Oil And Oil Stocks Are Spring Loaded

In January 2017, I wrote this for MarketWatch: The Trump oil trade, and why oil might soon reach $100 again

Today, we are well underway in that move higher in oil prices. Will the price of oil reach $100 again? That depends on whether there are unexpected supply disruptions. Regardless, the oil market conditions I detailed are still manifesting and oil will at least remain firmly in a higher range compared to a few years ago.

This higher oil price era, which could be interrupted by a recession, with a price range from the low $60s to $80s per barrel of oil, will be enough to drive significant earnings gains for lean U.S. oil producers. With the recent pullback in oil stock prices, investors are being given what might be the last opportunity to buy oil stocks at a discount to expected future earnings.

Oil Is In A Higher Price Range

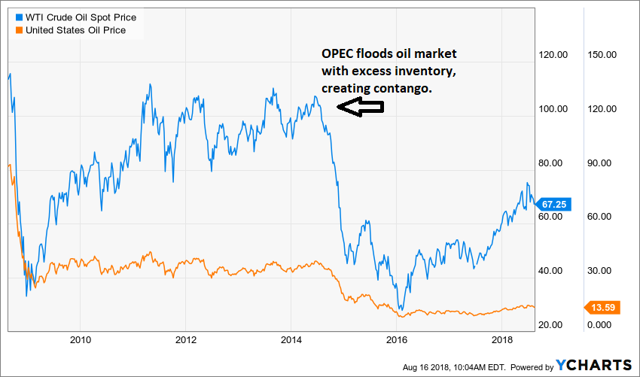

When OPEC confirmed its decision to flood oil markets on Thanksgiving 2014, the price of oil, which had already begun to slide since I forecast oil would fallthat summer, moved into crash mode.

From early 2016, when oil price bottomed, a new upward price trend began. It was confirmed when the oil market finally moved from contango to backwardation in early autumn 2017.

For about the past year, the upward trend in oil price has been obvious. Although short-term traders try to game the slightest moves, what we can see is that there are discernible price levels for longer-term investors to buy. We are at such a price point now.

Oil Price More Likely To Rise Than Fall

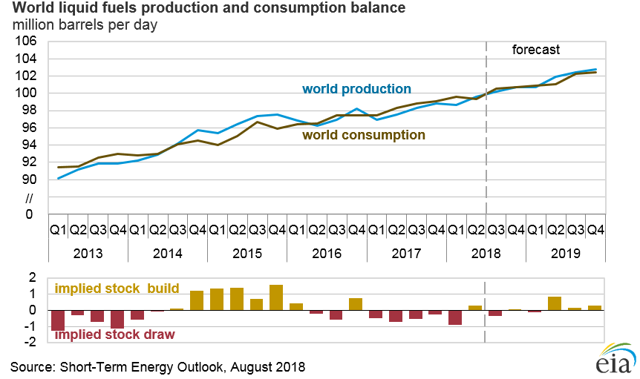

The likelihood that the price of oil rises from here is strong. There are several factors we should recognize. The first is that the oil supply and demand equation has clearly moved into balance.

Despite concerns that global oil demand will be disrupted by emerging markets gyrations, the upward trend in oil demand is clear for at least the next several years. The potential for a trade disruption has also caused oil prices to pull backAs I described in Expect Positive Surprises On President Trump's Trade Policies, I do not believe we see an all-out trade war, though as I discussed in a recent webinar, I am more concerned now than six months ago:

OPEC just lowered their outlook for next year to an oil demand increase to 1,430,000bd from 1,450,000bd. I typed that out so you'd see it's only a 20,000bd decrease in their estimate of INCREASED demand, or 1.38%. I would suggest that OPEC might be playing with numbers to justify not increasing oil output as much as President Trump might want, while also putting a little downward pressure on oil prices ahead of November midterms.

What investors need to be aware of as well, is that U.S. production is unlikely to increase much from current levels until next summer. The Permian bottleneck is just hitting as production curves in other basins level off. New production for the next year is roughly likely to just keep up with declines. I covered that here:

Rising Earnings On Higher Oil For Shale Stocks

In the meantime, sanctions on Iran kick fully in this November. We have already seen oil consumers, including China and India, begin to take less oil from Iran. While it is not official policy of China or India to take less Iranian oil, refiners are taking less for financial, insurance and reliability reasons.

The U.S. expects approximately 1 million barrels per day to be taken off of international markets by November. Helima Croft of RBC Capital Markets estimates over 1mbd will leave international markets. As of July over 430,000bd has already been taken off, including about 180,000bd to China.

Bank of America Merrill Lynch is projecting oil price to rise to $90/b by Q1 2019, while Goldman Sachs is suggesting $100/b is possible.

Oil Investment Ideas

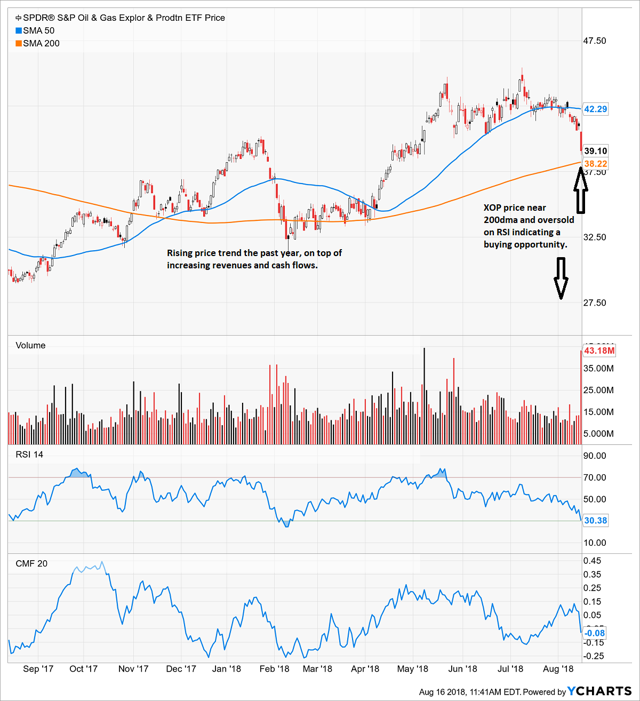

Jeffrey Gundlach and other heavyweight investors are mentioning the SPDR Exploration & Production Oil & Gas ETF (XOP) as an investment idea. I have discussed this fund several times the past year, including here.

With the recent pullback in XOP, I believe it is a strong buy for investors looking to increase asset allocation to oil stocks.

For those with a willingness to invest directly in oil, the U.S. Oil Fund (USO)once again presents an interesting opportunity. As illustrated above, the price of oil is near the bottom of its range. So, there is very likely movement towards the higher-end of the range in coming quarters. A potential Iran conflict that takes more than a million barrels per day off of international markets could cause the noted potential breakout. I rate USO a speculative buy. LEAPs are also an interesting play.

I will be discussing oil, oil stocks and China markets on my free weekly investor webinar. You can find details in my blog.

Disclosure:

I am long XOP, USO.

20% Discount Through Labor Day! Margin of Safety Investing is an investment advisor replacement service. If you have a few hours per week ...

more

Craving more of your updates...