Natural Gas Prices And Seasonality Based On April Weather Trends

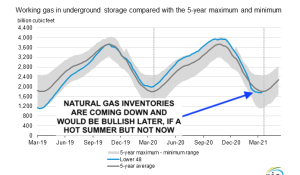

Natural gas prices have oscillated back and forth over the last few weeks as bearish spring weather has been somewhat offset but stronger LNG exports and lower stocks. One can see how stocks are now below the 5-year average. This will make any little hot weather scare or hurricane this summer and fall that much more important.

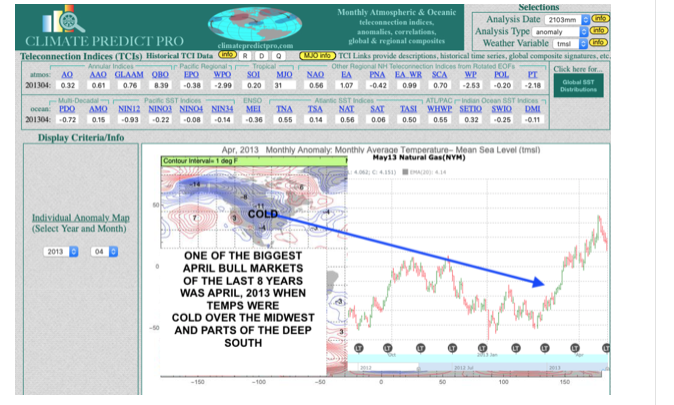

While many traders are thinking that natural gas prices are oversold, it takes cold weather to usually rally this market in April, as was the case in April 2013. Here is one of the most significant price moves in April following a brutally cold month. My in-house Climate Predict models have helped to predict everything from the February Arctic pig and the severe U.S. cold to longer-term trends, months in advance looking at teleconnections such as Sea Ice, La Nina, and a host of other climatic variables.

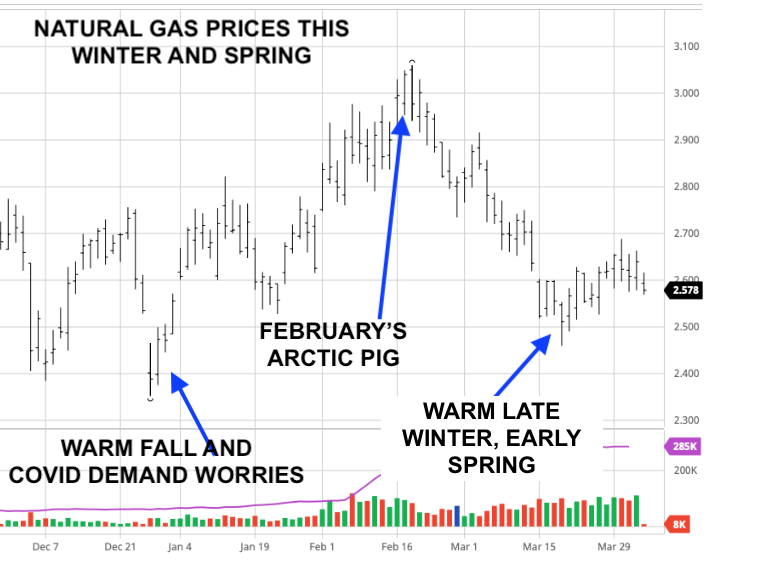

The price chart below shows how the weather has affected natural gas prices since last fall.

The one big price move and profitable trade from the long side occurred in February and what I call the "Arctic Pig." Please tell me you don't see too much resemblance! Thanks.

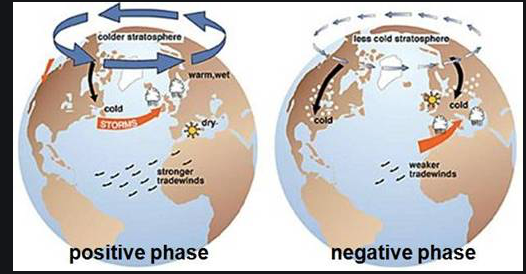

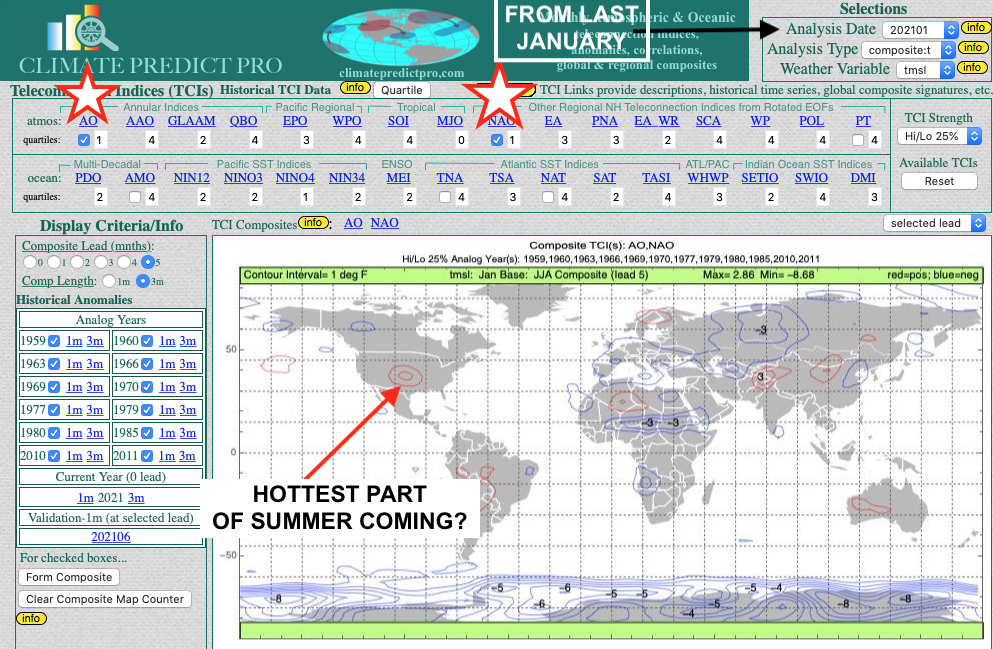

Warm April's following weakened La Ninas and can often bring hotter than normal U.S. summers. Here is my in-house program again that looks at close to 30 global teleconnections. Where you see the stars were two very important climatic indicators, which influenced this past winter's weather at least as much as La Nina. They are called the Arctic Oscillation and NAO index; very familiar terms to seasoned natural gas traders around the world. In a nutshell, we had mostly a positive NAO/AO index this winter, which means the Polar Vortex remained mostly over northern Canada and the Arctic. Melting Sea Ice and a warming climate also contributed to this. The NAO/AO index turned negative in February helping the Polar Vortex head south for a few weeks and hence the cold U.S. February and natural gas price rally

Look what my program reveals about June-August temperature trends when the winter AO/NAO index is mostly positive during the winter. Hot weather in parts of the Midwest and Plains may not only influence grain prices but support natural gas prices after June or July. The analog years you see to the left of this map below are "all winters with mostly a positive AO/NAO index." This is a combination (average) of all the analog years, but some of them were El Nino, some La Nina, and some El Nino neutral.

The negative phase of the NAO index shown above helped to predict what I coined years ago (The Arctic Pig) and produce one rally in natural gas last winter. That was of course in February. Otherwise, this index has been mostly positive.

Conclusion:

It is my job to isolate which of these years are most important in developing long-range weather forecasts and trading strategies for clients in multiple commodities. I do believe, based on my research that natural gas prices will bottom by summer, but any major rally above $3.00 will only occur during the "hottest" of these analog years shown below. Too many pundits have been talking about a major long-term bull market in natural gas for years based on LNG exports, etc., but the reality is, there is more than enough supply to meet demand and the weather is always the most important driving force in this market.

June-August global temperature projections (predicted last January from a mostly +NAO/AO winter)

(Click on image to enlarge)

Jim Roemer's climatepredict.com program above and how the mostly positive NAO winter suggests a hot summer for parts of the Midwest and Plains (above)

I would love to help you develop some trade strategies at my site bestweatherinc.com with one of two newsletters I offer to farmers, traders, the natural ...

more