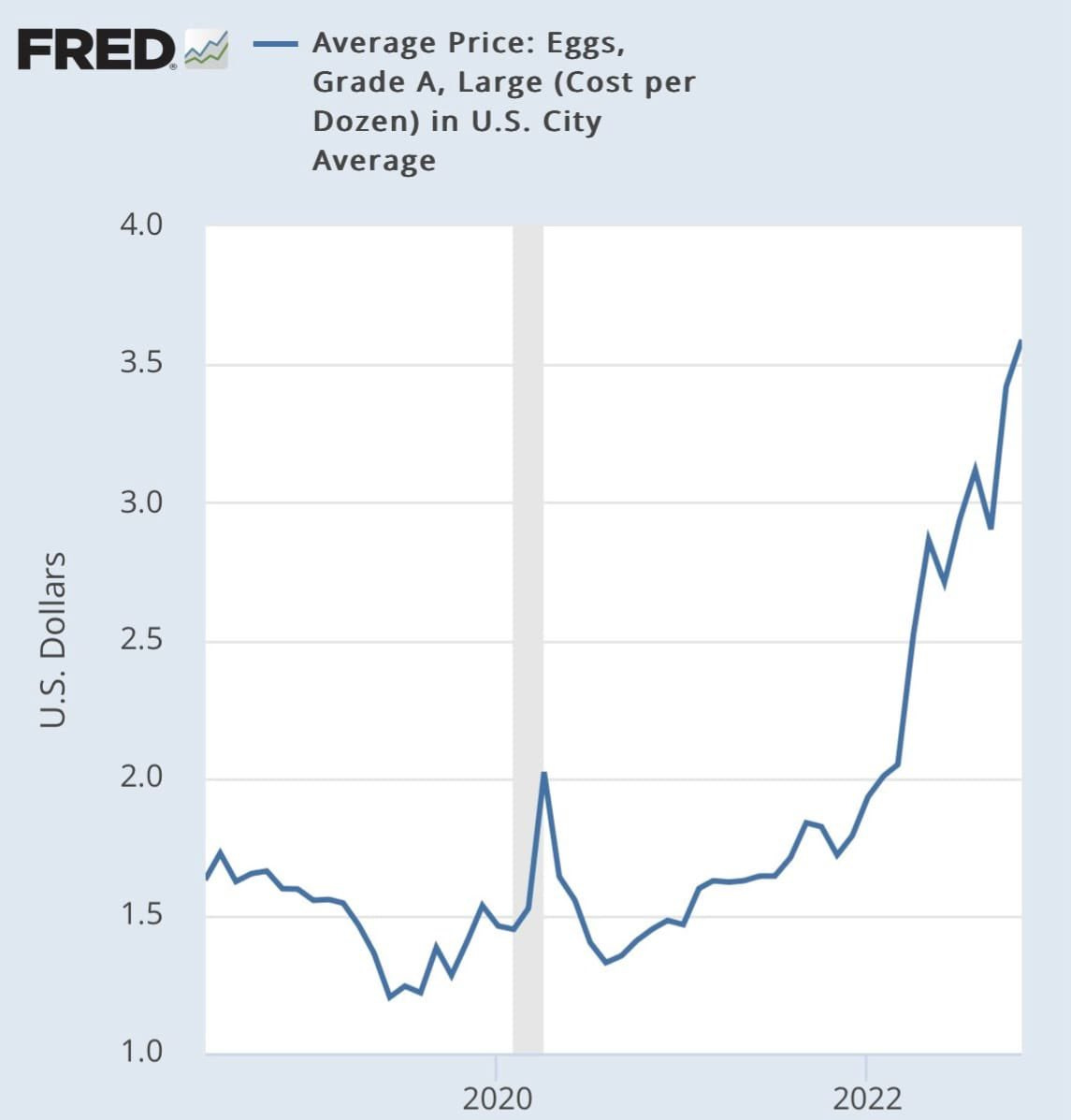

The prices of certain everyday consumer products continue to soar. In two years, the price of eggs has tripled in the United States!

Only a recession could now calm the resurgence of inflation.

The US employment figures do not yet show a significant slowdown.

The New York Fed's Empire State Manufacturing Index is down sharply (-32 points). Durable goods orders are also in decline, suggesting a deterioration in the situation.

The market is anticipating a slowdown, but not a strong and lasting recession. This is the prevailing sentiment, less pessimistic than a few months ago.

And this is reflected in the price of copper. As the most important commodity in industry and construction, "Doctor Copper" is playing its role as a thermometer of global activity:

(Click on image to enlarge)

Last summer, when expectations of a recession were very high, the price of copper corrected sharply in a few sessions before testing the level broken in 2021. The more the risk of recession recedes, the more the metal rebounds in this area. Copper is already up +25% in the last six months, showing that the market is now anticipating a less severe recession than expected.

The recovery in copper prices is also due to the reopening of the Chinese economy, a factor that could also boost inflation.

The downward revision of the short-term recession scenario caught the shorts off guard, who had opened record short positions at the end of the previous month:

(Click on image to enlarge)

As I wrote in my article:

"One major element is nevertheless protecting the indices from a downturn: the number of open bearish positions on the SPX is at a record high. These peaks of pessimism often coincide with market rebounds. Market makers love this type of configuration to initiate squeezes when too many put positions are open.”

The market rebound is part of this large short-squeeze movement. In fact, the best-performing stocks at the beginning of the year have been the best-selling stocks like Tesla.

The markets no longer seem to believe in the Fed's speech regarding the continuation of long-term tightening. U.S. rates have been easing in recent weeks, anticipating a change in the Fed Chairman's speech:

(Click on image to enlarge)

The behavior of the interest rate market is consistent with Nouriel Roubini's analysis that the Fed and other central banks will be forced to forego raising interest rates.

In this context, inflation expectations are likely to rise again. This prospect is probably one of the drivers of the recent rise in the price of gold.

More By This Author:

Gold And Fractals: Is The Price Of Gold Determined By Time?

Gold Is Replacing Real Estate As A Tangible Safe Haven

Recession, Gold Prices, CBDC: What Economic Developments In 2023?

Disclosure: GoldBroker.com, all rights reserved.