"It Has Arrived": Uranium ETF Sees Record Inflows Amid Retail Buying Frenzy; Japan Hints At Restart Of Nuclear Power Plants

One week ago, and about a year after we turned bullish on the uranium sector which has more than doubled since despite Democrats' unwillingness to include uranium in their ESG umbrella...

(Click on image to enlarge)

... we presented readers with a unique take from Harris Kupperman, who explained how the Sprott Physical Uranium Trust could serve as a springboard to substantial further gains not only in the price of uranium itself but also uranium-linked stocks and ETFs. Comparing its action to the positive feedback loop that emerged in the Grayscale Bitcoin Trust, which served as the springboard allowing bitcoin to rise from $10,000 a year ago to over $60,000 earlier this year, Kupperman said that the Sprott Trust had the potential to "upend" the illiquid uranium market by creating an actual physical shortage that would then translate to much higher prices, to wit:

The Sprott Physical Uranium Trust commonly (known as SRUUF), is the entity that has upended the uranium market. Since launching its ATM 13 days ago, it has acquired 2.7 million pounds of uranium. This is an average daily rate in excess of 200,000 pounds or roughly a third of global production on an annual basis. If GBTC is the roadmap to follow, as the price of uranium begins to appreciate, the inflows into the trust should accelerate. Interestingly, there are plenty of other entities also purchasing physical uranium, uranium that utilities were counting on for their future needs. The squeeze is on.

As expected, the utilities are blissfully unaware. Surprised?? I’m not. Utilities are quasi-governmental agencies, managed by the types of fukwits who’d work at your local DMV, except they enjoy stock options. The fact that they’ve ignored the coming squeeze shouldn’t be surprising. Inevitably, they’ll demand rate increases to buy back this uranium–it’s not their money anyway. This is your bid at some point in the future.

Kupperman summarized his bullish thesis as follows: "Uranium is a small market at roughly $6.3 billion in annual consumption (180 million pounds at $35/lb). SPUT has raised approximately $85 million in the 13 days since the ATM went live. It’s hoovering up supply and is already struggling to procure pounds, as shown by their increasing cash balance—cash that they’re legally forced to spend. Something is going to give here, and I suspect it’s the price of uranium."

Since then, Uranium prices have risen as expected, while the price of both uranium stocks and the SRUUF has soared.

(Click on image to enlarge)

And while gains in the price of physical uranium are welcome for commodity speculators and producers such as Cameco, what was really needed for the Uranium thesis to take off in the capital markets, was similar euphoria in paper Uranium, namely ETFs which track the sector. That's precisely what happened today.

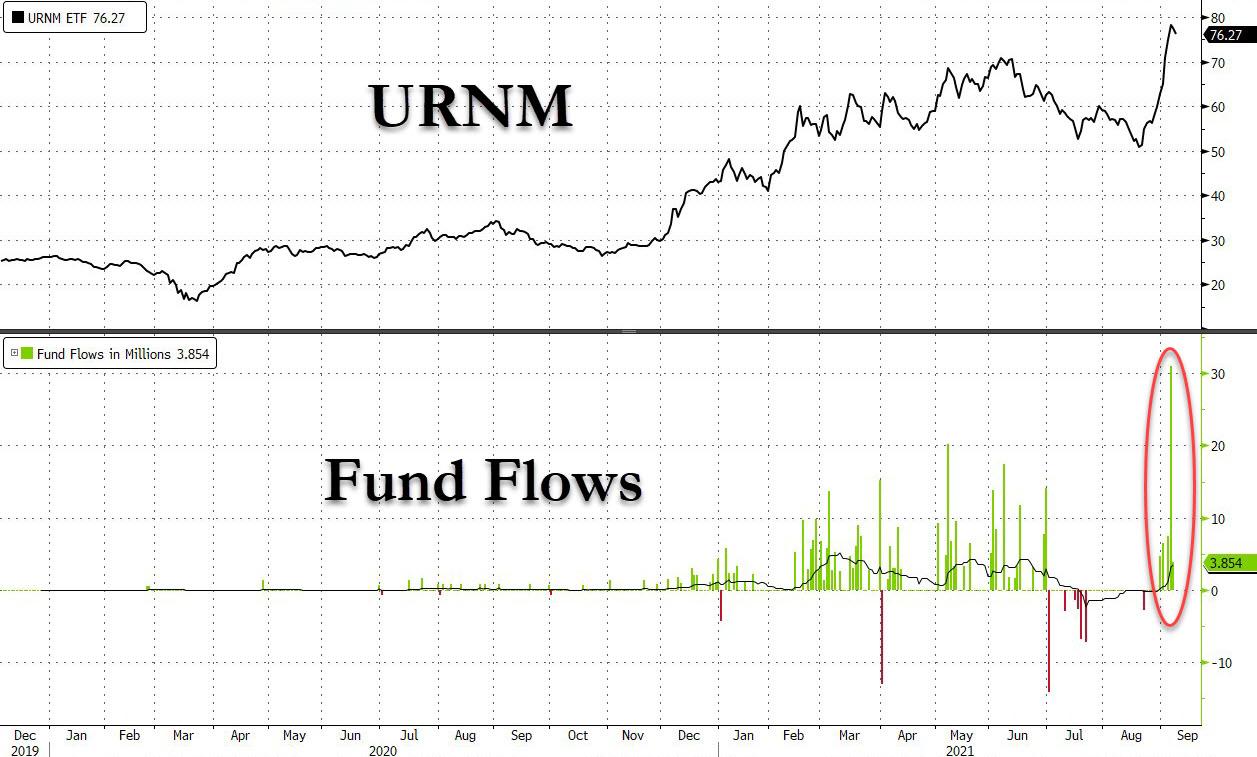

As Bloomberg's in-house ETF expert Eric Balchunas writes, the Uranium ETF URNM is having the "biggest flow week of its life after a 50%(!) move up in less then 3wks." Indeed, URNM Is now up 82% YTD and 216% since launching 18mo ago. It's now about half a billion and trading over $10m/day regularly.

(Click on image to enlarge)

As Balchunas summarized, "In short, it has arrived."

The Uranium ETF $URNM having biggest flow week of its life after a 50%(!) move up in less then 3wks. Is now up 82% YTD and 216% since launching 18mo ago. It's now about half a billion and trading over $10m/day regularly. In short, it has arrived. pic.twitter.com/Cj5OEcPVHa

— Eric Balchunas (@EricBalchunas) September 9, 2021

But while the mass retail investor has clearly discovered uranium on the "ETF table", and more upside is assured if the SRUUF mechanism described above accelerates and especially if the upward momentum is picked up by the reddit day trading army, another far bigger catalyst looms which few have noticed.

On Wednesday, shares of Japanese utility companies surged after Taro Kono, the administrative reform minister and the most likely candidate to replace Yoshihide Suga as prime minister said Japan needs to restart nuclear power plants, in order to realize its goal of achieving carbon neutrality by 2050.

"It's necessary to some extent to restart nuclear plants that are confirmed to be safe, as we aim for carbon neutrality," Kono, currently regulatory reform minister, told reporters according to Japan Times.

"Basically, our priority is to increase the use of renewable energy sources, but it would be possible to use nuclear plants whose safety is confirmed for now if there are power supply shortages," Kono said, adding that while "nuclear plants will disappear eventually, I'm not saying that they should be scrapped immediately, like tomorrow or next year."

The comments are notable as Kono had been a vocal opponent of nuclear power in the past; some renewable energy stocks have surged on bets that he’ll win the race to become Japan’s next prime minister. And once the world realizes what a Japanese restart of NPPs would mean for uranium demand, uranium stocks could double from here purely on uranium supply/demand dynamics, returning to levels last seen before the 2011 Fukushima disaster which mothballed Japan's nuclear energy.

And if that wasn't enough, Sanae Takaichi, a former internal affairs minister who is also gunning for the newly vacant prime minister position, said that she would make small modular reactors a national project, read: more uranium demand. The comment was made during Wednesday’s press conference when she announced her formal bid for LDP leadership.

In short, after years of being left for dead, the uranium sector is not only vastly outperforming the broader market but its upside from here could be dramatic.

Disclosure: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more

Doesn’t mass inflow of retail usually signal the peak?