Natural Gas Futures: Further Losses Favored In The Short Term

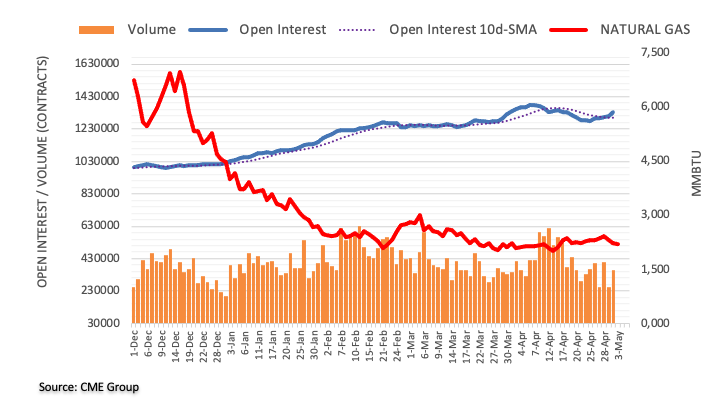

In light of advanced prints from CME Group for natural gas futures markets, open interest rose for the fifth day in a row on Tuesday, this time by around 28.5K contracts, the largest single-day advance so far this year. Volume, in the meantime, remained choppy and increased by nearly 110K contracts.

Natural Gas: Another test of $2.00 looms closer

Prices of natural gas extended the bearish start of the week into Tuesday’s session. The negative price action was in tandem with rising open interest and volume and suggests that further retracement seems on the table in the very near term. Against that, the immediate support emerges at the $2.00 mark per MMBtu.

More By This Author:

USD Index Comes Under Pressure And Challenges 102.00

USD Index Price Analysis: Downside Alleviated Above 103.15/20

Crude Oil Futures: Room For Further Upside Near Term

Disclosure: Information on this article contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes ...

more