No More Juice - The Rise And Fall Of Orange Juice Futures

Image Source: Pexels

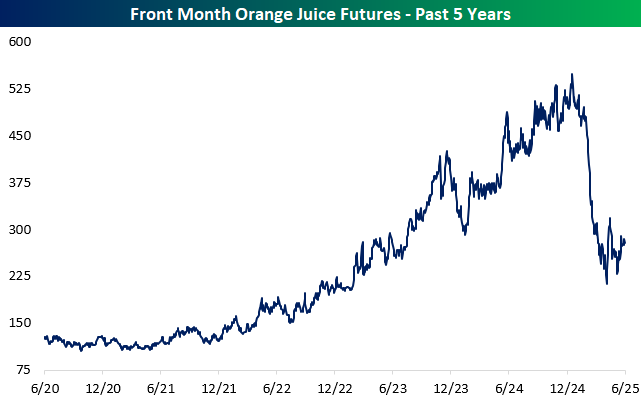

Over the past five years, orange juice futures have seen a wild ride, surging to record highs and then crashing just as dramatically. At the heart of it all has been a perfect storm of tightening supply and speculative hype.

Starting in 2020, the orange juice market began heating up. Florida's orange production was getting hammered by citrus greening disease, which is a long-standing bacterial infection caused by a bug that decimated groves across the state. On top of that, extreme weather events like hurricanes Ian (2022) and Milton (2024) only exacerbated an already weak supply backdrop. As supply dropped off, prices started creeping higher, and that’s when the financial players stepped in.

By 2022, hedge funds and other money managers began piling into orange juice futures. Prices, which historically hovered between $1 and $2 per pound, shot up, eventually peaking near $5.50 in December 2024 as OJ became one of the hottest trades in the agricultural commodities space. According to CFTC data, managed money had built up a near-record long position earlier in 2024, totaling about $260 million in speculative longs. These weren’t farmers or juice companies hedging their harvests, but instead mostly speculators betting on prices continuing to rise.

After OJ prices took the stairs up from 2022 to 2024, it took the elevator down to start 2025. Given the build-up in speculative positions, it didn't take much to spark a rush for the exits when Trump's tariff threats began earlier this year. Canada and Mexico are by far the two largest importers of US orange juice, and when President Trump began fighting with those two countries on trade at the start of his second term, OJ futures cratered from more than $5.25 in mid-December to less than $2.25 by April. The thin market in the commodity magnified the move, with relatively small volumes leading to outsized price swings. In the entire history of the Orange Juice futures contract, the four-month decline from the December high was the largest on record!

Domestic fundamentals for OJ remain shaky. The USDA forecasts a 25% drop in Valencia orange production this season in the US, with Florida’s output expected to be 38% smaller than last year’s. Greening disease continues to harm groves, and Florida’s citrus acreage keeps shrinking due to both infection and land development.

While the US supply picture looks bleak, the global story shifted in early 2025. As Florida’s production has collapsed nearly 90% since 2005, the US has leaned more heavily on imports, especially from Brazil and Mexico. In 2024, the US brought in over 400,000 metric tons of orange juice, the highest level in nearly a decade. Then, in early 2025, Brazil projected a massive crop rebound of 300 million boxes, up 30% from the previous year. Along with US tariff concerns, Brazil’s expected surge in supply also contributed to OJ's price drop.

So where do we go from here?

In the short term, orange juice futures have stabilized in the $2.75–$3.25 range. If the new Brazilian supply materializes, it would ease scarcity concerns and likely keep downward pressure on prices, especially with the U.S. relying heavily on imports. The effect could be even stronger if the Brazilian real stays weak, making exports to the US more attractive.

That said, there’s still a plausible bullish scenario. The National Hurricane Center is forecasting another above average season of tropical activity in the Atlantic, and if one of those storms were to hit Florida this year, or if greening disease worsens, supply could be disrupted again in both the US and Brazil, potentially pushing prices back above $4. And if inflationary pressures resurface, agricultural commodities could catch another bid from macro traders.

Ultimately, this market remains highly reactive. It doesn’t take much to move the needle when fundamentals are tight and speculative money is involved. If you’re trading orange juice futures, it’s less about slow and steady fundamentals and more about who’s in the trade, how fast they’re moving, and whether the supply narrative is tightening or loosening. For now, the squeeze is easing—but it wouldn’t take much to bring the juice back.

More By This Author:

Farewell To MayThe Next Mega-Caps?

Gold And S&P 500 Both Volatile

Disclaimer: Bespoke Investment Group, LLC believes all information contained in this report to be accurate, but we do not guarantee its accuracy. None of the information in this report or any ...

more