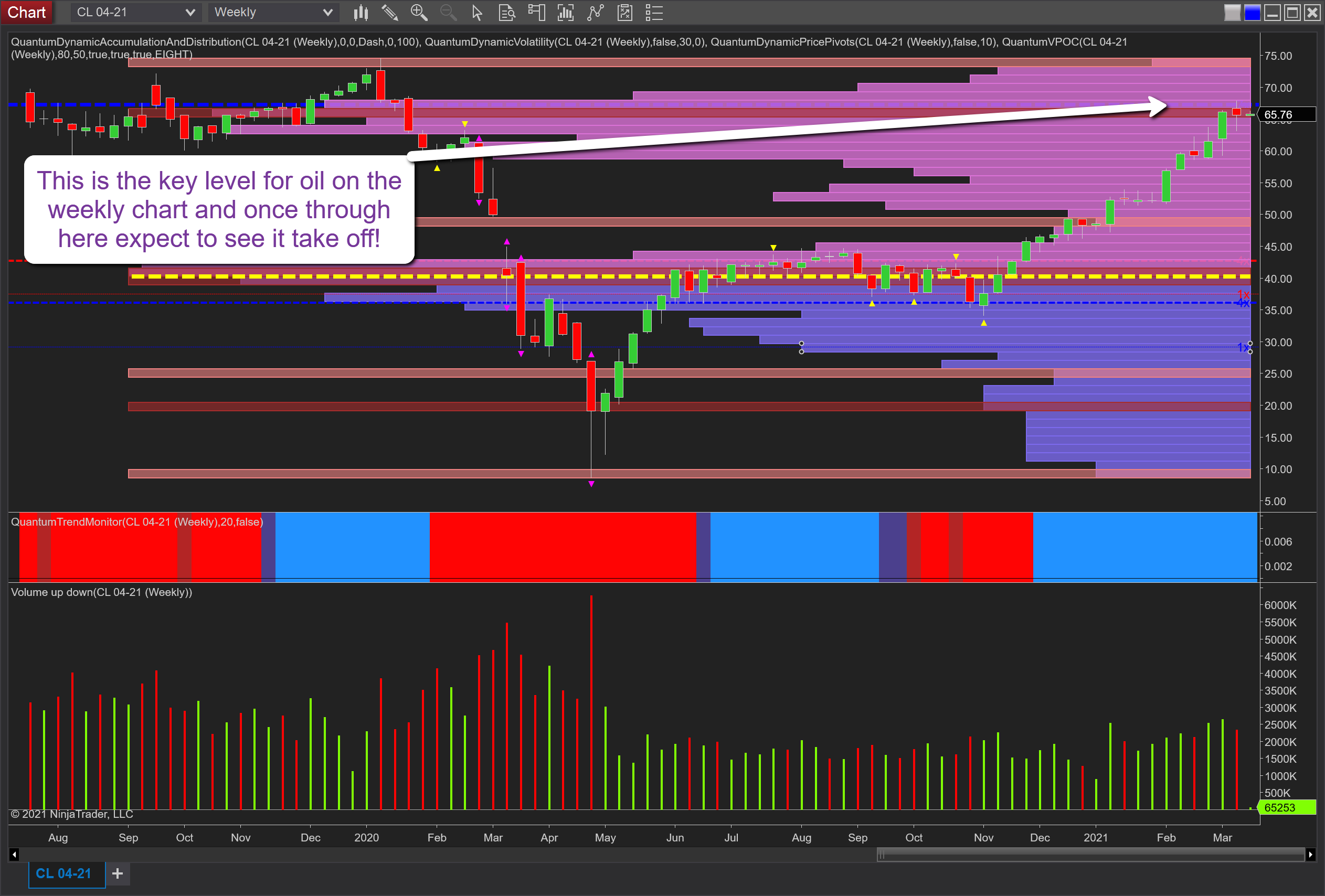

Oil Continues To Test This Level, But Once It’s Breached, Off We Go Again

(Click on image to enlarge)

I highlighted a key technical level for crude oil last week and as expected this has come into play and bringing with it a pause point to the current bullish trend. The area in question is that denoted with the blue dashed line of the accumulation and distribution indicator which sits at the $66 per barrel area.

The indicator presents each level in terms of its strength, the thicker the line then the stronger the level, and as can be seen on the weekly chart, this is a sustained technical area that must be breached for oil to continue higher. Last week’s candle closed as a Doji on good volume and merely confirmed the congestion now building at this price point. However, once this is breached on good volume and a solid wide spread up candle, expect to see oil prices continue higher, and with momentum given the decline in volume on the volume point of control (VPOC) histogram allowing the price to move through this area easily and on towards the $75 per barrel in due course on the next leg of the trend.

Disclaimer: Futures, stocks, and spot currency trading have large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in ...

more

Rinse, repeat..