In Case Gold Has Further To Fall

Adoration Of The Golden Calf. Picture from the 12th Century Hortus Deliciarum of Herrad of Landsberg. Via Wikimedia Commons.

Was The Recent Gold Rally A Fakeout?

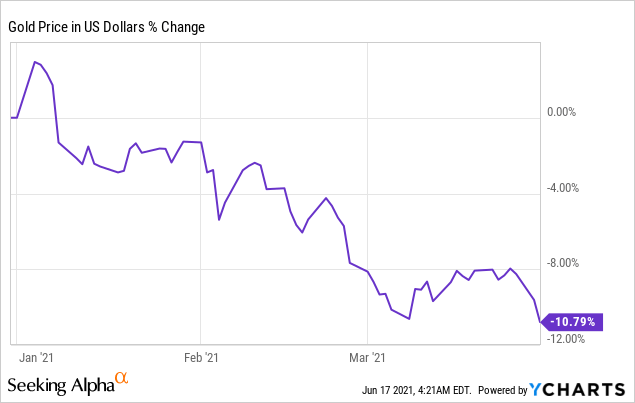

Gold got off to a pretty terrible start this year. Despite record fiscal and monetary stimulus, and inflation bubbling through the economy, gold was down more than 10% in the first quarter.

Next, gold rallied, making up its first-quarter losses. Then came this week's Fed meeting.

The Fed trying to calm investors pic.twitter.com/RAZZmED9ON

— Jerome Powell (@alifarhat79) June 16, 2021

Gold's reaction after news broke that the Fed might make a couple of rate increases in 2023 prompted TD Ameritrade's lead anchor Oliver Renick to wonder if the recent rally had been a fakeout.

past month might've been a fakeout? So brutal. pic.twitter.com/zpuQCdhrkg

— Oliver Renick (@OJRenick) June 16, 2021

Regular readers may recall that Oliver Renick called the Bitcoin top last month. In case he's right about gold's recent rally having been a fakeout, it might be worth adding some downside protection here. We'll show a couple of ways of doing so using the SPDR Gold Trust (GLD) as a proxy for gold below. First, we'll answer the inevitable goldbug question.

Why Use GLD As A Proxy For Gold?

GLD works as a proxy here because it's liquid and has options traded on it, unlike the Sprott Physical Gold Trust (PHYS). No, neither ETF correlates exactly with gold prices all of the time, but GLD correlates closely enough with gold that it's useful as a proxy.

Hedging Against A Further Drop In Gold

Let's say you owned 1,000 shares of GLD or roughly the same dollar amount in physical gold. Here are two ways to protect against a greater-than-10% drop over the next several months.

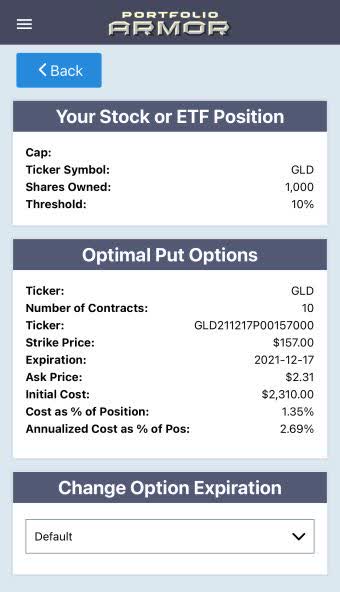

Uncapped Upside, Positive Cost

As of Wednesday's close, these were the optimal put options to protect against a >10% decline in GLD by the end of the year.

This and the next two screen captures are via the Portfolio Armor iPhone app.

The cost of that protection was $2,310, or 1.35% of position value, calculated conservatively, using the ask price of the puts (you can often buy and sell options at some price between the bid and ask). By way of comparison, it was cheaper to hedge GLD this way than it was to hedge SPY or TLT on Wednesday.

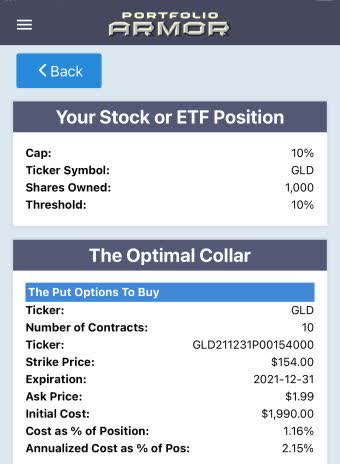

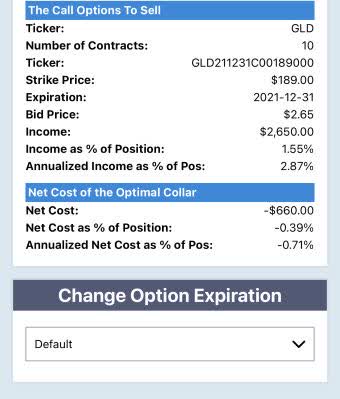

Capped Upside, Negative Cost

If you were willing to cap your possible upside at 10% over the same time frame, this was the optimal collar to protect against a >10% drop in GLD by the end of the year.

In this case, the cost was negative, meaning you would have collected a net credit of $660 when opening the hedge, assuming, to be conservative, that you placed both trades (buying the puts and selling the calls) at the worst ends of their respective spreads.

Options Give You Options

If gold keeps dropping and you're hedged with the optimal collar above, you may be able to buy-to-close your call leg for much less than you bought it, eliminating your upside cap. If you're still bullish on gold, you could also sell your appreciated puts and use the proceeds to buy more at a lower price. Being hedged gives you options.

Other Ways To Play The Inflation Trade

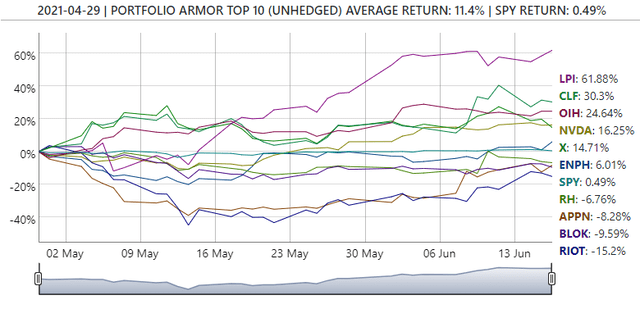

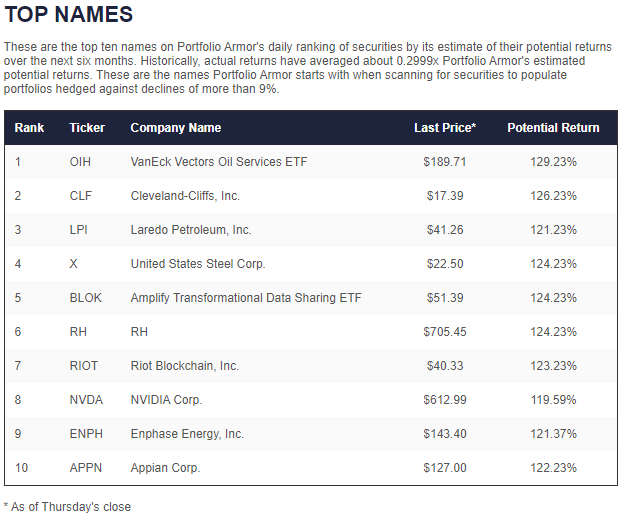

If you're concerned about continued inflation and are looking for other investments to consider, we mentioned one on Sunday (Instead Of Gold: Consider Iron). The iron miner we mentioned there, Cleveland-Cliffs (CLF), was a top name of ours in late April.

Screen capture via Portfolio Armor on 4/29/2021.

It's up about 30% since but has hit our top ten again this week.

CLF has dropped a couple of dollars a share since we wrote about it over the weekend, but our system is still bullish on it.

Disclaimer: The Portfolio Armor system is a potentially useful tool but like all tools, it is not designed to replace the services of a licensed financial advisor or your own independent ...

more