Rare Earth Element Mining Stocks Have Recently Jumped +32.8% Due To U.S. Tensions With China

This article identifies the companies involved in the mining of rare earth elements, its uses, and the countries with the largest known reserves.

Rare earth elements (REEs) are not rare in the common sense of the word but, because they are almost universally by-products typically present in small proportions to what is otherwise being mined, it is very expensive to develop a REE mine and the production costs associated with its mining and processing.

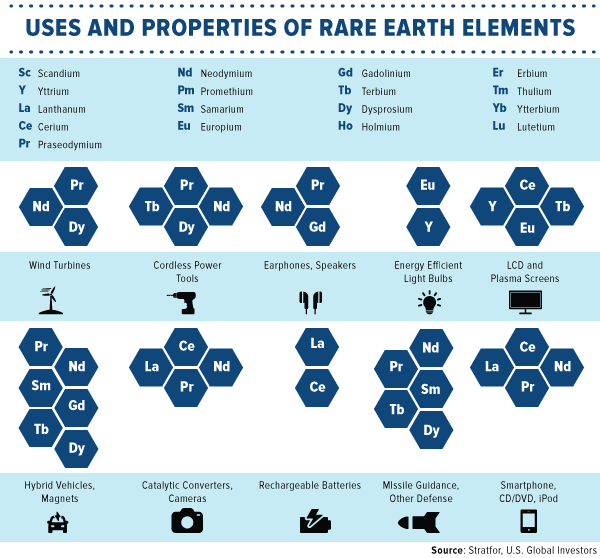

There are 17 rare earth elements (REEs) and they are widely used in smartphones, flat-screen TVs, LED lights, wind turbines, electric vehicles, fighter jets, missiles, radar and lasers.

85% of global output of the REEs comes from China and that dominance poses a considerable economic and national security risk to the U.S., one that’s become all the more apparent in the months since trade relations between Beijing and Washington soured further. China is prepared to "weaponize" its supply of REEs just as it did in 2019 when it threatened to curb their export to the U.S. in retaliation over tariffs and, to validate these not-so-veiled threats, China’s rare earth exports to the U.S. have begun to slow, falling nearly 18% in September from the previous month.

The White House was so worried it's U.S. Department of Energy awarded $19 million last April for 13 projects supporting production of REEs and critical minerals and, in November, the Defense Department announced contracts and agreements with several REE producers. More government money can be expected to be invested in the REE sector going forward.

The list of publicly traded companies that exclusively mine REEs outside of China is limited to MP Minerals Corp. (MP) and Lynas Rare Earths (LYSCF) and, since trade relations between Beijing and Washington began to turn sour in late September, their stock prices have jumped in price.

- MP Materials Corp. (MP) is UP +32.3%

- is the only U.S. company doing so and operates the Mountain Pass mine in California. In November 2020, the Defense Department awarded the company a $9.6M to aid in its effort to bulk up value-added processing and separation capabilities at the Mountain Pass facility.

- Lynas Rare Earths (LYSCF): UP +36.1%

- is the largest REE miner and processor outside of China It extracts REEs from its high-grade mine in Australia and processes them at its facility in Malaysia.

| Country | Mine Production 2020 | Reserves | % of Reserves |

|---|---|---|---|

| China | 140,000 tons | 44,000,000 tons | 38.0% |

| Vietnam | 1,000 | 22,000,000 | 19.0% |

| Brazil | 1,000 | 21,000,000 | 18.1% |

| Russia | 2,700 | 12,000,000 | 10.4% |

| India | 3,000 | 6,900,000 | 6.0% |

| Australia | 17,000 | 4,100,000 | 3.5% |

| United States | 38,000 | 1,500,000 | 1.3% |

| Greenland | - | 1,500,000 | 1.3% |

| Tanzania | - | 890,000 | 0.8% |

| Canada | - | 830,000 | 0.7% |

| South Africa | - | 790,000 | 0.7% |

| Other Countries | 100 | 310,000 | 0.3% |

| Burma | 30,000 | N/A | N/A |

| Madagascar | 8,000 | N/A | N/A |

| Thailand | 2,000 | N/A | N/A |

| Burundi | 500 | N/A | N/A |

| World Total | 243,300 | 115,820,000 | 100% |

As can be seen in the table above from Visualcapitalist.com, China tops the list for mine production and reserves of rare earth elements, while the U.S., with only 1.5 million imperial tons in reserves, is dependent on imports from China for refined rare earths at this point in time and, as such, must either tap into the reserves of other countries or further develop mines in the U.S. itself.

Visit munKNEE.com and register to receive our free Market Intelligence Report newsletter (sample more