How A Stratospheric Warming Event Created A "Fake Out Rally" In Natural Gas Prices & What Is A Strangle?

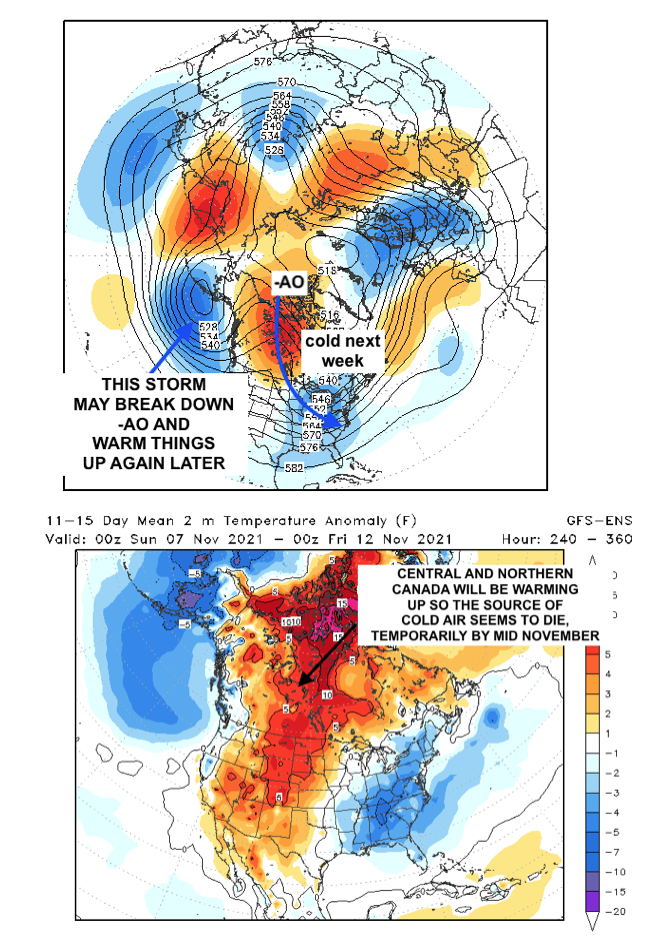

The map above shows warming (red) in the stratosphere some 10-15 miles above the earth's surface. When these events happen in winter, they can force a Polar Vortex south and bring bone-chilling air. This helped to rally natural gas prices some 50 cents ($5,000 a contract) earlier this week.

However, I am sitting here in my office (sometimes at 4 am) watching every weather map that comes out move the natural gas market. It's incredible. Last Wednesday night at 4 am EST in the United States, I put out a more bearish outlook for my Weather Wealth newsletter, based on my view that warm air in Canada would offset some of the La Nina-based teleconnections and cold models. Everyone was talking about a stratospheric warming event early this week that would force a cold vortex south into the heart of the United States, but the warming needs to be closer to the North Pole and displace a Polar Vortex. There is no Polar Vortex yet, it is too early, and hence the warmer outlook for the first half of November.

(Click on image to enlarge)

Here were the models I sent out to clients before the extreme 60 cent break in natural gas prices late this week. Everyone and their dog were buying cold November weather maps for the market, but there is no doubt that the historical droughts and warmth this summer, combined with Climate Change is preventing any sustained cold weather to affect the United States.

Source: Stormvista (Discussion on maps BestWeatherinc.com)

October has been warm. This is why recent EIA numbers have been bearish. One cold shot this week is not enough to sustain a major rally. We need stratospheric warming to be over the Arctic and not bleed into Canada and warm things up. This is what I feared last week and hence the major, sell-off in prices.

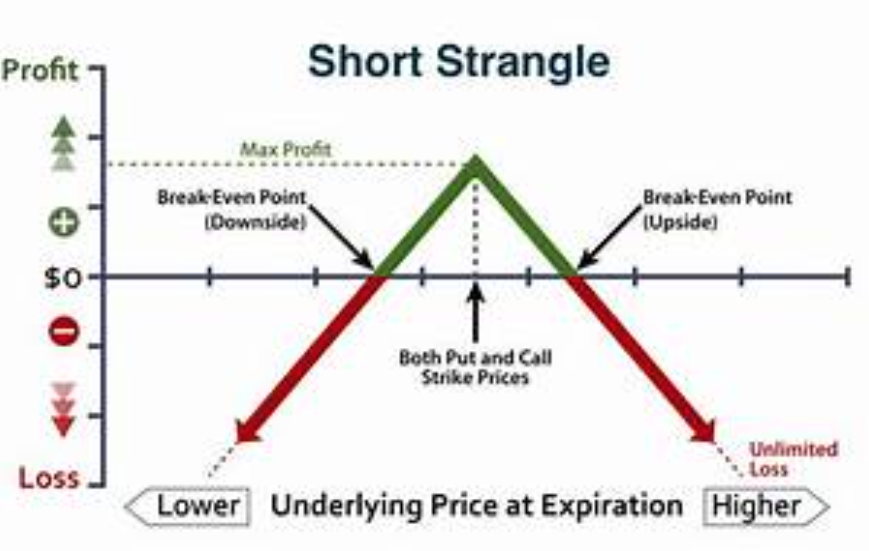

But this winter will be extremely volatile. There are enough climatic signals with respect to La Nina, something we call a negative QBO index, and a cool northern Pacific near California (-PDO) that winter should not be warm the entire time. So how does one trade natural gas? Use volatility, such as option strangles.

A strangle is basically an iron condor without two of the protective option strikes. For a short strangle, a trader would sell a call while also selling a put in the same expiration month for a given underlying. The short strangle, also known as sell strangle, is a neutral strategy in options trading that involves the simultaneous selling of a slightly out-of-the-money put and a slightly out-of-the-money call of the same underlying stock and expiration date.

The short strangle, also known as sell strangle, is a neutral strategy in options trading that involves the simultaneous selling of a slightly out-of-the-money put and a slightly out-of-the-money call of the same underlying stock and expiration date.

(Click on image to enlarge)

CONCLUSION NATURAL GAS: So which strangles should you use and what happens if the entire winter ends up warm? This advice is reserved for our clients, but the bottom line is, that based on this particular La Nina and other studies I have done, there will be some cold outbreaks as we go into winter, following some November warmth. This will create some of the best trading opportunities in many years in natural gas and other energy related spread positions.