Recession, Gold Prices, CBDC: What Economic Developments In 2023?

Rampant inflation, the war in Ukraine, zero covid policy in China, reopening of many coal-fired power plants, geopolitical tensions, popular revolts in many countries... The year 2022 is coming to an end with a more than contrasted balance sheet, although some good news has appeared in the last few months, especially in terms of scientific discoveries (treatments for Alzheimer's disease, nuclear fusion, etc.).

So what might this new year look like?

According to the Institute of International Finance (IIF), the global debt/GDP ratio has reached a historic level of 352% at the end of 2022. For many, often the most idealistic, this ratio does not mean much. In reality, in a world where money exists only through debt - that is to say, our own - this ratio constitutes the nerve center of our economic, financial, and political system; and its increase is the means to pursue the myth of infinite growth and to hold at arm's length a mortifying economy, whereas the emergency requires the accelerated development of a productive economy.

Faced with this ratio, inflation, which has been present for more than a year, is a major issue. In fact, the global rise in prices condemns the central banks to act through a restrictive monetary policy, which risks putting an end to the reign of illusion, and plunging the world economy into the abyss. If, in theory, inflation could be a solution to considerably reduce this ratio, this idea has all the makings of a chimera given the situation of the world economy.

What could be the level of inflation in 2023?

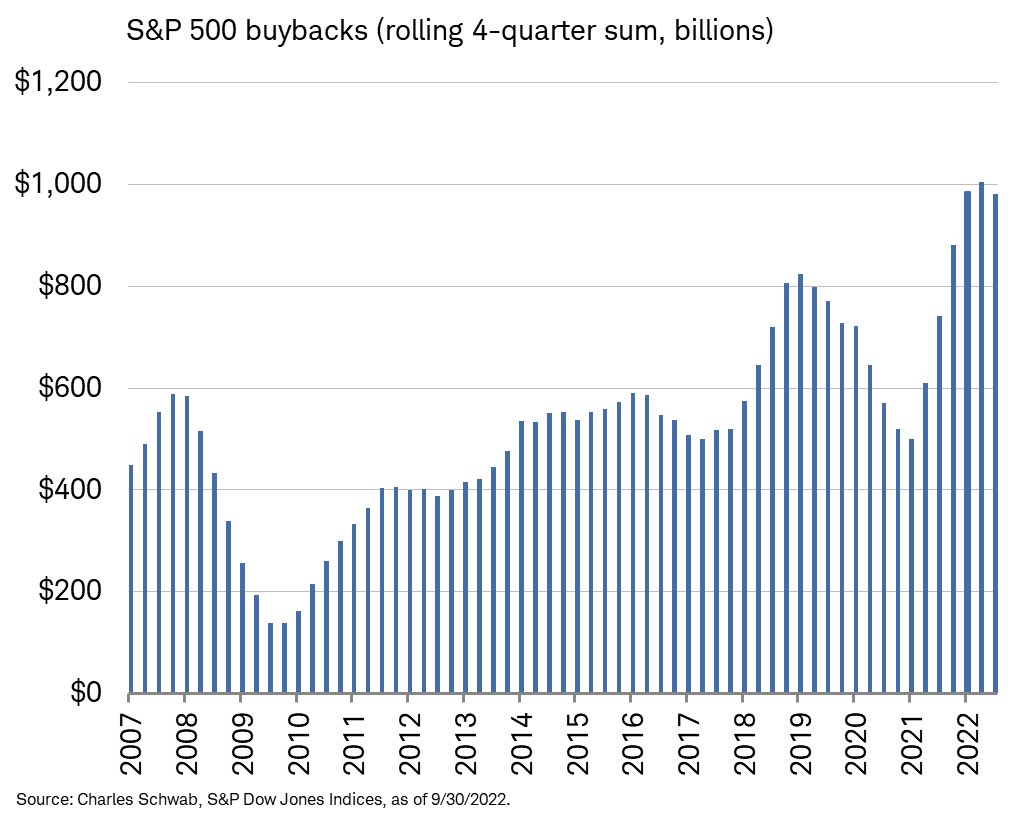

While Western central banks are trying to stem the rise in prices (still at a historically high level) by heavily penalizing the credit that is at its origin, their monetary tightening - made of rate hikes and balance sheet reduction via the sale of securities and the non-reinvestment of those that have reached maturity - risks accentuating the liquidity problems on the financial markets, as many analysts believe. If for now these monetary policies have mainly impacted the crypto-currency market (the bursting of the bubble was more than predictable), but also the real estate market to a lesser degree, the continuation of this policy will inevitably have greater consequences on the financial system, while the S&P500 - the main US stock index - signs an historic decline of 20% over the year 2022, its worst year since the subprime crisis of 2007-2008 and this, in spite of record stock buybacks.

Faced with these future deteriorations, which will most likely occur in a period of still abnormally high inflation, central banks will be obliged to pause their monetary tightening, and then to re-establish an accommodating monetary policy by reducing their key rates and increasing their balance sheets by buying new debt on the secondary market.

At the same time, taking into account the profound changes in the global economy - in particular the return of protectionism in many countries - and the geopolitical tensions that cannot be ruled out (between China and Taiwan, between North Korea and Japan, between the West and Russia, etc.), there is a risk that inflation will remain well above the central banks' mandate objective in 2023, namely 2%.

But this level cannot be sustained, mainly for social, political and financial reasons.

- Social, because rising prices lead to an unprecedented loss of purchasing power for the middle classes, but also for the elderly, who save massively and thus suffer from the fall in their risk-free real returns. In fact, if inflation were to remain in place for a long time - which seems inevitable - social movements could appear (all the more so if we consider the multiplication of migratory waves, notably those linked to the war in Ukraine).

- Political, because the increase in poverty and inequality caused by inflation may lead the citizens of the eurozone to move towards other political parties, especially the more "radical" ones, which are likely to be eurosceptic and therefore contrary to the interests of the ECB. (This phenomenon is all the more threatening because it concerns a particularly conservative category of the population - senior citizens).

-

Financial, because investors are demanding higher and higher yields to protect themselves from inflation, thus leading to higher rates on the bond markets; this complicates the management of public finances for governments, particularly in the eurozone, where structural differences condemn the ECB to a wait-and-see policy, but also for many emerging countries, which are suffering the full force of the rise in the dollar and the increase in the cost of their debt denominated in US currency.

Therefore, given that this half-hearted evolution remains the only possible outcome for monetary institutions (failing to move towards other solutions such as the cancellation of part of the debt of the governments held by the central bank), and in view of the current geopolitical and economic context, the beginning of 2023 will be marked by a recession in Western countries in particular, and by an increased risk on the financial markets. As we explained earlier, central banks have reached a dead end, a hypothesis that is no longer excluded in the public debate.

What developments can be expected for gold in 2023?

Gold could benefit from this scenario. The recent rise in the price of the yellow metal is a testament to investors' continued attraction to gold when uncertainty sets in in the economy. The possible policy pivot by central banks - coupled with persistent inflation and geopolitical tensions - has reignited gold's price. In effect, the assumption of a future rate cut and increasingly less "aggressive" monetary tightening has allowed gold to rise more than 10% since September, and to post a decline of only 0,2% in dollars over the year 2022, far less than the major stock indices and bonds.

If we add to this phenomenon the massive purchases of gold by many central banks in recent months - at the highest rate in fifty-five years - and the increased demand of investors for liquid assets, the price of the yellow metal could continue its rapid rise at the beginning of 2023.

While predictions for the price of gold next year differ among analysts, the most optimistic ones, including those at Saxo Bank , expect a level close to $3,000 by the end of 2023, believing that this coming year will be characterized by the fact that the market will discover that inflation is likely to take hold in economies.

2023: the finalization of central bank digital money?

The coming year will also see the finalization of the European digital currency.

According to the ECB's timetable, the Governing Council's decision to launch the implementation phase of the central bank digital currency (CBDC) will take place in September or October 2023. Until then, the monetary institution will continue the development of this new currency.

This digital central bank money - resulting from the creation of the central bank - would, according to the various communiqués of the ECB, replace the current forms of money (bills, coins, scriptural money). However, unlike the current forms of money, it would be free of debt, i.e. not backed by debt. In practice, this means that each citizen would have an account with the central bank of his country. This money would come either from a central bank subsidy to the inhabitants of the eurozone (in the framework of a state aid, a universal income, etc.), or from a transfer of the citizen from his bank account to his central bank account. However, in order to avoid important capital leaks towards this central bank account and thus a weakening of bank reserves, the amount of these transfers would be limited.

In addition, this digital currency allows the ECB to finance directly - in central currency - the citizens of the eurozone (which is not prohibited by the European treaties, unlike direct financing to the governments), thus protecting them from any risk of bankruptcy of a commercial bank. The parallel with the situation in which central banks find themselves, notably the ECB, is particularly striking since the introduction of this new currency would make it possible to protect economic agents from any systemic risk.

However, if the introduction of this new currency could in theory bring many benefits to the monetary system, the economy and the citizens of the eurozone, its non-democratic process, and the possible infringements of individual liberties constitute major threats. In fact, despite a reassuring communication, the functionalities of this CBDC are in no way decided by the citizens of the eurozone, which suggests that the protection of personal data and the free will of users could be particularly affected. One of the major challenges for the ECB is therefore to succeed in getting this currency accepted by economic agents, at a time when inflation is deteriorating the confidence of individuals, after a year marked by successive confinements in which individual freedoms were strongly restricted.

More By This Author:

How Will The Dollar And Gold Perform In 2023?

Precious Metals Outperformed Stocks And Bonds In 2022

Silver, The Next Sector To Be Hit By The "Elon Musk" Effect?

Disclosure: GoldBroker.com, all rights reserved.