Models No Longer All Bullish – A Look At The Indices

Image Source: Unsplash

Last week, a number of our stock market models turned neutral to negative as I wrote in my Fed update post. That creates some crosscurrents given the seasonal tailwind and higher volatility stocks leading lower volatility stocks for most of the rally.

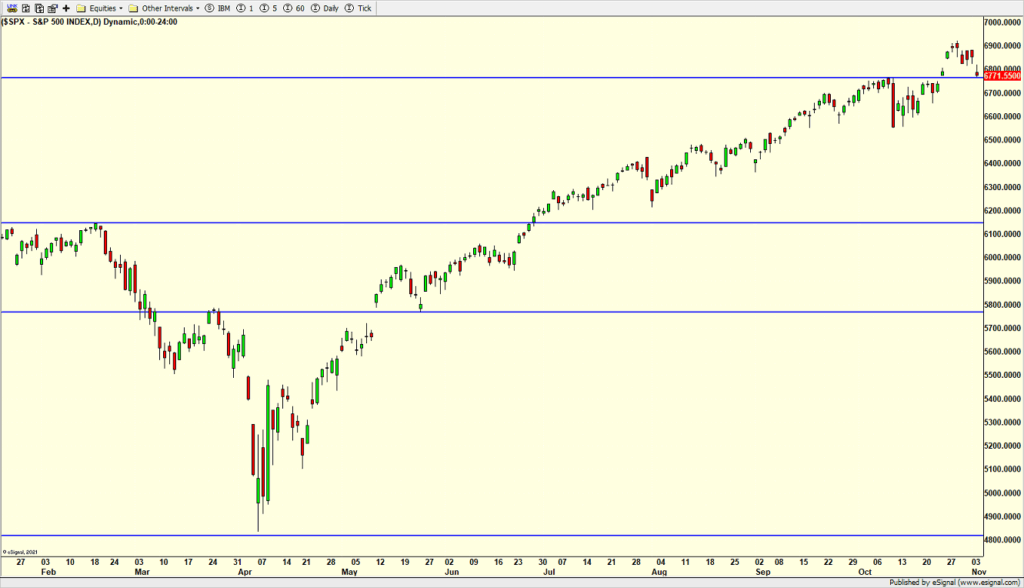

The bull market is not over, so folks do not need to ask about that. The best case for the bears is that stocks are entering a period of sideways activity that frustrates everyone. The S&P 500 is first. It has already pulled back to the initial level of what is to be expected. Even a few hundred points lower would not be out of the question, nor break the back of the rally.

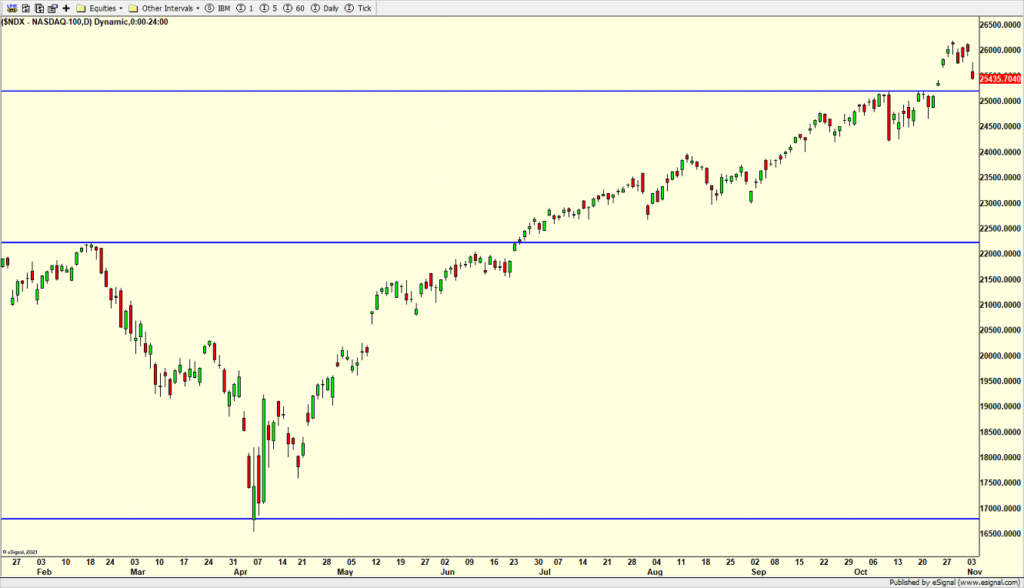

The AI-driven, tech-laden Nasdaq 100 is next. It is not quite at the same level as the S&P 500, but it should be this morning.

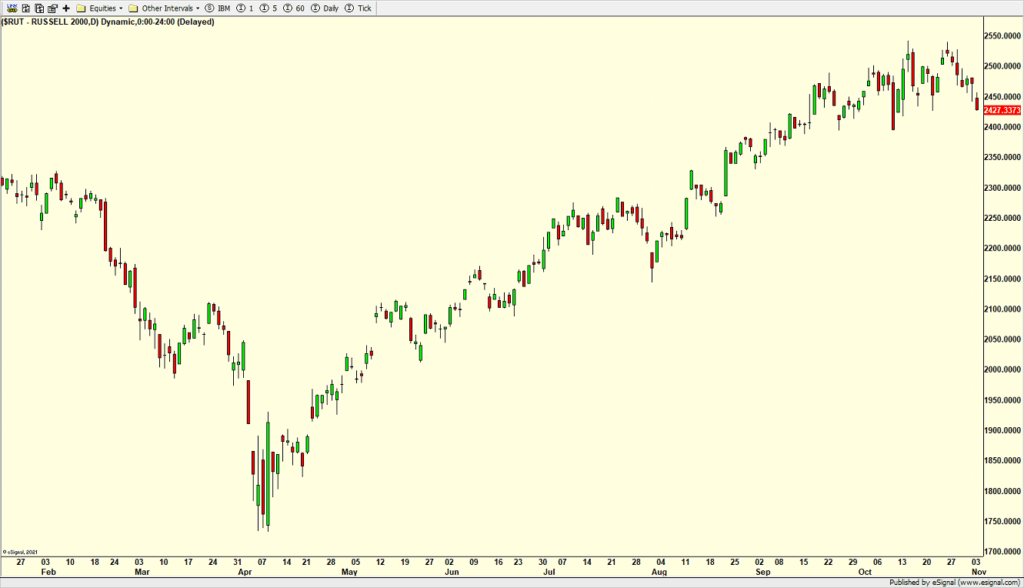

Finally, the small-cap Russell 2000 Index is below. It definitely looks a bit different than the first two indices. It has already pulled back, but it looks like it can go another 2-3% lower if it wants to without upsetting the apple cart.

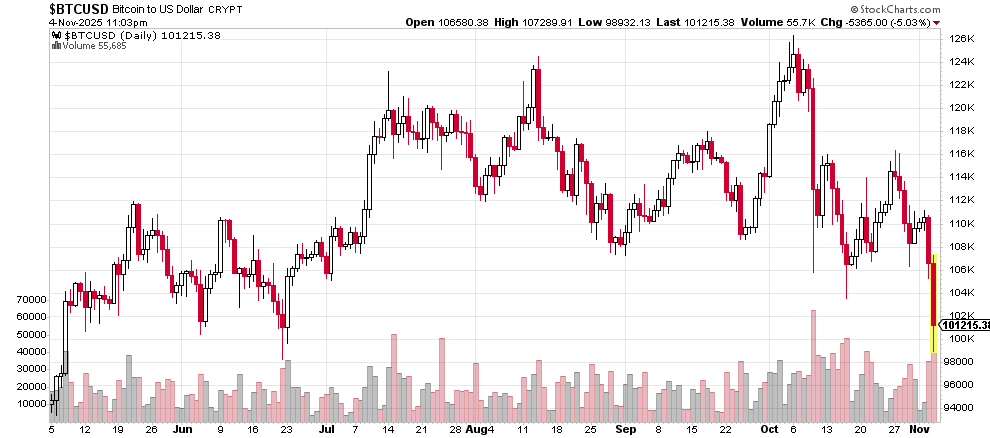

Since “risk on” assets bottomed in April, I have selectively picked on various assets where greed, giddiness, and euphoria set in. Bitcoin was the first, and it certainly looks like the latecomers have been punished in a big way over the past month. I am looking for a low to set up over the coming week for at least a bounce.

On Monday, we bought XLU, more NNOV, and more KNOV. On Tuesday, we bought SSO, more HD, and more DG. We sold EMB, GDX, some AMZN, some AAPL, some GOOG, some MDB, and some NJNK.

More By This Author:

Fed To Cut Rates, Dow 50,000 But Bumpy First, Buying Silver & GoldUncertainty Ahead? Active Management For Your Retirement Portfolio In Today’s Market

Punishing Gold & Silver Late Comers

Disclosure: Please see HC's full disclosure here.