Inflation Is Definitely Back In The United States

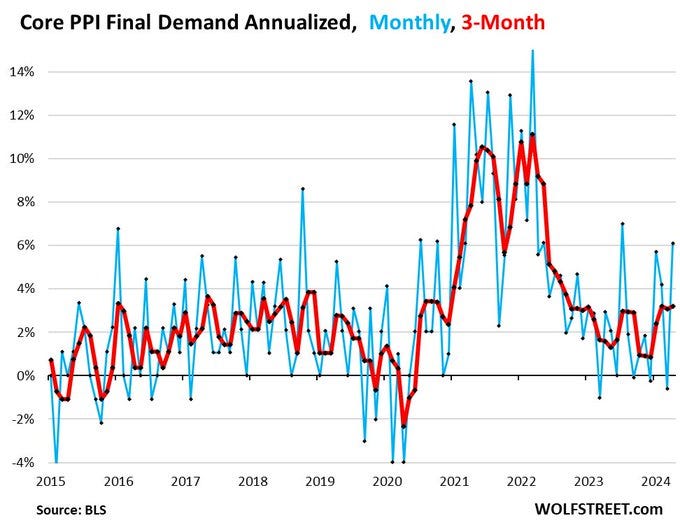

Inflation seems to be making a comeback in the United States, as shown by the core PPI figures, which indicate an increase in prices paid by manufacturers. The pulses observed on this indicator foreshadow an increase in prices paid by consumers, pointing to a further rise in the core CPI in the months ahead.

In April, the Core PPI index rose by 0.5% on the previous month, well above the 0.3% expected. This represents a pick-up in inflation to an annual rate of over 5%.

CPI figures released this week confirm a further rise in prices, which continues to weigh heavily on consumers. On an annual basis, food prices are up by 4.1%, electricity by 5.1%, rents by 5.4%, car repair costs by 7.6%, hospital services by 7.7%, transport -especially air fares- by 11.2%, and car insurance by 22.6%.

This new surge in inflation is accompanied by a marked denial on the part of most analysts, who continue to favor assets that are nonetheless becoming very risky in this inflationary context.

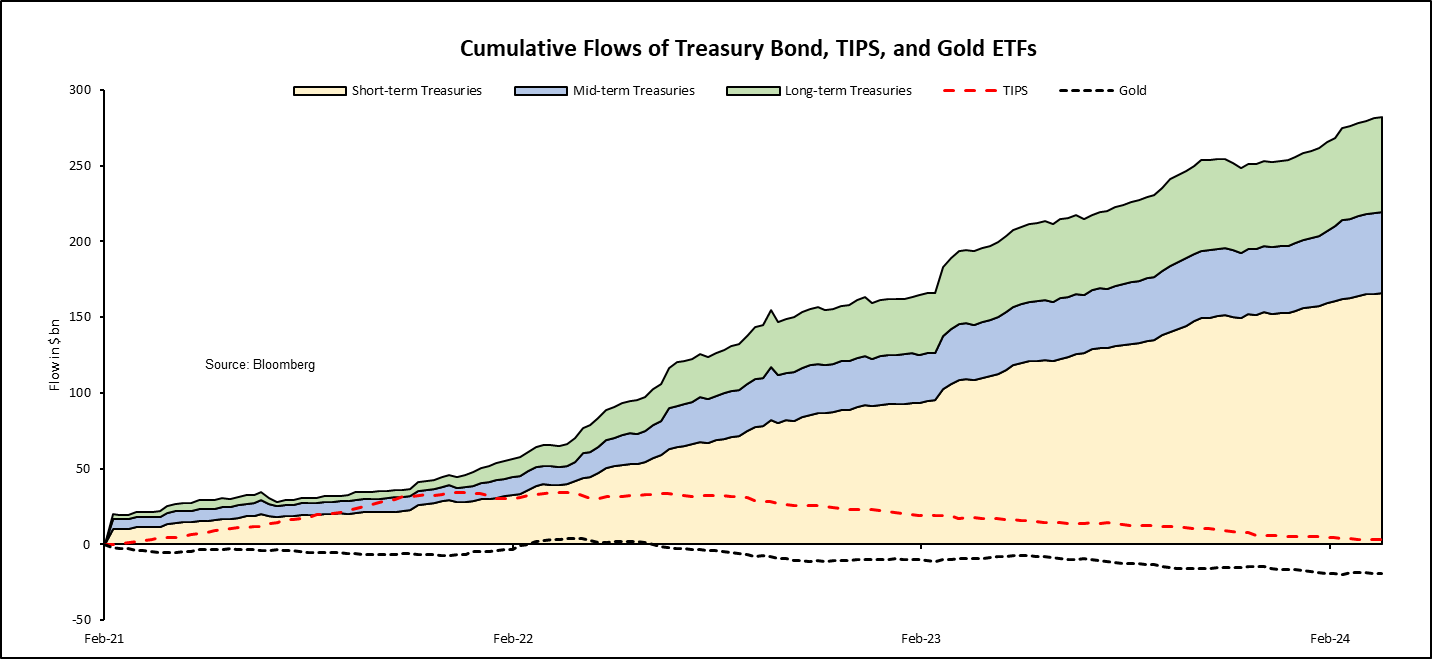

Since the start of an inflationary phase in 2021, investor behavior has remained unchanged, and we have not observed any significant change in asset allocations.

The rate hike initiated by the Fed has led to a deterioration in bond portfolios, with a logical decline in the value of bonds purchased at lower rates. Despite this, most investors do not seem to believe that rates will continue to rise, and continue to buy bonds currently offering attractive yields. The risk of inflation continuing and rates rising again is considered minimal.

With inflation continuing for the third year running, savers are continuing to buy Treasury bonds on a massive scale. These assets have remained in high demand since inflation began to rise. Even TIPS, which are supposed to offer protection against inflation, are under-subscribed compared with T-bills:

For most investors, inflation is seen as a transitory phenomenon. It seems to be perceived as a non-event, as evidenced by capital movements: T-bill-linked ETFs gained $290 billion, TIPS recorded no increase, and gold-linked ETFs suffered a loss of $20 billion.

This is extraordinary: since the start of inflation, precious metals ETF outstandings have fallen. What's more, we've also seen a decline in outstandings on commodity-linked ETFs:

Did you say inflation? What inflation?

According to this chart, it hasn't really started yet!

The market consensus has never been clearer: the inflationary phase we've been going through for the past 3 years is only a transitory phenomenon, and most investors expect a return to normal. They don't believe in the paradigm shift we've been announcing in these bulletins ever since inflation awoke in 2021.

The poor figures for April raise an important question: is the Fed's target of bringing inflation down to 2% realistic? Inflation is still far too high, and the data are not pointing in the right direction.

Since the Fed declared victory over inflation last December, the figures have been rising again. Without even lowering rates, the Fed has created a new accommodative monetary environment. In fact, we have even returned to historically high financial conditions, at the same level as when rates were at zero:

In other words, not only does the market seem to be ignoring the effects of inflation, but the rate hikes initiated to counter inflation have had no impact on financial market conditions.

In the real economy, far from the financial market bubble, the impact of inflation is beginning to be felt: until now, consumers have coped with inflation by taking on more debt. As inflation rose, consumers resorted more and more to credit to maintain their standard of living.

But since rates began to rise, the number of credit card defaults has continued to rise. In fact, they have reached their highest level since 1991:

The Fed has failed to curb inflation and the American consumer is being squeezed by this inflationary recovery.

Historically, high levels of credit card defaults have often coincided with the onset of recession. These recessionary forecasts have also had an impact on copper prices in the past. When a recession is anticipated, "Doctor Copper" plunges in anticipation of falling demand.

This time, it didn't. Copper is soaring towards its all-time highs:

(Click on image to enlarge)

Similarly, the gold/silver ratio is set to rebound. However, we are seeing a downward breakthrough in this ratio, with even a significant breakdown this week:

(Click on image to enlarge)

This week, the price of silver is at an eleven-year high. But unlike 2021, this new record has been reached amid widespread indifference:

(Click on image to enlarge)

The slowdown in the US economy no longer has the same effect on these indicators (copper, silver, gold/silver ratio), as it is taking place in an inflationary context.

Stagflation is changing the game on a whole range of assets, which are still largely neglected by investors.

More By This Author:

Stagflation & Money Printing: An Explosive Cocktail In Gold's Favor

To Buy A House In The US, Save In Silver

Towards A New Silver Short Squeeze?

Disclosure: GoldBroker.com, all rights reserved.