It’s A Big 'If' That Soybeans Futures Are Long Term Predictors At All

“[I]t’s a big IF that soybeans futures are LONG TERM predictors at all”

That’s a quote from an Econbrowser reader who is almost uniformly wrong on all matters related to economics, but it seems useful to me to provide the empirical evidence on futures as predictors, especially as noted in a recent post rising commodity prices have put upward pressure on inflation rates. Further, with the efficiency of futures markets might have changed over time, with greater financialization.

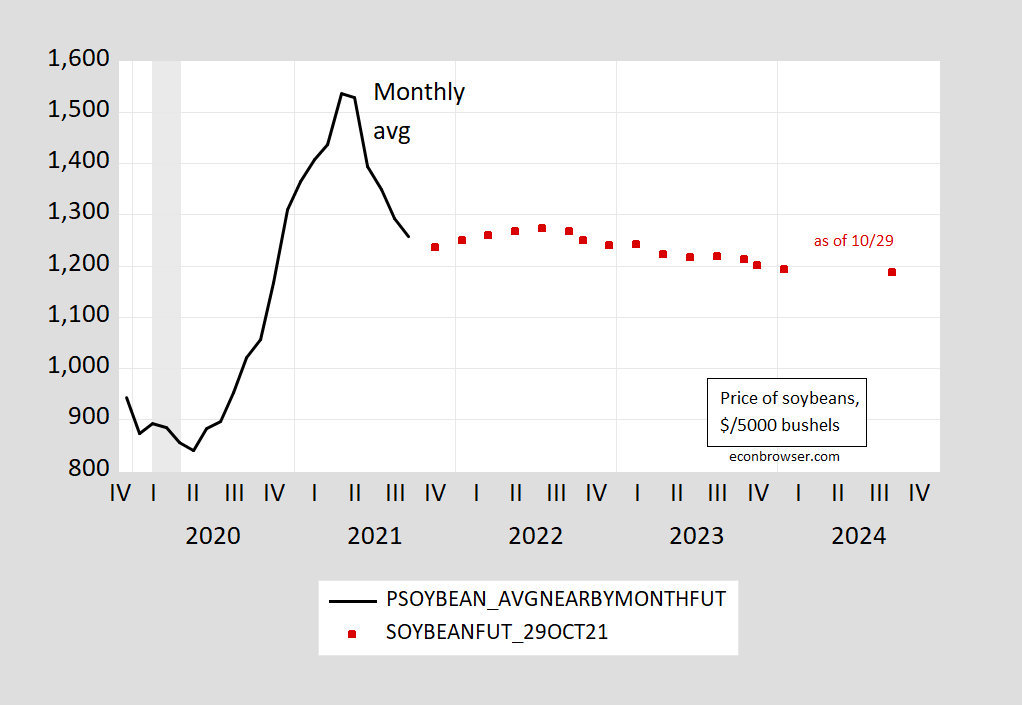

Figure 1: Price of soybeans, nearby month futures, monthly average of daily data (black), and soybean futures as of 10/29 (red squares), both in $/5000 bushels. Source: investing.com, ino.com (accessed 10/30/2021).

Previously, I’ve noted my work with Olivier Coibion (Journal of Futures Markets, 2014), in which we evaluate — among other commodities — soybean prices. V. Fernandez (Resources Policy, 2017) conducted an update of our work. Kwas and Rubszek (Forecasting, 2021) has examined the predictive power of futures up to March 2021 (starting the sample in 2000) (neither examines soybeans, though).

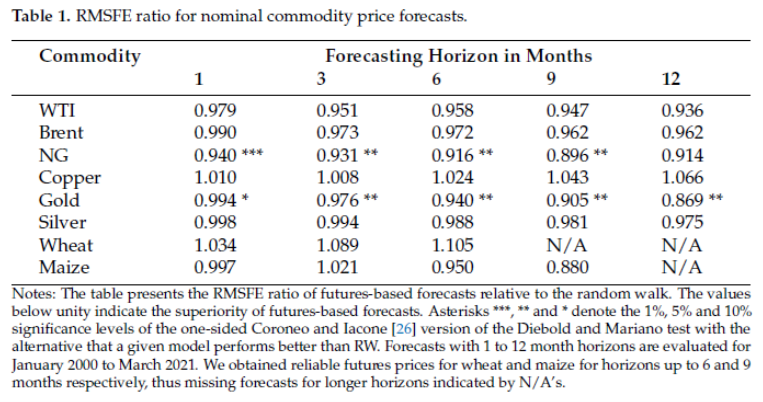

In Table 1, the ratio of the root mean squared forecast errors (RMSFEs) for futures relative to random walk is shown. Values less than one indicate futures outperform the random walk, with the asterisks denoting significance (one-sided tests).

Source: Kwas and Rubszek (2021).

Note that with the exception of natural gas and wheat, futures outperform a random walk.

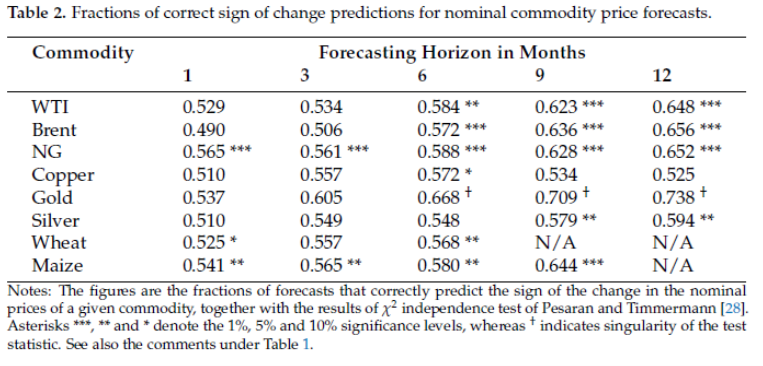

Another conventional way to assess forecasts performance is to see whether the indicator signals the correct direction of change. When the statistic is greater than 0.50 in Table 2, then futures outperform a coin toss; once again, asterisks denote statistical significance.

Source: Kwas and Rubszek (2021).

Note that with one single exception, futures correctly predict direction vs. a no change prediction. Admittedly, not all instances are statistically significant – but there are quite a few that are.

As I noted before, neither of the studies examined soybean futures specifically. However, in a 2019 paper (Huang, Serra, Garcia, Eur. Rev. Agric. Econ.) [ungated working paper version], the authors write:

Using quantile regression, we evaluate the forecasting performance of futures prices in the soybean complex. The procedure provides a more complete picture of the distribution of forecasts than mainstream methods that only focus on central tendency measures. Forecast performance differs by location in the futures price distribution. Futures forecast perform well in the centre of the distribution. However, futures prices tend to over-forecast when futures prices are high and under-forecast when futures prices are low, suggesting that futures prices tend to under-estimate price reversion towards the centre of the distribution. Forecast errors are larger when futures prices are high.

At the time that reader CoRev was debating the informativeness of soybean futures, the price was 814, which places the price at the upper end of the lower price range, i.e., roughly in the center of the distribution, exactly where the authors find soybean futures to be relatively good predictors of future soybean prices.

Disclosure: None.