Precious Metals Rally, As Japan Opens Door To Selling U.S. Treasuries To Leverage Trade Dea

Gold and silver were mixed on Friday to close out the week, with gold rebounding after yesterday’s selloff, while silver traded slightly lower.

The gold futures were up $14 to $3,235.

(Click on image to enlarge)

Silver was down 27 cents to $31.97.

(Click on image to enlarge)

The precious metals didn’t have an abnormally large reaction to this morning’s labor report, which came in better than the Wall Street expectations.

Although keep in mind that those expectations were only for 133,000 jobs (the print was 177,000), which seems a bit different from the message Jerome Powell has repeated about the strong economy.

Yet in either case, what does have more significant implications than today’s labor report is a recent statement from Japan. Where Japanese Finance Minister Katsunobu Kato said that Japan would not rule out using their US treasury position as leverage in a trade deal.

(Click on image to enlarge)

‘Japan could use its $1 trillion-plus holdings of U.S. Treasuries as a card in trade talks with Washington, its finance minister said on Friday, raising explicitly for the first time its leverage as a massive creditor to the United States.

While Finance Minister Katsunobu Kato did not threaten to sell holdings, his remarks touch on a critical concern global investors have about what Japan and China, the two largest owners of U.S. government debt, might do in seeking tariff concessions from the Trump administration.

Kato said in a television interview the primary purpose of Japan's U.S. Treasury holdings - the largest in the world - is to ensure it has sufficient liquidity to conduct yen intervention when necessary.

"But we obviously need to put all cards on the table in negotiations. It could be among such cards," he said when asked whether Japan, in trade talks with the U.S., could reassure Washington it will not sell its Treasury holdings in the market.

Reuters also points out how this was in contrast to what Japan had said just one month earlier, when they were willing to rule that out.

‘Kato's remarks contrast with those he made last month, when he ruled out using Japan's U.S. Treasury holdings in trade negotiations.’

My guess is that a trade deal does get reached before Japan really goes more seriously down that path. Yet these are things that were not discussed, and certainly not broadcast publicly in past decades. And speak to the way that the role of the US treasury as the safe haven asset is changing before our eyes.

Maybe it’s been changing for a long time, and then the trend just accelerated in 2022 after the sanctions were placed on Russia.

But all of a sudden, now even US trading partners are looking at treasuries in a way unlike the financial world has known for the past 50 years.

‘However, he said the huge market sell-off in Treasuries in April likely affected Washington's approach in talks with Japan.’

Many market commentators have surmised that the treasury is paying incredibly close attention to the yields, and now the Japanese finance minister confirms as much.

Japan's and China's presence in the Treasury market makes them a huge point of attention whenever U.S. yields spike, although little is known about their trading activity.

While Japan, as a close U.S. ally, is seen as less likely to use its Treasury holdings as a bargaining tool, some analysts speculate that China may liquidate its holdings as a "nuclear" option as trade tensions with the U.S. escalate.

Again, just not the kind of thing you used to hear in the financial media 20 years ago.

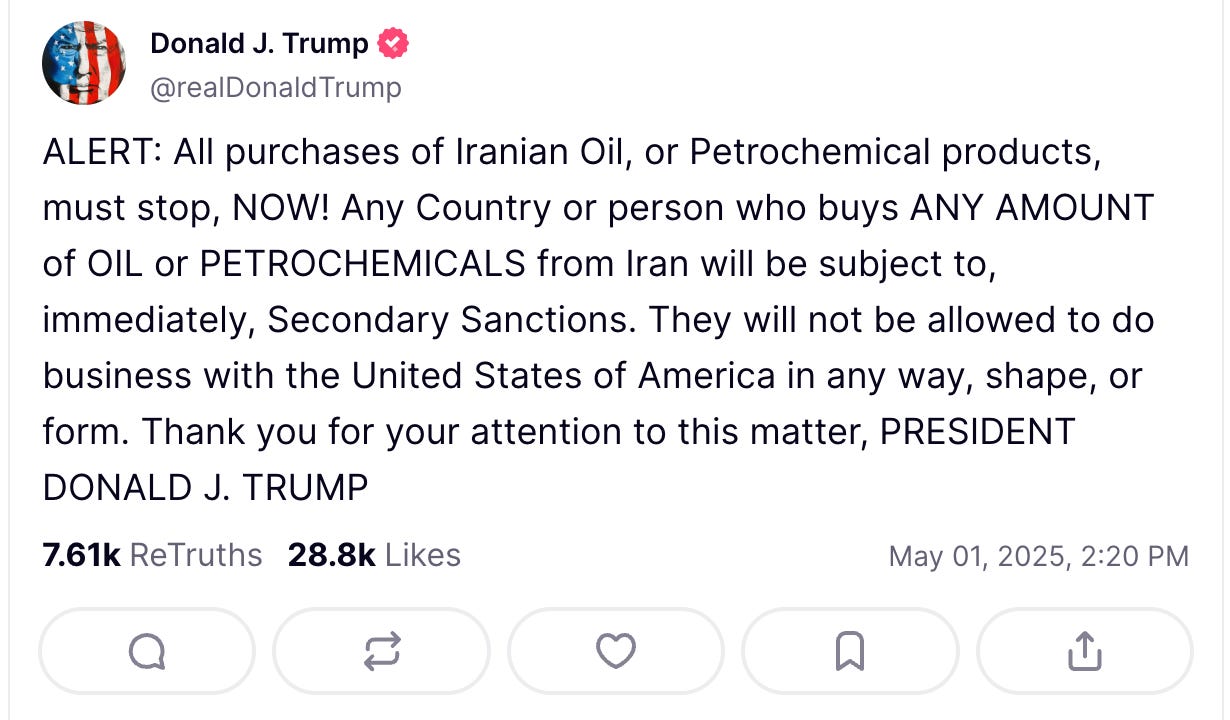

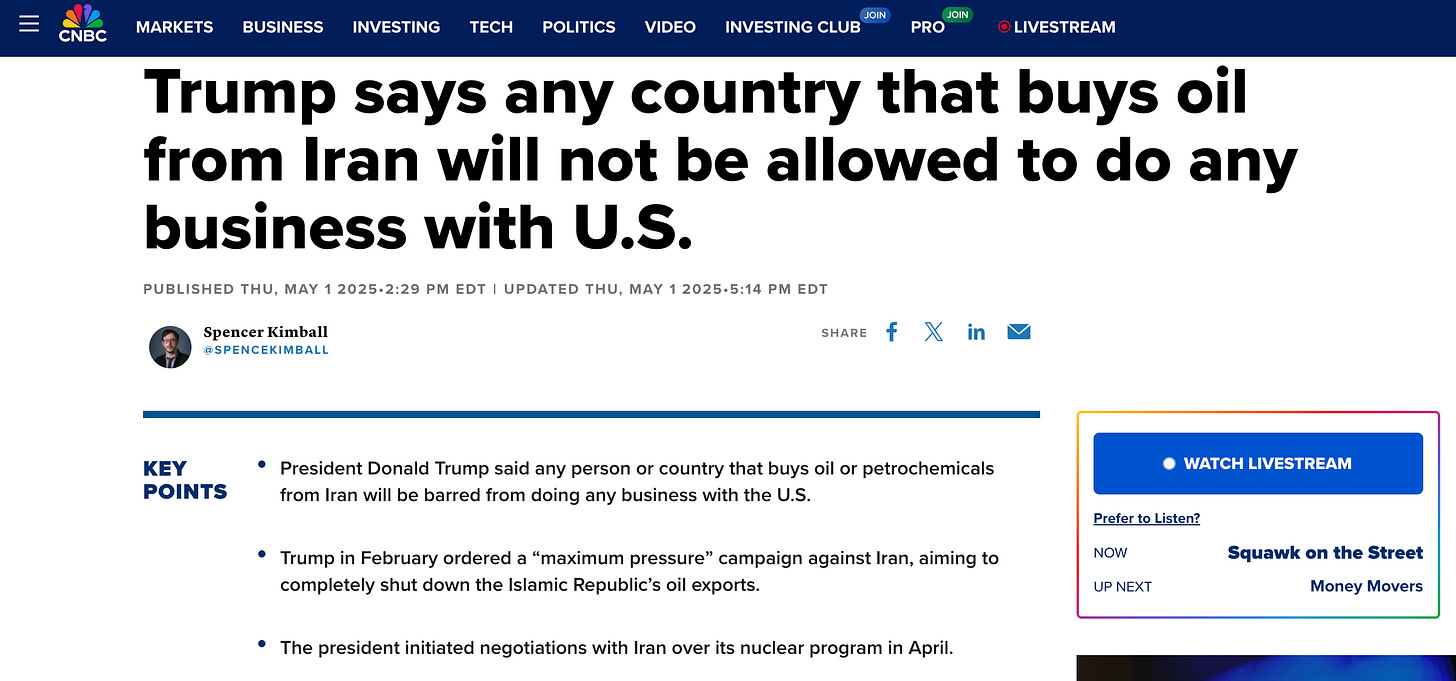

At a time when (to put it kindly) trade relations are not at their all-time best, there was also the news that Trump has threatened any country that buys oil from Iran that it will no longer be allowed to trade with the US.

In February Trump ordered a “maximum pressure” campaign against Iran to shut down their oil exports, and now comes this latest news.

Here you can see how the headline looks on CNBC.

‘Trump’s comments are clearly directed at China, which is importing more than 1 million barrels per day from Iran, said Scott Modell, CEO of consulting firm Rapidan Energy.’

Between the ongoing trade war, the recent threat of additional banking sanctions on Russia, the BRICS’ already stated desire to continue de-dollarizing, and now this threat against Iran, that sure is a growing portion of the world that the US is threatening to walk away from.

There hasn't really been any news about the Fort Knox audit lately. Although the DOGE board continues to be active, and has uncovered some staggering, and truly fascinating amounts and levels of fraud.

Here's a brief clip with Elon Musk and one of the DOGE investigators talking about how the US Treasury was spending approximately 5 trillion dollars per year (on items like renting football stadiums or Caesar’s Palace for parties), but leaving out any authorization codes.

And how once DOGE implemented a feature that a receipt had to be uploaded for the expense to be accepted, all of a sudden the requests stopped.

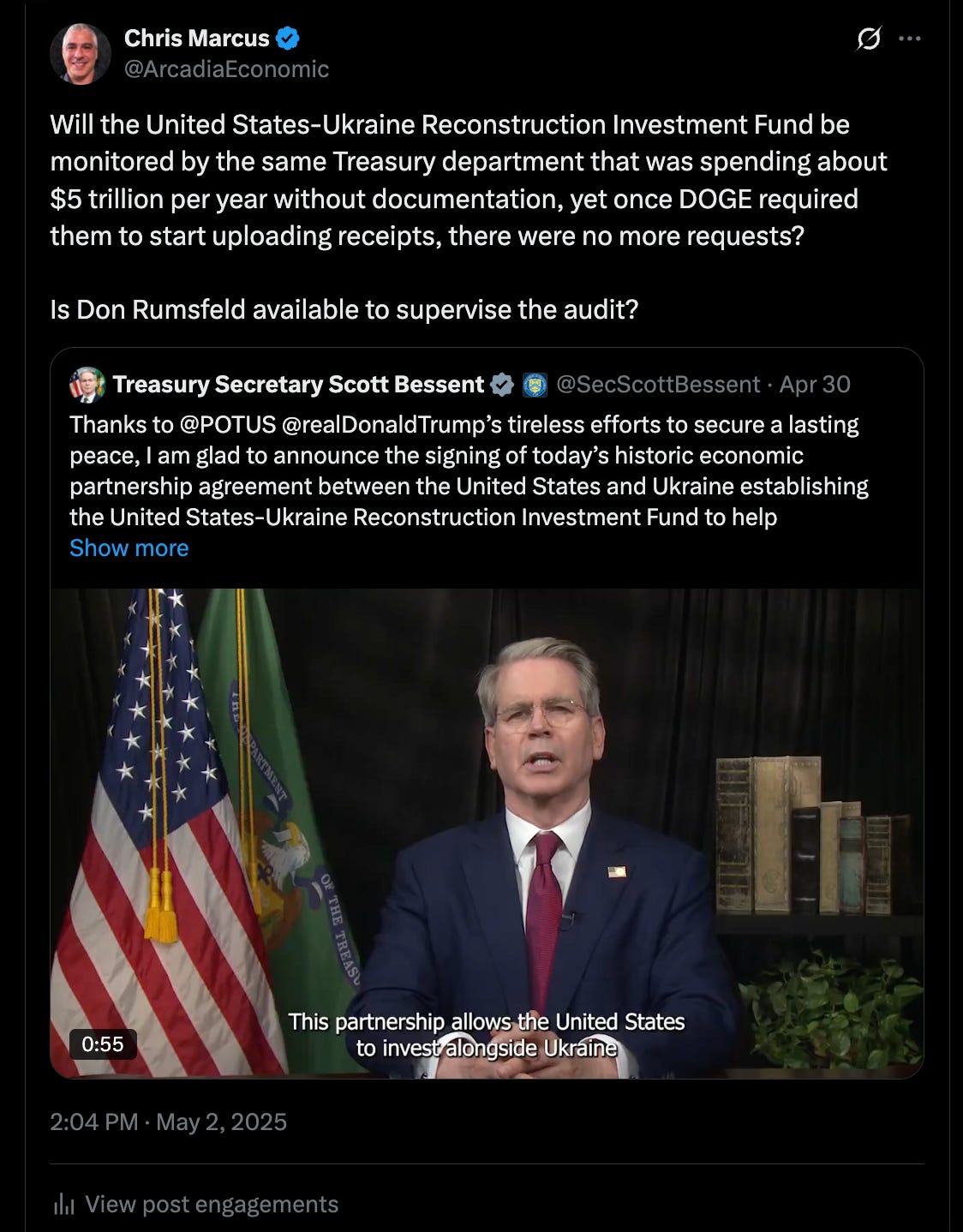

Treasury Secretary Scott Bessent was also active again this week, as he announced the signing of the United States-Ukraine Reconstruction Investment Fund.

Maybe I'm still a little biased from reading John Perkins’ ‘Confessions of an Economic Hitman’ fifteen years ago. But especially if it was just revealed that the treasury was spending 5 trillion dollars per year without documentation, along with how the fact that it suddenly stopped once receipts were required isn't the best look, now we're essentially counting on that same group to oversee this reconstruction investment fund?

Obviously I'm in no position to say what they will or will not do. But at least if I was in charge, or a member of the DOGE board, I would certainly be keeping an eye on those receipts.

Although perhaps somewhat justifying my skepticism was this report about how the US and Ukraine also signed a deal ‘that will give the United States preferential access to new Ukrainian minerals deals.’

Seems in the least ‘prone to abuse.’

And as someone who was born in the United States and still lives here, these aren’t statements I make with joy. Yet when you study events like ‘the weapons of mass destruction’ in Iraq, the overthrow of Mohammad Mosaddegh in Iran by the CIA in the 1950s, and see trillions go missing from the Pentagon on a regular basis, it seems prudent to at least question.

However the last note for this week is just a picture of a headline from the Wall Street Journal, where they talk about how Chinese exports have plunged. And since we’ve been discussing the growing possibility of goods shortages this year, I just point this out to highlight the kind of headlines being presented to the public right now.

All of which can sometimes be a bit to handle. Yet just makes appreciating what we have, and what is going well at the moment all the more important.

So do have a wonderful weekend, thank you as always for spending part of your day with me here, and I'll look forward to covering the markets with you again on Monday.

More By This Author:

Gold & Silver Prices Selloff, As China Says It ‘Won’t Kneel Down’ To US & Trump

Latest Silver Data Shows Market Still On Track For Dislocation

Gold Continues To Diverge From Silver & Trade On Monetary Premium

Disclosure: None.