Nasdaq 100 Forecast: Stocks Scale Higher Ahead Of The FOMC Rate Decision

Image Source: Pexels

US futures

Dow futures +0.19% at 36640

S&P futures +0.2% at 4651

Nasdaq futures +0.3% at 16408

In Europe

FTSE +0.37% at 7577

Dax +0.11% at 16818

- Stocks rise for a fourth straight day

- PPI was weaker than forecast at 2% YoY vs 2.2% exp.

- Fed could push back on rate cut bets

- Oil holds steady after steep losses yesterday

Stocks rise for a fourth straight day

US stocks are pointing to a modestly positive open on Wednesday as investors look ahead to the Federal Reserve interest rate decision later in the day.

The move higher comes after US indices posted gains on Tuesday, marking their fourth straight daily rise after US inflation data showed that consumer prices are cooled in line with expectations.

Today, the producer price index cooled by more than forecast to 2% YoY, which bodes well for consumer prices continuing to cool.

The FOMC rate decision later today is the only show in town. The Fed is expected to leave interest rates on hold at 22 22-year high of 2.25% to 2.5%, marking the third straight meeting that rates are on hold as good as confirming the Fed has ended its rate hiking cycle.

The dot plot comments by Fed Reserve Chair Jerome Powell will provide guidance over the futures path for interest rates, particularly as the market is forecasting 100 basis points of cuts next year.

In light of the robust data and sticky inflation, Powell could well push back on expectations of a rate cut as soon as next spring, which could dampen demand for stocks in the near term.

Fed chair Jerome Powell not pushing back on rate cut expectations could be considered a green light for a rally into the end of the year.

Corporate news

Pfizer is set to fall 6% after providing the market with disappointing guidance for 2024. The pharma giant sees revenue at $60bn + or - $1.5 billion which is below the consensus of $63.1 billion. Adjusted EPS is expected to be in the range of $2.05 to $2.25, a big miss of consensus of $3.16.

Netflix will be in focus after releasing viewing figures for almost all its titles The report will be published biannually going forward and acknowledges the lack of transparency retarding its titles.

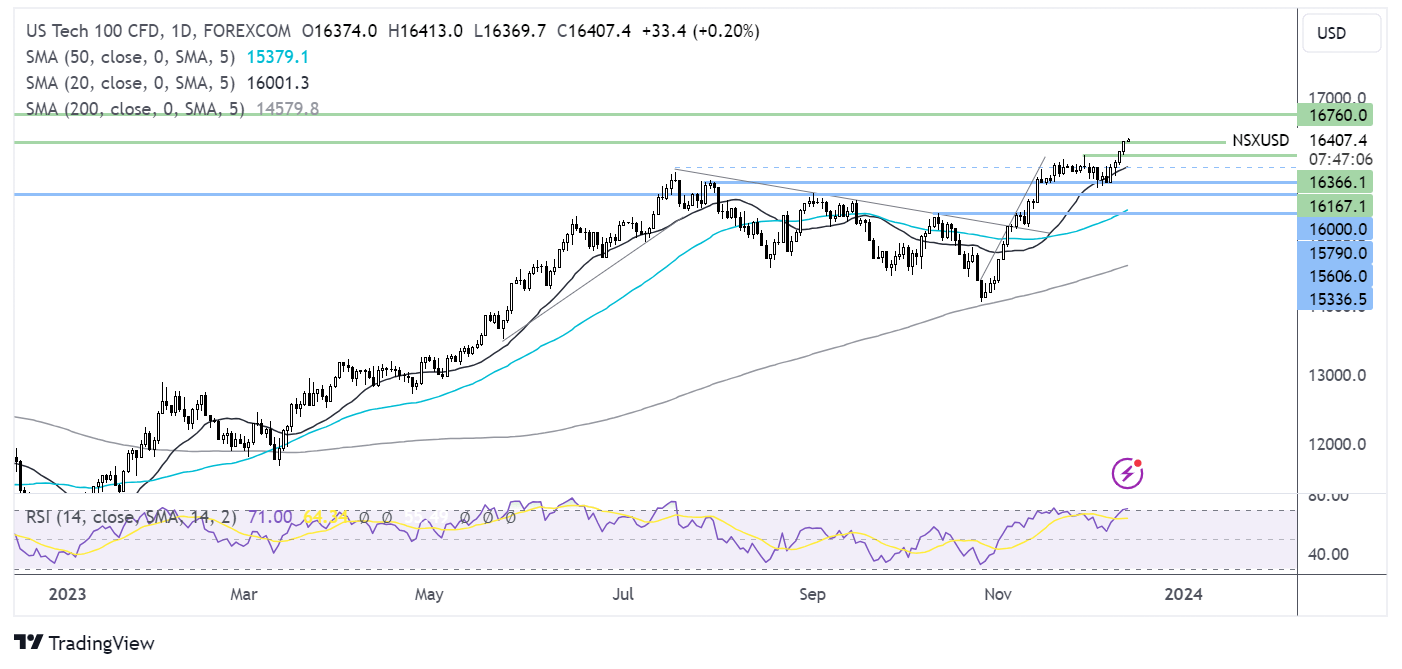

Nasdaq 100 forecast – technical analysis

The Nasdaq broke out of its consolidation pattern at the start of the week, pushing to 16400, its highest level since the start of 2022. Buyers will look to scale to 16,770, an all-time high. On the downside, support can be seen at 16186, the November high, with a breakdown here opening the door to 16000.

(Click on image to enlarge)

FX markets – USD falls GBP/USD falls

The USD is edging lower after losses in the previous session as investors await the Fed rate decision. A hawkish-sounding Fed could give the USD a boost.

EUR/USD is steady in cautious trade after eurozone industrial production fell by more than expected, fueling bets of a recession in the final quarter of the year. The data also supports the view that the ECB will start cutting interest rates early next year, potentially as soon as March. A weak economic outlook, along with dovish ECB expectations, is putting pressure on the euro.

GBP/USD is falling after weaker-than-expected UK GDP data raised concerns over a recession and has seen traders ramp up expectations of a BoE cut in 2024. Following the data, the market is now pricing in an 85% probability of four rate cuts next year, with the first one in June. The data comes ahead of the Bo E meeting tomorrow, where the central bank is expected to leave interest rates on hold and could reiterate its recent stance that it's too early to discuss rate cuts.

EUR/USD +0.05% at 1.080

GBP/USD -0.16% at 1.2540

Oil steadies after steep losses

After falling over 3% in the previous session, oil prices are holding steady around a six-month low. Concerns about oversupply and falling demand pulled WTI below 70.00 per barrel.

Concern surrounding the outlook for the global economy and, therefore a deteriorating demand outlook, combined with voluntary cuts from OPEC+ and record non-OPEC production, have resulted in oil prices falling sharply lower heading towards the end of the year.

Oil markets will look to the FOMC rate decision for further clues over the demand outlook. Markets had been expecting steep cuts from the Fed next year: any disappointment could pull oil prices lower still. The FOMC holding rates high for longer could be a real obstacle for oil prices to advance.

Ahead of the FOMC rate decision, EIA crude inventory data is due and is expected to fall by 0.65 million barrels after falling 4.63 million barrels in the previous week.

WTI crude trades +0.5% at $69.1

Brent trades +0.5% at $73.69

More By This Author:

Two Trades To Watch: GBP/USD, USD/JPY - Tuesday, Dec. 12

Two Trades To Watch: EUR/USD, FTSE - Monday, Dec. 11

Two Trades To Watch: EUR/USD, Oil - Thursday, Dec. 7

Disclaimer: StoneX Financial Ltd (trading as “City Index”) is an execution-only service provider. This material, whether or not it states any opinions, is for general information ...

more