Latest Silver Data Shows Market Still On Track For Dislocation

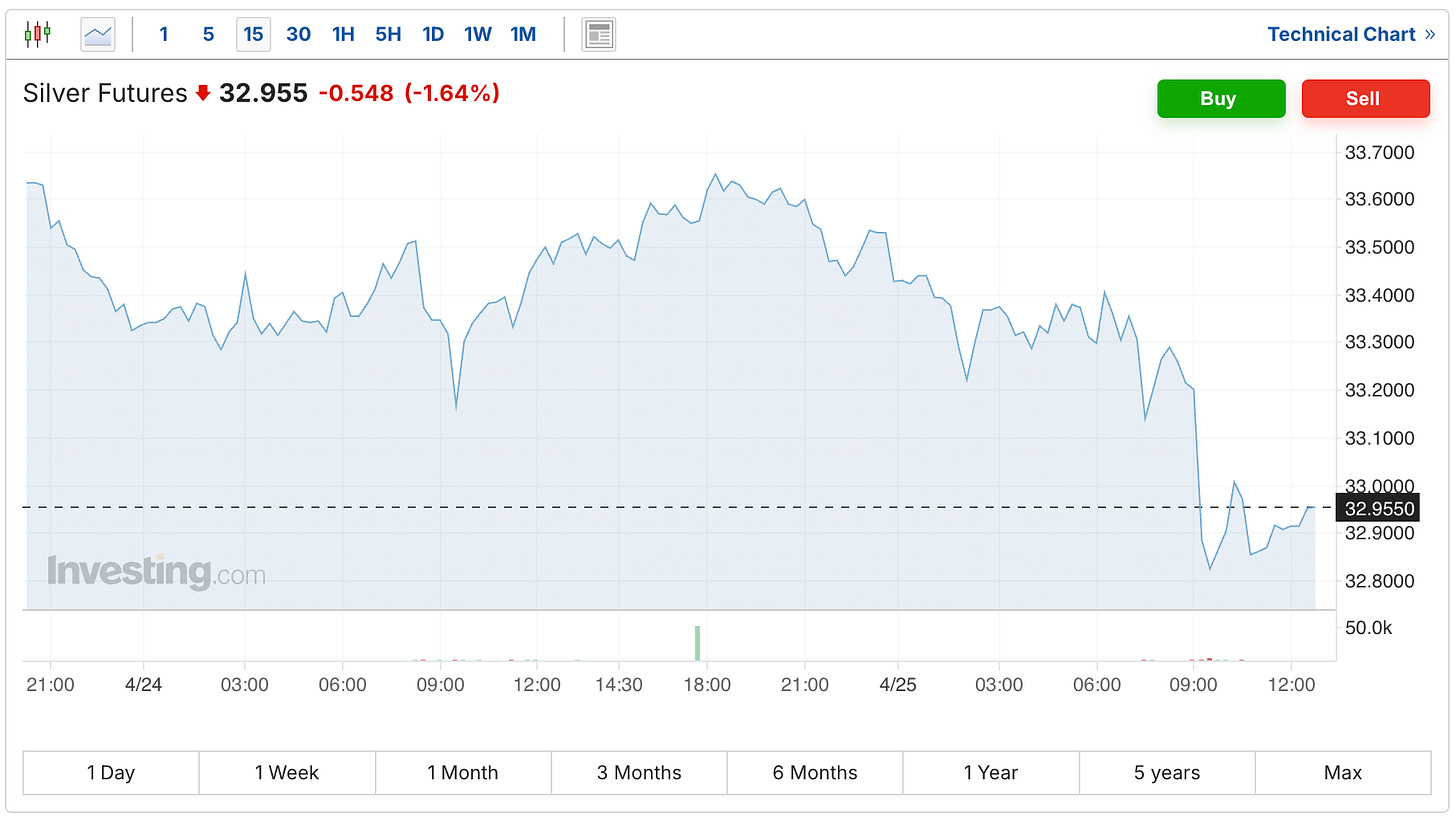

The volatility continued on Friday in the gold and silver markets.

Although unlike over the past week, this time both gold and silver were highly correlated, with gold down $54 to $3,294 (-1.62%), while silver was down 54 cents to $32.95 (-1.64%).

(Click on image to enlarge)

Again, in this type of environment, when tomorrow's rules generally aren't known until a few hours ahead of time, you're going to get volatility like this.

And it was also interesting to wake up and see the gold price already down $50 this morning, and wonder, is a $50 move up or down now just a regular day for gold?

As I mentioned last week, the latest World Silver Survey was recently released, which once again showed another significant deficit.

Metals Focus (who writes the report) just put out a piece highlighting their conclusions, which had some interesting comments worthy of discussion.

‘One of the report’s key findings was the continued strength of silver’s underlying fundamentals, as the metal saw its fourth year of a major deficit in 2024.’

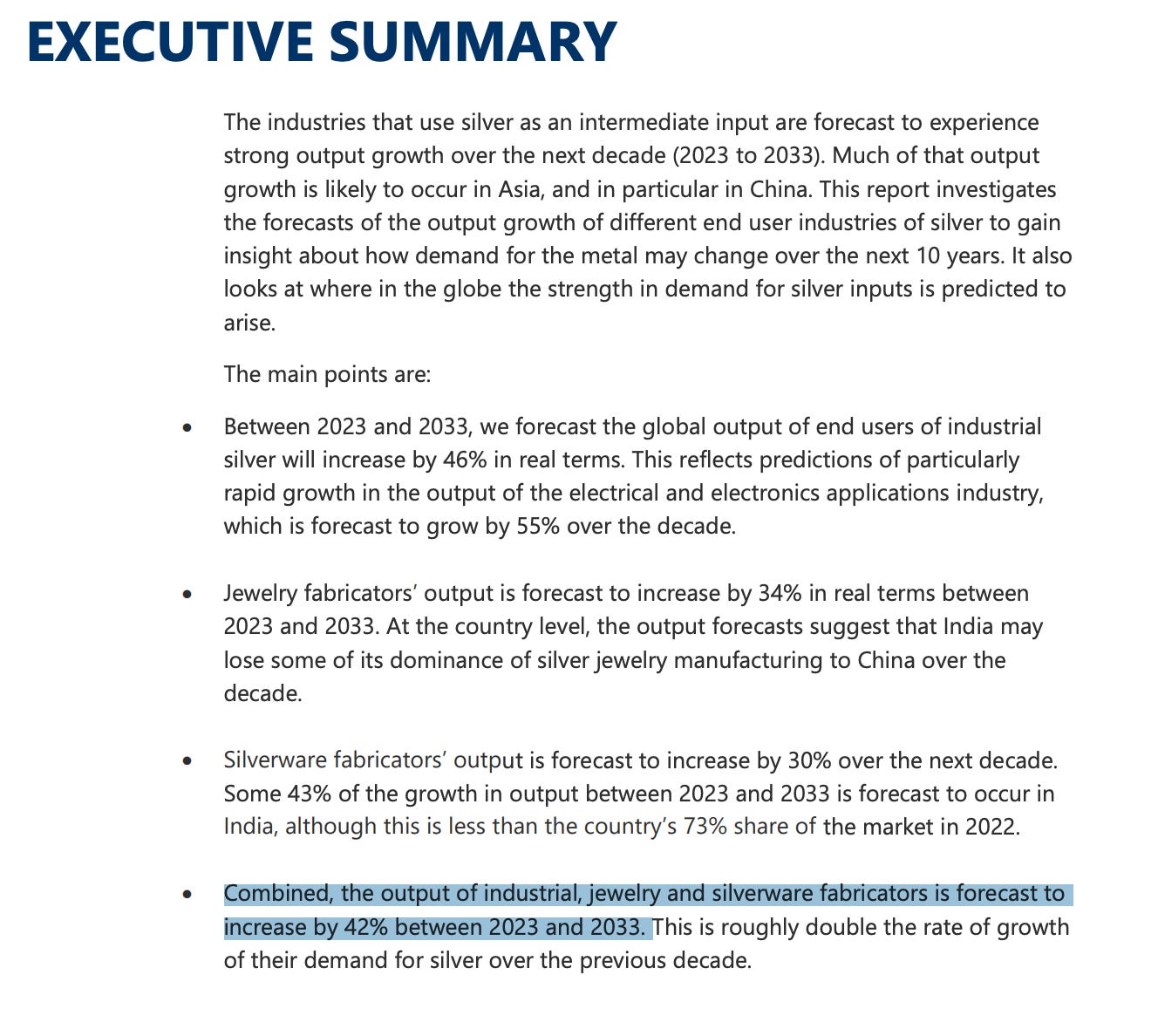

The deficit was driven by the industrial demand. And worth noting is that two years ago the Silver Institute commissioned a study by Oxford Economics on the expected growth of industrial demand for silver over the next decade, and you can see the executive summary in the picture below.

Which includes the conclusion that ‘combined, the output of industrial, jewelry and silverware fabricators is forecast to increase by 42% between 2023 and 2033.’

(Click on image to enlarge)

The just released Metals Focus report that summarizes this year's Silver Survey also talked about silver's performance relative to gold.

‘Some investors were disappointed with silver’s price performance relative to gold. This mainly reflected elevated geopolitical and policy uncertainty being mostly supportive of gold’s more widely accepted quasi-monetary properties.’

I've shared the reasons that I feel are driving the divergence between the two precious metals throughout this week. And if you have not yet seen it, this column has a great overview, as well as a video discussion with a silver mining executive where we talked about that divergence.

‘Despite a 3% decline in 2024, total silver demand remained historically high. Underpinning overall demand was the continued strength of industrial offtake, which achieved a record high for the fourth consecutive year.

Structural gains in the green economy, such as grid infrastructure and vehicle electrification, as well as the photovoltaic (PV) market, remained the principal growth drivers last year.’

Keep in mind that while they mentioned that overall demand fell by 3%, there is a nuance in that number.

Industrial demand set a new record at $680.5 million ounces, while investment demand, particularly in the US, was weaker. And over the past few months, we’ve mentioned several times how there’s been a wave of investor selling on the retail silver level over the past two years (although it seems like that has subsided somewhat over the last month or two), which makes me continue to wonder how these numbers will look if and when that selling turns to buying.

Because I particularly found it interesting to hear several dealers or wholesalers mention that some of the coins and bars that were being sold back by retail investors were actually being melted down into 1000 ounce bars to meet industrial use.

So again, when you see that overall demand was down by 3%, keep those factors that exist beneath the surface in the back of your mind.

‘While very limited in most sectors, there was notable thrifting within PV. This helps explain why growth in overall industrial demand slowed sharply from 11% in 2023 to last year’s 4%.’

Some more counterbalancing factors here.

There is thrifting going on as they mention. Yet at the same time, the newer panels currently being used do require substantially more silver than the old technologies.

Although of course that's one of the many things that we will keep you posted on in this column going forward, and if you are currently a free subscriber, but would like to upgrade to our daily service so that you can make sure you get all of those updates, you can always do that easily and conveniently here.

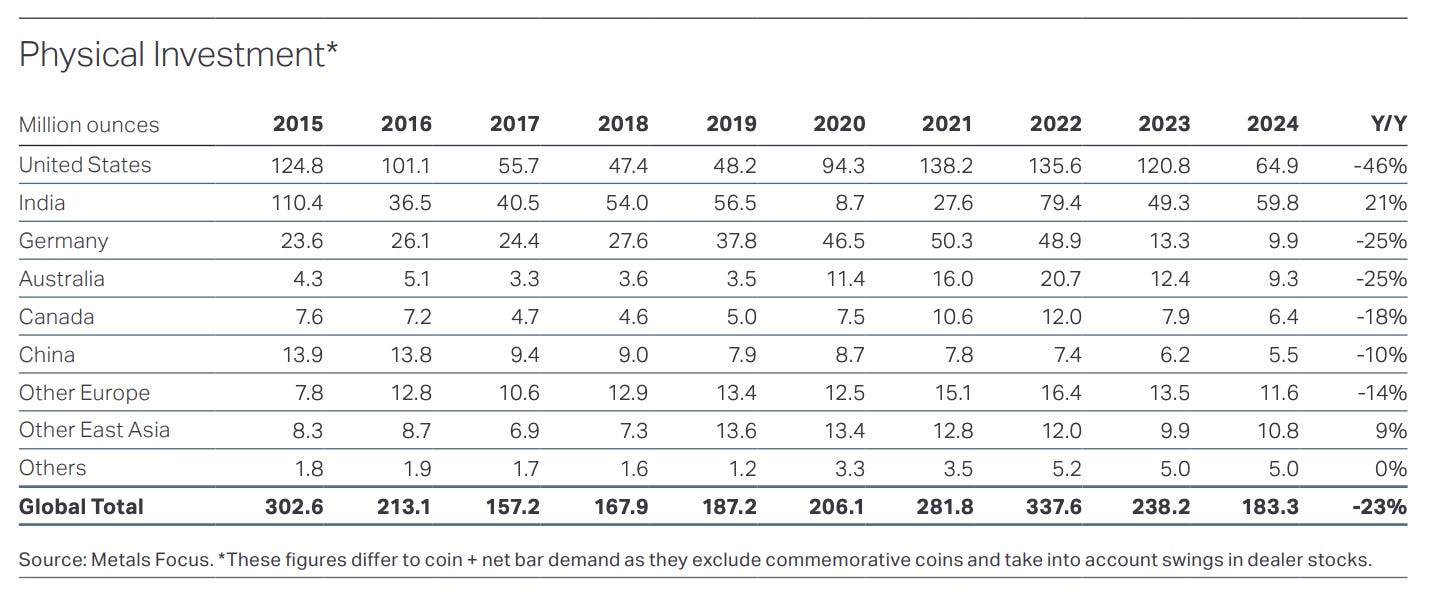

‘These aforementioned gains were more than offset by a 22% drop in bar and coin demand. All key Western markets saw declines, typically due to cost-of-living issues and profit-taking at higher prices. The fall was steepest in the US (-46%) due to investors’ reaction to high prices, Trump’s win and market saturation.’

I already touched on this. Although it does remind me of something else I've been thinking about lately. In that when we think of the silver investing market, I rarely hear it mentioned how it is largely an American affair.

You can see in the chart below how in 2024, the US was 1/3 of the silver investment market.

(Click on image to enlarge)

In 2023, the US was over half of the investment market.

So when you see a period like we just have where there’s been a lot of retail selling in the US, that's how you end up with a drop in demand like that.

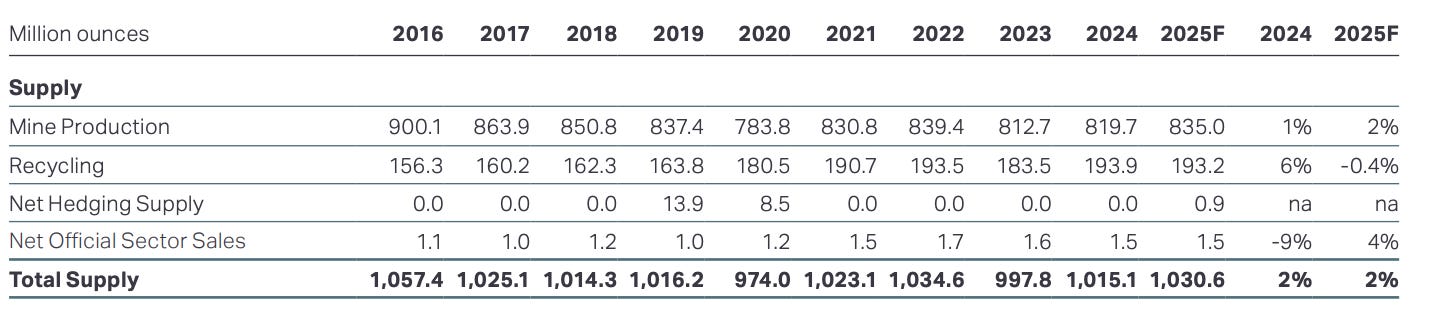

‘Total supply grew by 2% last year. Global mine production increased by 0.9% y/y. The rise was led by a recovery in Mexico, as Newmont’s Peñasquito mine returned to full production following the temporary suspension in 2023.’

The Peñasquito mine was shut down for a strike in 2023. So while the supply did grow 2% last year, it still remains on the lower end the past decade (especially if you factor in that 2020’s production figure was impacted by mine shutdowns in response to COVID).

(Click on image to enlarge)

And with capital continuing to be reluctant to find its way into the silver equities market, it’s likely to remain a challenge to meaningfully increase silver production in the years ahead, while industrial demand is forecast to rise further.

Which again makes it quite intriguing to see what will happen when the retail selling turns to buying.

‘With a 2% rise in total supply and a 1% dip in demand, this year’s deficit will be 21% lower y/y and less than half of the 2022 peak. In keeping with 2024, this deficit is unlikely to make a material contribution to prices in 2025. This is due to the still sizable stockpiles of silver, which should prevent a sustained physical squeeze.’

While the stockpiles have been declining, and the London inventories only have enough free floating silver to cover about 1 year’s worth of a deficit, there is still silver out there. Especially in New York right now.

Of course it's also possible that the silver required to meet the expected deficits in the years ahead might not be delivered at the current price. And it's possible that the deficits could force an upward price correction, even without the market entering an overt shortage.

Additionally, with the way the current dynamics in the silver market stack up, while there is still time on the clock, it does seem that the conditions that would be required to lead to a shortage are currently rather firmly in place.

And if we do see silver pick up more of a monetary premium in the years ahead, similar to how gold has done over the past few years, that could also exacerbate the timeline on such a scenario.

All of which will make it a lot of fun to follow the gold and silver markets in the years ahead. And hopefully you've been enjoying these past few months, where even after a $200 sell-off in the gold market over a 2-day period, the price still remains just under $3,300 per ounce.

So go and have a great weekend, and I’ll look forward to checking back in with you on Monday.

More By This Author:

Gold Continues To Diverge From Silver & Trade On Monetary PremiumWhat Donald Trump Wants To Say To Jerome Powell: 'You're Fired!'

UBS Says Gold Still Has Room To Run

Disclosure: None.