Nickel Skyrockets

Nickel futures surged 64% today as Russian supply concerns sparked a massive short squeeze in the commodity. There was a modest pullback into the close but remained extremely elevated nonetheless. Today’s move put nickel at an all-time high and it was also the largest single-day move in the history of the commodity. The skyrocketing price of nickel has implications for a variety of industries and countries, which we outline below.

The US is heavily reliant on Nickel imports, as only about one percent of the Nickel mined globally originates in the US. Indonesia, the Philippines, and Russia are the three largest producers of the commodity, and Australia, Indonesia, and Brazil have the largest share of global reserves (as per the United States Geographical Survey). Russia’s leadership in global nickel mining largely explains the recent price spike, but many countries are poised to benefit from the price appreciation. While it will take time to ramp up production, countries with the largest share of reserves are likely to increase their mining operations to capitalize on higher prices, especially given the fact that many of the countries with the highest amount of reserves are emerging economies that do not play a substantial role in global geopolitical conflicts.

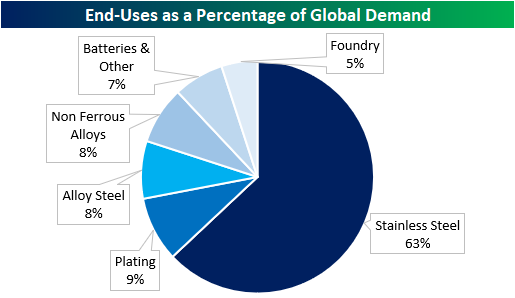

Over the last few years, investors have focused on the electric-vehicle use case to justify nickel positions, but over 70% of first-use demand for Nickel originates from steel products. The spike in this commodity will increase construction costs, mitigate the impact of Biden’s infrastructure package, slow the EV transition, and make batteries, in general, more expensive for consumers and enterprises alike. Put simply, a lot of industries have exposure to the recent hike in nickel and related metals prices.

Although it is hard to view this as a positive for the US economy or global inflation, one country poised to benefit from the surge in nickel prices is Indonesia. Pre-pandemic, around five percent of Indonesia’s GDP came from Nickel exports which is not an insignificant amount. Not surprisingly, the MSCI Indonesia ETF (EIDO) has been one of the top-performing country ETFs on a YTD basis gaining 3.5% through Monday’s (3/7) close.

(Click on image to enlarge)