Is The Gold Market A Bubble? Or Is Something Else Going On?

Gold is up over 109 percent since the beginning of 2024. Some analysts say that the yellow metal is in a bubble destined to pop. However, there is another possibility. What if the meteoric rise in the price of gold is signaling a paradigm shift?

Reuters columnist Edward Chancellor thinks that’s the case, and I think he makes a pretty compelling argument.

Conventional wisdom holds that when an asset swiftly rises in price, it is setting up for a fall. Every time the gold price falls, mainstream pundits declare the air is coming out of the bubble. And every time gold rallies again.

Most recently, the mainstream declared the bottom was falling out when gold corrected in late October. But that downturn only trimmed about 9.8 percent from October’s record high price, and gold is once again testing that level less than two months later.

Of course, all this proves is that the gold bulls are resilient. It doesn’t preclude a deeper correction or even a deflating bubble in the future. But this resiliency could also signal that gold’s rapid price increase isn’t just bubble behavior.

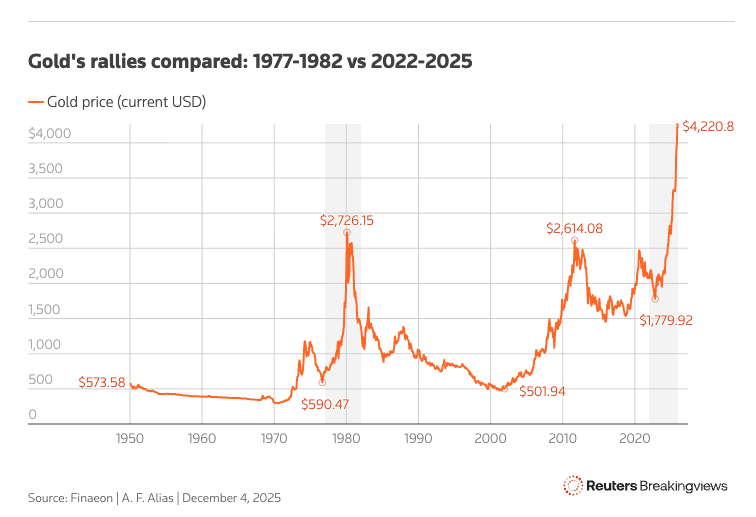

Some analysts point to gold’s bull market in the 1970s to make the bubble case. The price rose rapidly through the 70s only to crash in the early 1980s when Paul Volcker cranked interest rates to 20 percent to slay the inflation dragon. After its peak in late 1979, gold gave up nearly two-thirds of its price.

But it’s not the early 80s, and needless to say, no Volcker is waiting in the wings. The next Federal Reserve Chairman is likely to be even more inclined toward easy money than Jerome Powell.

A New Monetary Era

Chancellor notes that gold’s market valuation “tends to reflect different monetary regimes.”

“Gold reset higher following the credit collapse of the 1920s, and jumped in the second half of the 1970s as the so-called 'Great Inflation' took hold; over the next two decades it remained in the doldrums as price increases abated and real interest rates remained high; after Alan Greenspan’s Federal Reserve slashed interest rates in the early 2000s, gold enjoyed a long bull run. During the era of zero interest rates and quantitative easing from 2008 to 2022, the price was volatile, but its upward trend continued.”

Could we be on the cusp of another monetary paradigm shift?

The yellow metal is certainly behaving differently than in the past

Conventional wisdom holds that the price of gold moves inversely to real interest rates. Historically, the gold price has dropped when long-term interest rates rise, since it is a non-yielding asset. This is why we saw constant price pressure on the yellow metal in the early days of the Fed’s monetary policy tightening in early 2022. Conversely, falling rates tend to be bullish for gold.

However, in late 2022, gold began to break out of the doldrums despite falling inflationary pressures and rising inflation-adjusted bond yields.

In other words, the bull market picked up speed during a period when market dynamics should have been driving the price lower.

Wisdom Tree noted this disconnect, noting investors were beginning to perceive higher rates as bearish. Portfolio managers were “beginning to re-engineer portfolios for an era of structural deficits and active fiscal policy.”

“The asset's behavior has evolved: what was once a rate-sensitive trade has become a fiscal-risk hedge. Correlations with Treasury yields have flipped from deeply negative to positive, implying that gold now rises with, not against, higher long-term rates when those rates reflect sovereign stress. That's an inversion of an old mental model.”

What happened that might account for this defiance of conventional wisdom?

The U.S. and its allies aggressively sanctioned Russia after it invaded Ukraine. Then, in the spring of 2024, the Biden administration threatened to liquidate and sell some $300 billion in frozen Russian assets. This weaponization of the dollar drove gold to fresh record highs.

Using U.S. bonds and the dollar as a foreign policy billy club could certainly incentivize other countries to “behave,” but it also sends another message – get out of dollars while you can.

Chancellor described the impact of these moves.

“This act shook the foundations of the international monetary system in which the U.S. dollar had long served as lynchpin. Reserve managers at a number of central banks started looking for an asset that could not be seized and was not the liability of another sovereign. They returned to the original reserve asset: gold.”

Central banks have been aggressively adding gold to their reserves over the last three years.

On net, central banks officially increased their gold holdings by 1,044.6 tonnes in 2024. It ranked as the third-largest expansion of central bank gold reserves on record, coming in just 6.2 tonnes lower than in 2023 and 91 tonnes lower than the all-time high set in 2022 (1,136 tonnes). 2022 was the highest level of net purchases on record, dating back to 1950, including since the suspension of dollar convertibility into gold in 1971.

To put that into context, central bank gold reserves increased by an average of just 473 tonnes annually between 2010 and 2021.

You might look at the sudden surge in central bank gold buying and dub it a bubble. But Chancellor noted, “The irrational exuberance that normally accompanies a mania is absent.”

“Speculators are too busy obsessing about cryptocurrencies and anything related to artificial intelligence to pay much attention to the barbarous relic.”

He noted that despite the series of record prices, ETF gold holdings remain about 10 percent below the 2020 pandemic peak.

Gabelli Gold Fund portfolio manager Ceasar Bryan pointed out that the 1970s gold bull market was extremely volatile with several significant reversals. Knowing this history, investors hold their breath every time gold corrects. But so far, it has recovered quickly with each dip. Bryan said this time “feels different.”

As Chancellor noted, the monetary and fiscal background today couldn’t be more different than the 1970s.

“At the end of the 1970s, the United States was a significant international creditor. Today, it's the world’s largest debtor. Back then, U.S. government debt was around 30 percent of GDP. Today, it is nearly four times higher. For the past three years, the U.S. fiscal deficit has averaged around 6 percent of GDP, roughly four times higher than the budget shortfall in 1979.”

Chancellor swerved into another reason for the recent de-dollarization trend and the pivot to gold. The U.S. government keeps right on borrowing and spending despite a $38 trillion debt. Last month, the federal government posted a $173.28 billion deficit in November, despite a massive increase in tariff revenue. At some point, you stop loaning money to your drunk uncle who can’t get his spending under control.

Chancellor sums up the current environment.

“It’s not unreasonable to conclude that the rising gold price reflects a host of fiscal, financial and geopolitical uncertainties.”

More Food for the Bulls

But the paradigm shift isn’t complete. While central banks have aggressively bought gold. Most investors – particularly in the West – hold relatively little gold in their portfolios.

Chancellor called this “a costly mistake.”

“According to Goldman Sachs, the optimal portfolio over the last 10 years would have held half its assets in gold.”

Most U.S. investors only hold a handful of gold, if any at all.

However, that paradigm may be shifting as well. In what was described as a “seismic shift,” Morgan Stanley CIO Michael Wilson recently came out with an investment strategy that includes a 20 percent allocation to gold.

Historically, the conventional wisdom on Wall Street was a 60/40 portfolio, with 60 percent of the holdings in equities and 40 percent in fixed-income investments, primarily bonds. Given the changing market dynamics, Wilson said investors should consider a 60/20/20 strategy, swapping half of the bond portfolio for gold to serve as a “more resilient” inflation hedge.

"Gold is now the anti-fragile asset to own, rather than Treasuries. High-quality equities and gold are the best hedges.”

Since Wilson floated this idea, the 60-20-20 allocation scheme has received increasing attention in the mainstream financial media.

If the idea gains widespread acceptance, it could push gold to even loftier highs. With the average allocation to gold in most portfolios under 1 percent, investors would need to buy a lot of yellow metal to boost their gold holdings to 20 percent!

In conclusion, it's possible that gold is in a bubble. But it's probably not. The fundamentals argue otherwise. It's more likely that this historic gold bull market is telling us something. Chancellor thinks it may be signaling the beginning of a paradigm shift. Analyst Brien Lundin put it even more bluntly.

"Gold’s remarkable advance so far tells us that a paradigm shift has already occurred. Gold has returned to official recognition as money, and the only money that cannot be debased."

More By This Author:

November CPI Report Like The Gift Of An Ugly SweaterSilver Industrial Demand Expected To Grow Despite Higher Prices

Falling Prices Are Bad For You?