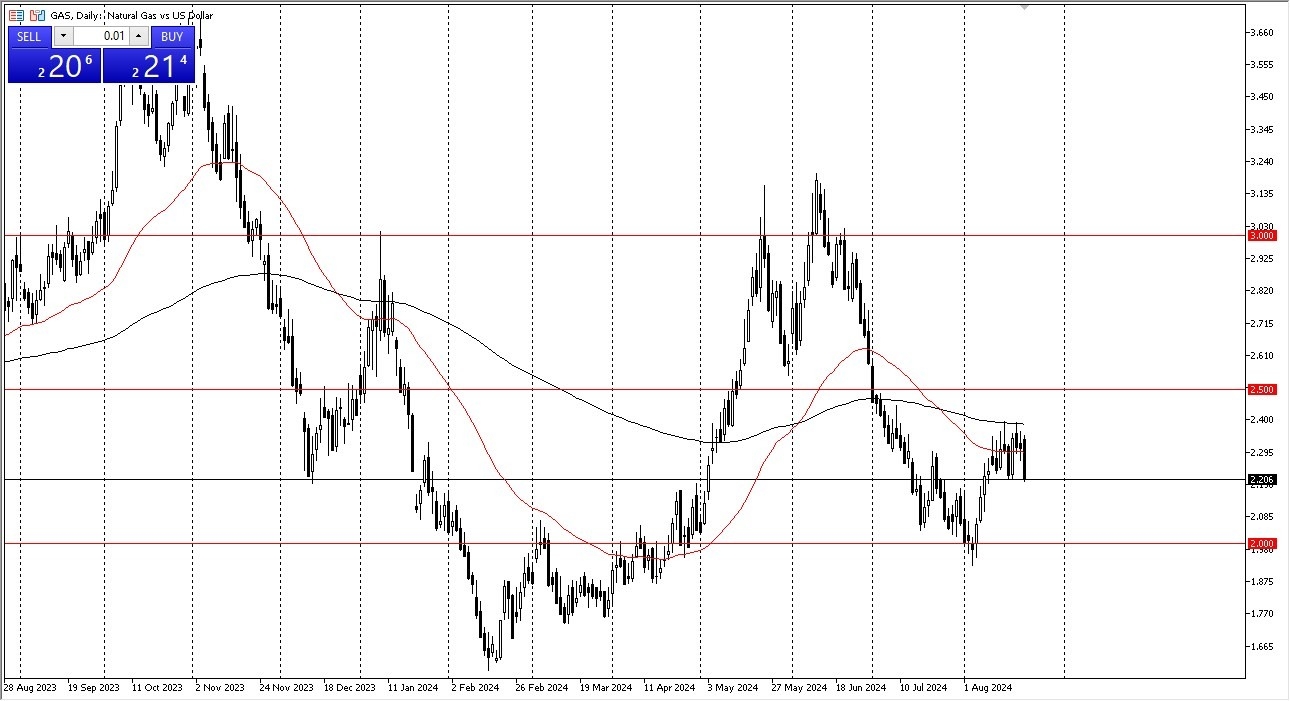

Natural Gas Forecast: Plummets After Inventory Numbers

- In my daily analysis of the natural gas markets, it’s obvious that we are still struggling overall, as we have been sideways for a while.

- At this point, it looks as if the inventory number of and addition of 35,000,000,000 ft.³ in US inventory has put a sour note on this market.

- Ultimately, this is a market that I think pulls back a bit, and as a result I think natural gas could end up breaking down enough to visit the $2.00 level given a little bit of a push.

(Click on image to enlarge)

Either way, one of the things that I always say about the natural gas market is that it’s not something to be trifled with. You don’t put a ton of money into this market, at least not unless you know what you are doing, and as a retail trader, you do not know what you are doing. That’s not to say that you cannot invest in it, but short-term trading is a great way to lose money in this market, especially if you dial up the leverage. I get emails on a weekly basis from traders who have lost a massive amount of the trading account and are now begging me for some type of advice on how they can turn things around.

It’s about the United States

The thing that most retail traders forget is that this is a market that is based in the United States, and the rest of the world doesn’t really matter most of the time. That’s not to say that the rest of the world cannot have some type of event is on the market, but it really comes down to whether or not the Americans are going to have to export more natural gas in the form of LNG.

All things being equal, this is a market that tends to be cyclical, and that’s what I’ve been doing here, buying little bits and pieces in a manner that I don’t have to worry about the day-to-day momentum. Quite frankly, if it’s a small enough position and you build on to it over the longer term, without leverage, then you can simply collect your profit as we head into the cooler months as price spikes. In the end, that’s the place here.

More By This Author:

BTC/USD Forecast: Resistance At $62,000 LoomsS&P 500 Forecast: Stretched Ahead Of Meeting Minutes

GBP/CHF Forecast: Potential Moves Above Resistance

Disclaimer: Mr. Christophe Barraud could not be held responsible for the investment decisions or possible capital losses of users. Mr. Christophe Barraud endeavors to provide the most accurate ...

more