Pre-December USDA Report - With Limited Dec US Demand Changes, New Covid Issues Grab Headlines

Market Analysis

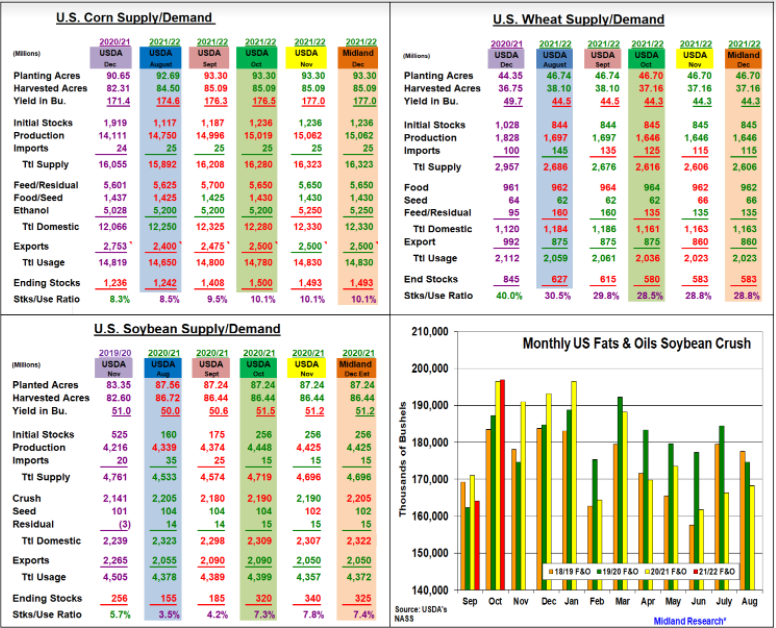

The upcoming USDA December 9 report isn’t sparking a lot of market conversation. With no US corn and soybean crop size update, the latest concerns about the Omicron Covid variant impact on financial and energy markets has created a very choppy agricultural trade since Thanksgiving. After its discovery, the reported symptoms have been lower than the Delta variant prompting a recent rebound. However, the markets will remain quite sensitive to this health matter until vaccine knowledge is known. With next week’s revision being primary a US & World demand update, the USDA has traditionally limited its changes in their major crop balance sheets as they wait for final US crop production in January. Corn’s US export sales are behind last year, but they are 159 million bu ahead of its seasonal pace to achieve the USDA’s 2.5 billion forecast. Shipments have been lagging, but elevation space and less S Am competition suggest a pick-up in 2022. Strong gasoline & biofuel processing margins have ramped up corn’s ethanol usage. However, lower N Hemisphere winter driving demand & last month’s 50 million bu US increase in this demand suggests the USDA could leave this usage unchanged, too This will likely mean no change in corn’s 2021/22 ending stocks this month. With wheat’s focus on S Hemisphere crops, heavy rains are prompting a larger Australian estimate. However, a higher portion of its output will likely have lower quality (protein). A higher US dollar has also reduced interest in US supplies, but the USDA could also stand pat on wheat’s exports after slicing 15 million from this demand last month, US soybean exports are sharply behind 2020’s pace with Brazil’s crop off to good start this year. However, sales are very close (20 million bu) to the seasonal pace to hit the USDA’s forecast suggesting no change. An important feed component, lysine, has been impacted by supply chain issues. This has prompt larger meal needs in rations surging Oct’s US crush to a record 196.9 million bu. This could prompt 15 million rise in the crush & a drop in US stocks.

What’s Ahead

The recent market volatility is a reminder about the world’s ongoing concerns about the Covid pandemic. China’s lack of urgency as the Phrase 1 deal nears the end is also troublesome. Brazil’s fast start to its growing season suggests possible strong competition. Utilize strength to $5.89-95 (CH), $12.75- 85 (SF) & $8.50-60 (KCH) to advance old crop sales to 60% and begin 2022/23 marketings at 10%.

(Click on image to enlarge)

Disclaimer – The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of any futures brokerage firm or its ...

more