"No Panic": Markets Surge As "Transitory Inflation" Narrative Reasserts Itself

It seems that the "non-transitory" inflation panic that gripped markets yesterday, resulting in the biggest one-day drop in the S&P since February, is gradually transitioning to "transitory" again, even though today's y/y PPI print of 6.2%, the highest on record, reaffirmed the soaring prices narrative.

Today the "transitory" inflation mood is reasserting itself, with Emini futures surging almost 100 points from the overnight lows.

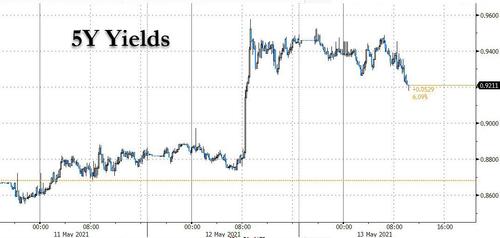

The battered FAAMG sector is solidly in the green as closely watched 5Y breakevens slide and nominals are down to session lows:

Wall Street traders also find comfort in the latest hot take from Morgan Stanley's QDS desk which notes that the the trading desk noted "there was no major panic outside the systematic community as the 'transitory inflation' narrative appeared to be adopted" and furthermore, "the desk continues to see demand in mega cap tech from the longer term community for the third day in a row."

Meanwhile, Bank of America writes that "Both the Fed and the bond market largely dismissed the report as a fluke. Speaking after the release Fed Vice Chair Clarida argued that the rise in inflation would likely prove largely transitory, that it is “one data point,” and that the year-over-year numbers are boosted by base effects. Bond yields barely budged on the news although there was some sell-off in equities over the course of the day. By contrast, we see a worrying pattern in the data. Excluding all of the special factors, including food and energy, leaves us with a “core” measure covering only 70% of overall prices. Moreover, not all of this is one time. As Alex notes, "May could be another big—but not as big—month for core inflation. More broadly, the surge is not just about constrained supplies, but reflects red-hot demand. Very aggressive monetary and fiscal policy has added rocket fuel to the economic reopening. We are still forecasting 10% GDP growth in 2Q. This has caused an acute shortage of inventories and workers. This explains not only the big jump in core inflation, but the 0.7% surge in wages."

Optimism was also fanned by market commentary from JPMorgan which almost verbatim echoed what we said yesterday, and overnight wrote that despite the blistering hot CPI and now PPI, nothing has changed "...from the Fed’s view. The Fed is focused on the labor market, believing that any transitory inflation can be weathered by Consumers."

Remember, Fed is focused on jobs, not inflation which is "transitory"

— zerohedge (@zerohedge) May 12, 2021

This does not change delayed tapering

Some more from JPM:

What is the Fed looking at (BLS)? US Market Intelligence thinks it is a combination of the unemployed (9.8mm; 6.1%), long-term unemployed (4.2mm, +3.1mm from Feb 2020), labor force participation rate (61.7%; -1.6% from Feb 2020), employment-population ratio (57.9%; -3.2% from Feb 2020), number of people not in labor force who want a job (6.6mm; +1.6mm from Feb 2020), and a new category “unable to work because their employer closed or lost business due to the pandemic” (9.4mm, down 2mm MoM, but this did not exist prior to Feb 2020; and, not all of these people are counted in unemployment measure). Finally, you have people “prevented from looking for work due to the pandemic” numbering 2.8mm which is -900k MoM; none of these people are counted in the unemployment measure.

Combine these numbers and you see a US labor market that is more fragile than headline numbers suggest. This may be why we continue to see Fed speakers reiterate a data-driven approach. Conversely, this may also be why markets are now seemingly more sensitive to inflation. Commodity-based and COVIDinduced supply chain inflation may overlap with wage inflation, creating a situation where the Fed may have to act more strongly than what investors have witnessed previously.

For those asking "how to monetize this line of thinking" JPM recommends commodities and commodity-linked equities, specifically Energy: "Consider both integrates like XOM and CVX, or XLE for general exposure. Further, refiners are a strong long play through 2021Q3, potentially longer, and would view VLO and MPC as the favored ways to play. In addition to that, inflation expectations are likely to pull yields higher, which benefit Banks."

Disclosure: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more