Two Trades To Watch: GBP/USD, USD/JPY - Tuesday, Dec. 12

Image Source: Pixabay

GBP/USD is holding steady after a mixed jobs report & ahead of US CPI

- Unemployment held steady at 4.2%

- Wage growth cooled by more than expected

- GBP/USD holds steady above 200 SMA

The UK jobs data painted a mixed picture. As expected, unemployment held steady at 4.2%, but wage data missed forecasts. Meanwhile, the claimant count was slightly higher than expected at 16,000, but employment change was also robust at 50,000.

Average earnings, excluding bonuses, rose 7.3% in the three months; however, they were down from 7.8% and missing forecasts of 7.4%. Meanwhile, average earnings excluding bonuses moved further from the record 8% at 7.2%. The BoE will closely monitor wage growth as it continues its fight against inflation.

Rate cut expectations for the BoE in 2024 didn't change following the release of the data, and the market is pricing around 75 basis points of cuts by the end of December 2025.

The data comes ahead of the BoE rate decision on Thursday, where the central bank is expected to keep interest rates on hold and could push back on rate cut expectations.

Looking ahead, US CPI data will now be in focus, and hotter-than-expected US inflation could see the pair fall lower.

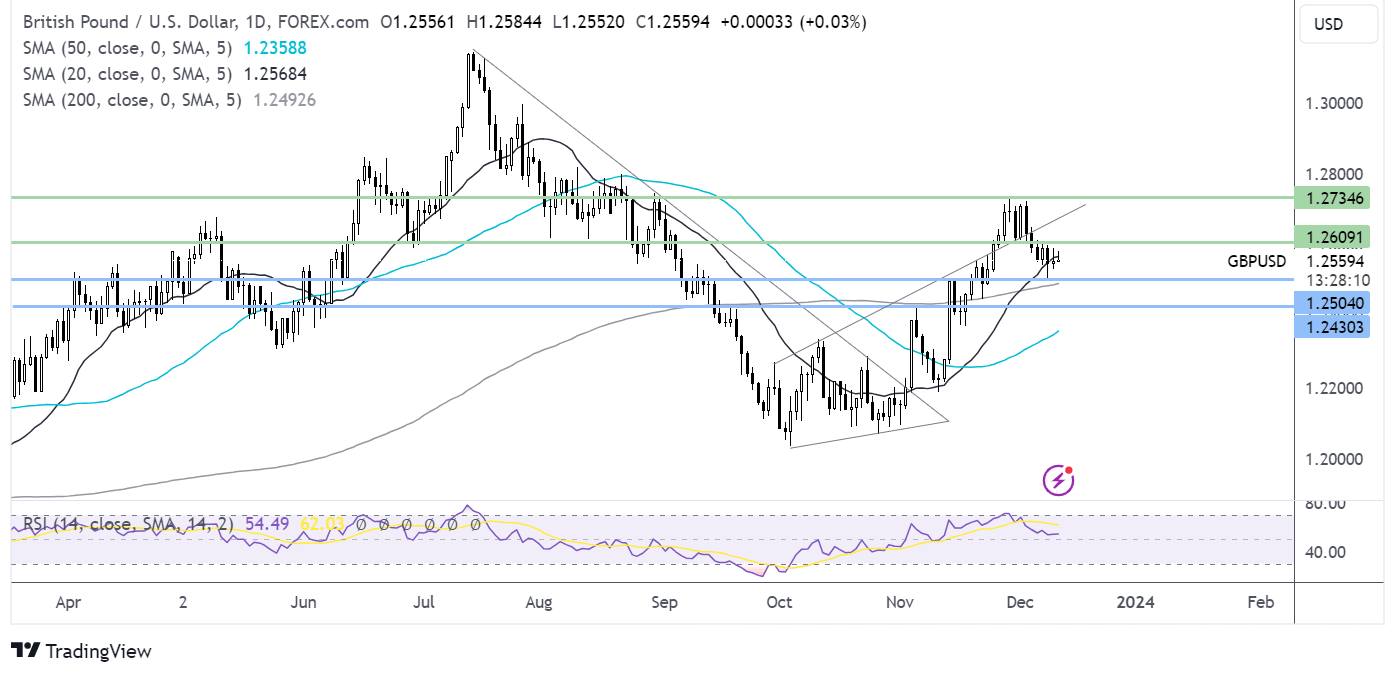

GBP/USD forecast – technical analysis

After finding support at 1.25 last week, GBP/USD has risen and is testing resistance at 20 SMA at 1.2570. Bulls will need to clear this level to test the 1.26 round number.

A move above here brings the rising trendline at 1.2690 into focus ahead of the November high of 1.2730.

Failure to rise above the 20 SMA could see a retest of support at 1.25 and the 200 SMA at 1.2480. A fall below here could see sellers gain momentum and target 1.2730

(Click on image to enlarge)

USD/JPY looks to US inflation data

- Japan PPI 0.3% YoY vs 0.1% expected

- US CPI is forecast to fall to 3.1% YoY in November

- USD/JPY fails at trendline resistance

USD/JPY is falling after two straight days of gains after stronger-than-expected Japan PPI data and amid weaker U.S. dollar ahead of US inflation figures.

US CPI is expected to cool to 3.1% YoY, down from 3.2% in October; however, core CPI is expected to remain on hold at 4%. However, traders will be wary that inflation could be hotter than expected, given Friday’s stronger-than-forecast non-farm payroll report.

Today’s CPI will set the scene for Wednesday's Federal Reserve interest rate decision, where the market is fully pricing in that the Fed will leave interest rates unchanged; however, the focus will be on guidance for 2024 and the timing of the first rate cut.

The market's pricing is in a 48% chance of a rate cut in March; this is down from 57% a week earlier following the NFP report.

However, it's worth noting that financial conditions have loosened since the previous Fed meeting, and policymakers will be conscious that the fight against inflation hasn't yet been won. The Fed will be cautious, not wanting to loosen financial conditions further.

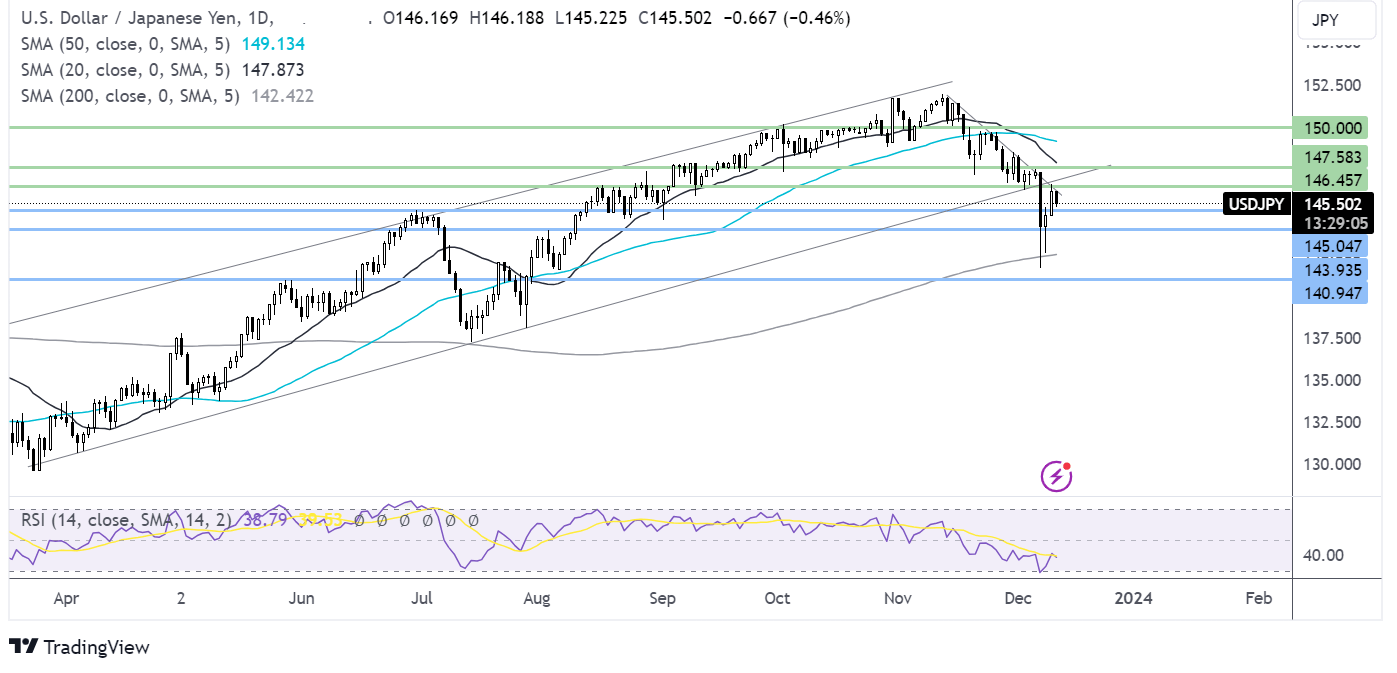

USD/JPY forecast – technical analysis

USD/JPY failed to rise above the multi-week falling trendline and rebounded lower, combined with the RSI below 50, keeping sellers optimistic of further downside.

Sellers will look to take out support at 145.00, the June high ahead of 143.90, the early August high, before exposing the 200 SMA at 142.42.

Buyers need to rise above the falling trendline resistance at 146.5 and yesterday’s high to test 147.50, last week’s high, before bringing 150.00 back into the target.

(Click on image to enlarge)

More By This Author:

Two Trades To Watch: EUR/USD, FTSE - Monday, Dec. 11

Two Trades To Watch: EUR/USD, Oil - Thursday, Dec. 7

Nasdaq 100 Forecast: Stocks Rise As Weaker Jobs Data Supports A Dovish Pivot

Disclaimer: StoneX Financial Ltd (trading as “City Index”) is an execution-only service provider. This material, whether or not it states any opinions, is for general information ...

more