La Niña Modoki And Is The Commodity Boom Over?

Climate forecasters have predictably run into the ‘spring barrier’ when models have a harder time making accurate forecasts during this time of the year, spawning in the process varying outlooks on the projected change in the sea-surface temperature (SST) patterns in the Equatorial East Pacific. However, my in-house long-range weather forecast program, Climate Predict, can give some historical clues, as to what will happen with La Niña in the months ahead.

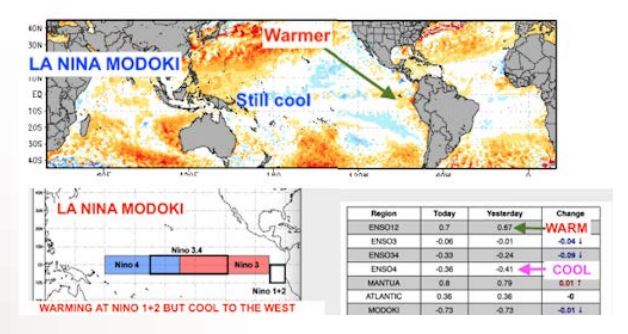

The phrase ending with ‘Modoki’ (Japanese for “similar, but different”) represents an event that is not “as qualified” as the genuine event. During a La Niña Modoki event, a colder central Pacific is flanked by a warmer eastern and western Pacific. Classical La Niña has warmer waters over the western Pacific; El Niño is the exact opposite.

Climate researchers say that since the 1980s, classical El Niño and La Niña events have become rare and that a second ‘flavor’ - in the form of Modoki - has evolved and become more prevalent. Both El Niño and La Niña Modoki events can occur when tropical ocean indices do not achieve thresholds of a canonical El Niño or La Niña event.

The maps above show how the eastern Pacific (Nino1+2) is warming a bit, but it is still slightly cooler than normal in the western Pacific. La Niña Modoki is a bit unusual.

Is the Commodity Boom Over? Where to Invest

After 10 years of under performance, commodities began booming later in 2020. Crude oil soared more than 100%, grains some 30% on global weather concerns and strong Chinese demand, plus rising silver and copper prices, due, in part, to the expansion of electric car manufacturing, new technologies and the green economy.

Companies like Goldman Sachs have been touting “the beginning of a much longer-term structural bull market’ that could rival the 1970s when crude oil traded over $120 a barrel and gold rose 25- fold. However, I disagree with this scenario that all commodities will be in a bull market. We have seen a stronger dollar and wheat, crude and gold prices collapse. Students of previous commodity bull markets are aware that the first mover in a synchronised rotational commodity upswing is usually gold, as this is the first to react to excess monetary creation. Last year, gold hit an all-time high as measured in all major currencies – not just the U.S. dollar. Since the U.S. came off the gold standard, in 1971 under President Nixon, the dollar has lost 98% of its value versus gold. Despite recent weakness, gold remains in a primary bull market, but gold is not the only commodity to offer a hedge against currency debasement – copper, silver, nickel, wheat and coffee are all eventually just as inflation-proof as gold. It is just that all these commodities do not go up at the same time and tend to trade in rotation. Over the recent 10 year period, commodity prices are only up about 10% versus, of course, a stellar 150% rise in the S&P 500. In the chart below, see how commodity prices broke above the bearish trendline a few months ago, due to global weather problems, demand surging from China and expectations for worldwide post-Covid economic expansion. However, right now we need to see major summer weather problems and a sell-off in the dollar again in order to see this commodity boom continue.

Source Bloomberg: The break-out in commodities the last few months has stalled due to improving global weather and the stronger dollar.

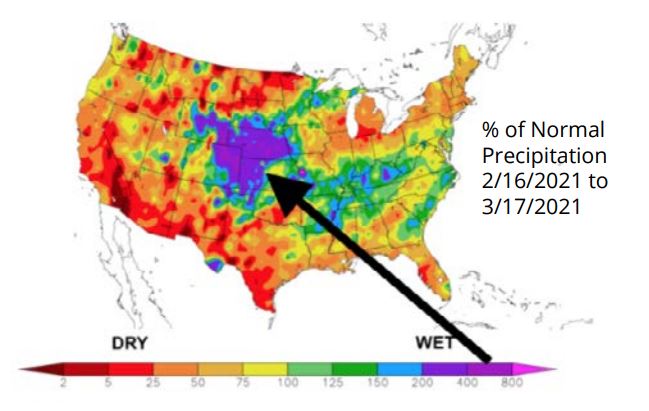

Global weather turned bearish for wheat

Important rains in the last two weeks in key U.S. wheat and corn growing areas, increased European and Russian crop estimates from improved weather, resulted in a massive sell-off in wheat futures. However, I will be watching very closely the northern Plains drought and parts of Canada that may have a bullish impact on spring wheat, if we find in a month or so that dry weather and planting delays continue. Spring wheat is traded on the Minneapolis Grain Exchange (MGEX). On these map images above, notice how soil moisture has improved in key areas of Europe and Russia. This means that earlier fears of drought have been abated. However, wheat prices already broke and it is a long growing season, so I would not necessarily advise selling wheat now, given such a big break in prices. Also, see the above normal rainfall (blue) the last couple of weeks in key U.S. wheat areas. However, look at the drought (red) in the northern Plains where spring wheat is planted later this spring. This could be bullish, later.

If you remember, I was calling the historically cold February outbreak the Arctic pig, but then mentioned we would have a “goat”; bear market in natural gas due to my forecast of a warmer later winter. Indeed, this has happened as the Polar Vortex retreated back to the Arctic, for the next couple of weeks. Following four winning natural gas trades in a row (mostly in conservative options) over the past nine months, I am considering some kind of conservative longer-term long position in natural gas. This is the “shoulder month” when natural gas demand is very weak and it will stay that way. STAY TUNED this summer and fall for my hurricane forecasts, etc.

A warm April on this map for much of the United States is usually still bearish for natural gas. However, a warm April can often imply a hot summer and be bullish, later for UNG (the natural gas ETF) as well as for NYMEX natural gas futures.

Cocoa: Improving Weather Pressures Prices Again

Concern that a spread of a third COVID-19 wave through Europe will lead to longer lockdowns and tighter travel restrictions that reduce economic growth and commodity demand is also undercutting cocoa prices. In addition, rains in West Africa (which produces 70% of the world’s cocoa) have increased again.

Coffee Market Not Yet Excited About The Poor Brazil Crop

Take a look at this photo. The coffee crop on the left was last year, when global supplies swelled helping to pressure coffee prices to $1.00 per pound. To the right, you see how some of the coffee plants recently looked in Minas Gerais. It’s a long growing season, so STAY TUNED. If the northern high Plains do not receive timely rains by midlate April (and ahead of planting), this will begin to be noticed by traders of the MGEX spring wheat contract. But, it is still early. Once we get into April-August, look for many trading opportunities in grains. Spring wheat is a different animal than soft-red wheat (grown in Illinois, Missouri, Indiana, Ohio and Europe) and hard-red wheat (high quality wheat, used in bread, grown from Nebraska, Colorado, Kansas, Oklahoma, Texas and Russia.

Buying Spring wheat and selling Chicago soft-red wheat might be a big trade deeper into spring if the drought in the northern Plains continues. The spike you see on this chart occurred in 2008 could possibly be repeated. Will this drought expand, again, into the heart of the Midwest corn belt? For now, a big improvement in drought conditions from Nebraska to Kansas has pressured wheat, but it is possible that summer weather problems could mount for the Dakotas spring wheat areas and parts of the Midwest grain belt.

The weaker Brazil Real, and global COVID-19 demand worries, continue to hurt this market. A few weeks ago, we had a brief rally on the lower Brazilian crop, but then other outside factors hurt prices.

This is an excerpt from James Roemer's premium subscription newsletter. Try a free trial subscription by clicking here.