It Turns Out The World Still Needs Coal

A Liebherr mining truck at dusk at Peabody's North Antelope Rochelle Mine in the Powder River Basin of Wyoming (photo via Peabody).

It Turns Out The World Still Needs Coal

Readers may remember President Biden ran on shutting down coal mining as part of his overall campaign against fossil fuels.

Video Length: 00:00:59

And as President, Biden has called for a transition away from coal towards "renewable" energy (solar and wind).

Today's energy crunch is partly due to a decline in production during the COVID lockdowns of 2020, but it's also due to a misguided focus on green, or renewable energy, as Noah Rothman noted earlier this month:

The sloppy, blinkered effort to transition away from fossil fuels to hypothetical sources of power that cannot meet the energy consumption needs of the planet due to the constraints imposed on them by the laws of physics is an obstacle to meeting “newly minted environmental, social and governance standards for clean energy.”

And a prime beneficiary of that has been Peabody Energy (BTU), whose shares spiked 23% on Monday after the company announced that its coal revenue in Q3 would be the highest in seven quarters and it offered bullish forward guidance.

A Top Name Last Summer

Peabody was one of our system's top names last summer, and appeared in a portfolio we shared here at the time (Building A Bear Proof Portfolio). It has also appeared in aggressive portfolios of ours as recently as last week.

Building A Bear 🐻-Proof Portfolio

— Portfolio Armor (@PortfolioArmor) July 20, 2021

via @zerohedge $BOIL $BTU $GNRC $GPRE https://t.co/BmYKe3Xz9O

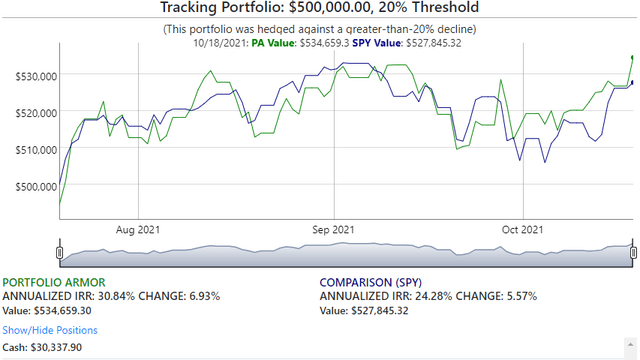

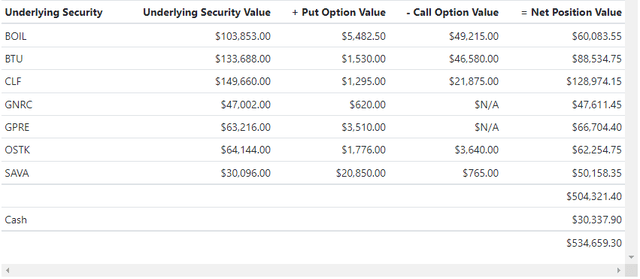

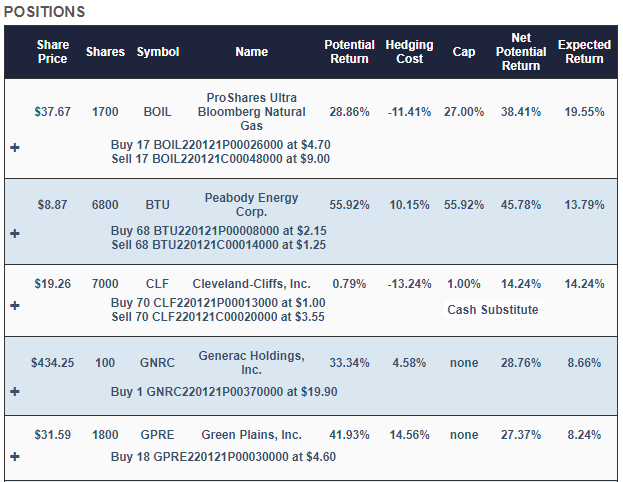

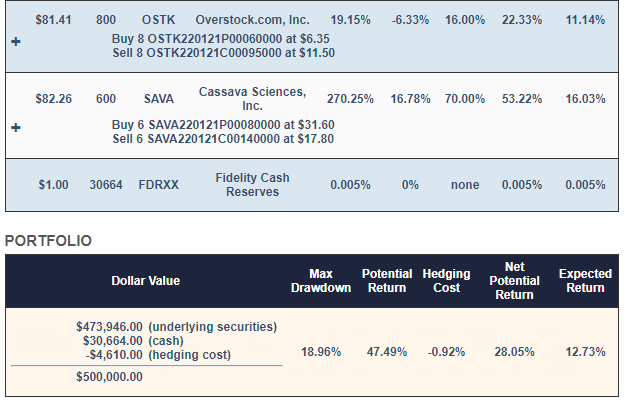

This is the hedged portfolio we presented in that article in July. In addition to Peabody Energy, it included the ProShares Ultra Bloomberg Natural Gas ETF (BOIL), Cleveland-Cliffs (CLF), Generac Holdings (GNRC), Green Plains (GPRE), and Overstock (OSTK), and Cassava Sciences (SAVA).

These and subsequent screen captures are via Portfolio Armor.

Why Those Names

Each trading day, our system analyzes total returns and options market sentiment to estimate potential returns for thousands of stocks and ETFs. The underlying securities above were selected because they were among our top names: the ones that had the highest potential returns, net of hedging costs. Our system started with roughly equal dollar amounts of each, and then rounded them down to round lots, to reduce hedging costs. It swept up most of the leftover cash from the rounding-down process into a tightly hedged Cleveland-Cliffs (CLF) position, to further reduce hedging cost.

Why Those Hedges

BTU is hedged with an optimal collar in that portfolio because our system estimated it would have higher returns net of hedging costs when hedged that way. We elaborated on how our system decides how to hedge securities in a previous post (When To Hedge With Puts Versus Collars), but a key factor here was risk tolerance. Every position in the portfolio above was hedged against a greater-than-20% decline over the next several months. Below will look at a more aggressive hedged portfolio including BTU, but first let's see how that portfolio has done so far.

Performance Of July 19th BTU Portfolio

Here's the performance of the portfolio above so far.

That portfolio was up 6.93% as of Monday's close, versus SPY which was up 5.57% over the same time frame.

Swinging For The Fences With BTU

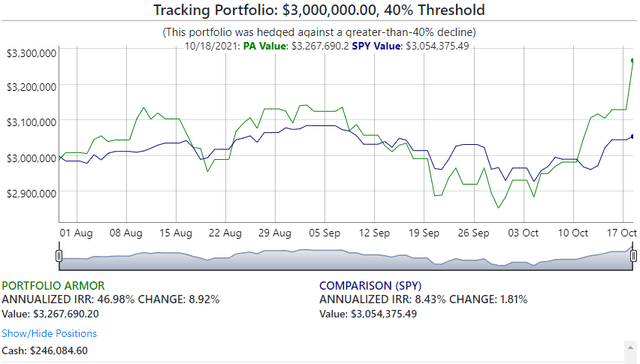

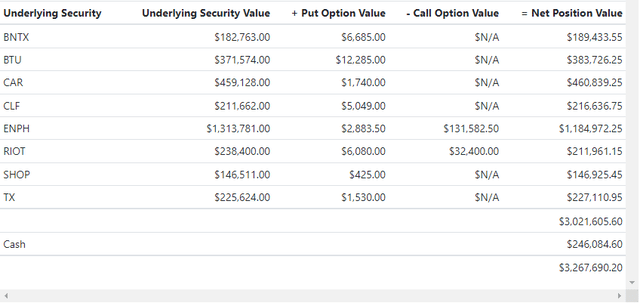

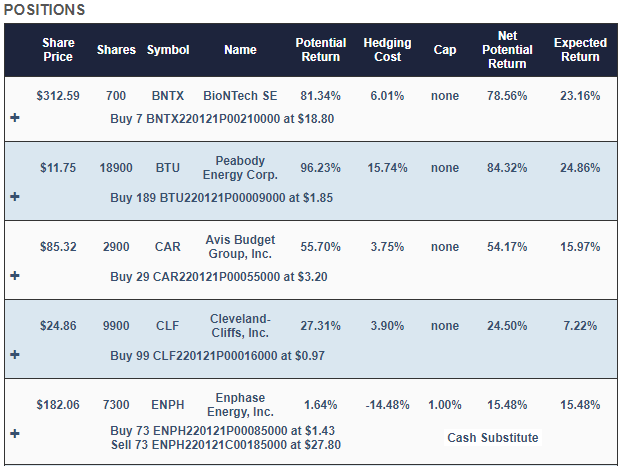

If you wanted to limit your downside risk to a drop of no more than 20% in BTU and the other names, the portfolio above was the way to go. But what if you were willing to take on twice as much risk? We created a portfolio that included BTU but that was hedged against a >40% decline about a week later, on July 29th. This is what it looked like.

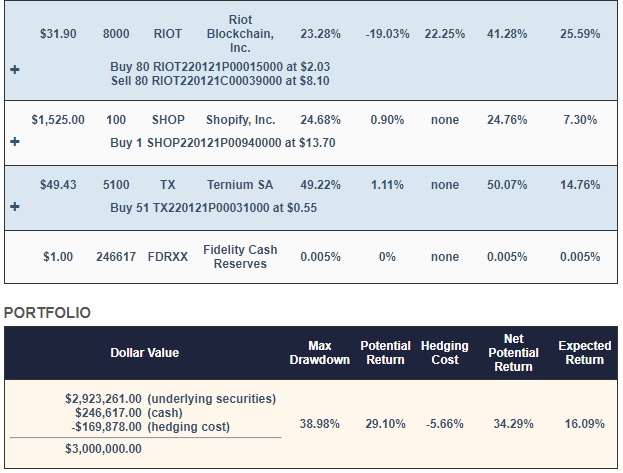

Note that BTU and most of the other names were hedged with optimal puts instead of optimal collars there, so their upside potential was uncapped.

Performance Of The July 29th BTU Portfolio

Since most of the underlying securities had uncapped hedges, we were able to capture more of the upside of BTU and the other names, as you can see below.

This portfolio was up 8.92% versus 1.81% for SPY.

The two portfolios aren't an apples-to-apples comparison, because other than BTU they don't include all the same names, and the starting dates were ten days off, but they do help illustrate the impact of a more aggressive approach.

Disclaimer: The Portfolio Armor system is a potentially useful tool but like all tools, it is not designed to replace the services of a licensed financial advisor or your own independent ...

more