LIT: Bet On Electric Cars And 5G With This ETF

One area in which many investors have expressed interest in recent years is electric vehicles. This is partly due to fears surrounding climate change as these vehicles are presumed to be more sustainable (which may or may not be true) and companies like Tesla (TSLA) have promised very cool-sounding features such as fully autonomous driving. Tesla may not be the best way to play this though due to the rising threat of competition and its valuation. The better way to play this trend is to own the necessary materials for the batteries so that you end up making money as these vehicles become more popular, regardless of who the manufacturer is. The easiest way to do this is to purchase the Global X Lithium & Battery Tech ETF (LIT), which consists of a variety of lithium miners, battery manufacturers, and others involved in the industry. There are also other reasons beyond electric cars that make lithium an attractive investment right now and we will discuss those in this article as well.

Why Invest In Lithium?

Lithium is a soft, silvery-white alkali metal that does not exist naturally in nature. It only exists in compounds such as pegmatitic materials and therefore requires various chemical reactions to liberate it. The element is highly reactive, which makes it ideal in a variety of applications that require the liberation of energy. Lithium is therefore used in a variety of production activities including thermonuclear weapons, heat-resistant glass, and ceramics, lithium grease lubricants, flux additives for iron, steel and aluminum, lithium batteries, and lithium-ion batteries. It is these last two uses that we are interested in today.

Most electric vehicles are powered by lithium-ion batteries due to their high energy density and low self-discharge rate. As electric vehicles lack an alternator to charge the battery while in operation, ordinary deep cycle batteries would not be practical due to range limitations. Therefore, we can conclude that as electric vehicles become more popular and are manufactured in greater numbers that the demand for lithium to make their batteries will rise. This should have a positive impact on the price due to the economic law of supply and demand.

Thus far, that has not been the case. As Morgan Stanley points out, lithium prices have been suppressed for a while now. This is mostly because electric cars have thus far not proven as popular as what was originally projected. Over the past few years, lithium producers such as Sociedad Química y Minera de Chile (SQM) have been expanding their production out of expectations that demand for electric vehicle batteries would surge. As that has thus far not happened, the industry has too much capacity at present. There are signs that this may be starting to change. Toyota Motors (TM), for instance, plans to introduce ten electric car models in 2020. Other manufacturers like Volkswagen (VLKAF) are also getting more aggressive about manufacturing these vehicles. As it seems unlikely that production will expand until lithium prices improve, this demand growth should steadily reduce the oversupply.

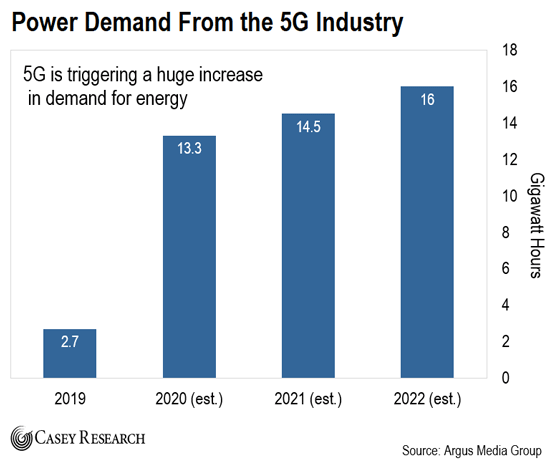

There are other things besides electric cars that will increase the demand for lithium going forward. One of these is fifth-generation cellular technology (5G), which is another area in which technology sector investors are focusing. One of the problems with 5G technology though is that the wavelengths are shorter than current cellular networks so they cannot propagate as far. Therefore, cellular providers will need to place ever-growing numbers of base stations across the nation as they roll out their 5G networks. This will cause power demand from the telecommunications industry to rise:

Source: Casey Research

Currently, fourth-generation cellular towers run on lead-acid batteries. The batteries are necessary to ensure that cellular service continues to work in the event of a power outage. These batteries do not have the energy density required to power a 5G tower, however. Rather, a new type of batter called lithium-iron-phosphate will be used for this purpose. As the name implies, these batteries require lithium to be manufactured. Thus, the rollout of fifth-generation cellular networks will also increase the demand for lithium, which should have a positive effect on the price.

About The Fund

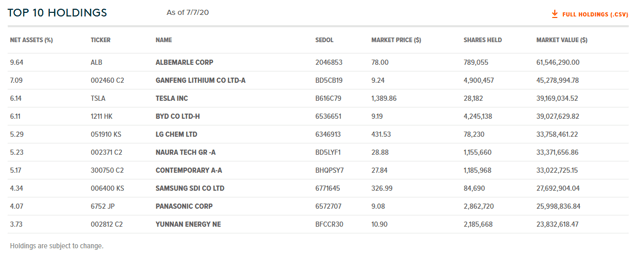

There are a few ways to play the likelihood of forward demand growth in lithium. The easiest way is buying the Global X Lithium & Battery Tech ETF. According to the fund's web page, this fund invests in the full lithium cycle including mining, refining, and battery production. This is apparent if we look at the largest positions in the fund. Here they are:

Source: Global X Funds

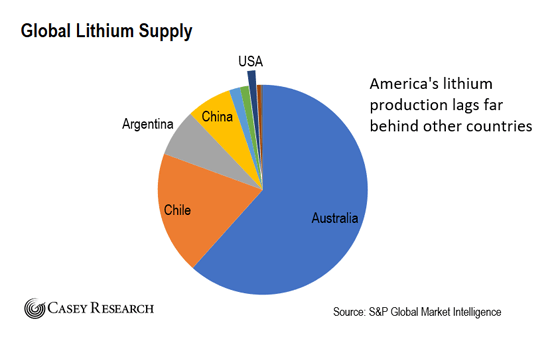

One thing that we can clearly see is that the fund has numerous large positions in non-American companies. This makes a lot of sense as the overwhelming majority of the lithium industry is located outside of the United States. In fact, more than half of the world's supply of lithium is produced in Australia with Chile also accounting for a sizable percentage of it. There is only one lithium mine in the United States:

Source: Casey Research

This is not something that investors really need to worry about. Australia has corporate governance regulations that are every bit as strong as the ones in the United States and so does South Korea. The significant exposure to Chinese companies may give some investors pause though as Chinese companies have a reputation for being less than transparent and honest with their investors, particularly foreign ones. Whether this reputation is truly deserved or not is anyone's guess but because China does produce a sizable quantity of the world's lithium there is no way to invest in the industry without having exposure to China.

One company that I am rather surprised to not see among the largest holdings is Sociedad Química y Minera de Chile. While this company is often considered to be a potash and fertilizer company, it is also the biggest individual producer of lithium in the world and boasts nearly a third of the world's lithium reserves. Thus, this company is certain to be a major player in the future of the lithium industry.

As my long-time readers are no doubt well aware, I generally do not like to see any single position account for more than 5% of a fund's total assets. This is because this is about the level at which an asset begins to expose a portfolio to idiosyncratic risk. Idiosyncratic, or company-specific, risk is that risk which any asset possesses that is independent of the market as a whole. This is the risk that we aim to eliminate through diversification. Thus, the concern here is that some event may occur that causes an individual stock to decline when the market as a whole does not and if that asset accounts for too much of the portfolio then it would drag the entire fund down with it. As we can see here, there are seven positions that each individually account for more than 5% of the total assets of the fund. Thus, the fund is highly concentrated in only a few positions so potential investors should make sure that they are willing to bear the risks of each of these stocks individually before taking a position in the fund.

Conclusion

In conclusion, there are a number of reasons to be confident in the future of lithium despite the industry's current overcapacity. The metal is necessary to power several of the major trends in the world today including the switch to electric cars and development of fifth-generation cellular networks. The Global X Lithium & Battery Tech ETF is perhaps the simplest way to profit off of these technological trends and could certainly prove to be a very solid long-term play.

Disclosure: I have no positions in any stocks mentioned in this article and no plans to initiate any positions within 24 hours.

Disclaimer: All information provided in this article is for ...

more

Thanks, I've recommended this article to others.

I ha So thanks for describing the reasons to consider it.d been aware of the use of lithium in battery systems for quite a while but had not considered investing in this area. So thanks for describing the reasons to consider this investment area.

But there are also many working to develop battery technologies that use less expensive and more commonly available materials.