Historic Tensions On The Silver Market

Image Source: Pixabay

In 2023, our outlook for silver suggested a bullish recovery for 2023 and 2024:

"The average silver price is expected to fall slightly in 2023 (to $21.30). However, this does not seem completely consistent to us, and other scenarios could be considered. Technically, the trend remains bullish despite numerous resistances. Moreover, market strength still favors gold over silver. A sustained move above $26 an ounce would trigger strong bullish potential. Otherwise, we can expect a lateral move. The bearish scenario being sui generis less likely."

In 2024, with almost one in five ounces now dedicated to the photovoltaic industry, tensions on the silver market are mounting: silver shortages due to growing demand and limits on production capacity, significant increases in production costs, etc. Against this backdrop, the price of the grey metal would be headed for good prospects. While the breakout from the $26/oz level has now been confirmed, analysis of the behavior of the various players shows that signals are still slow at this stage.

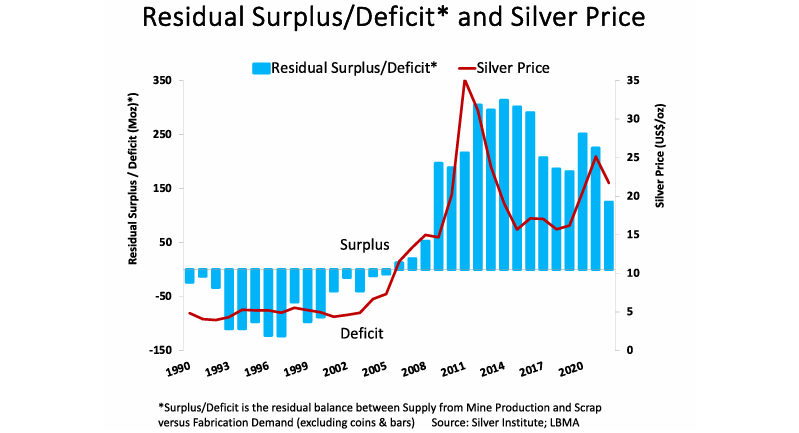

For the third year running, a historic supply deficit

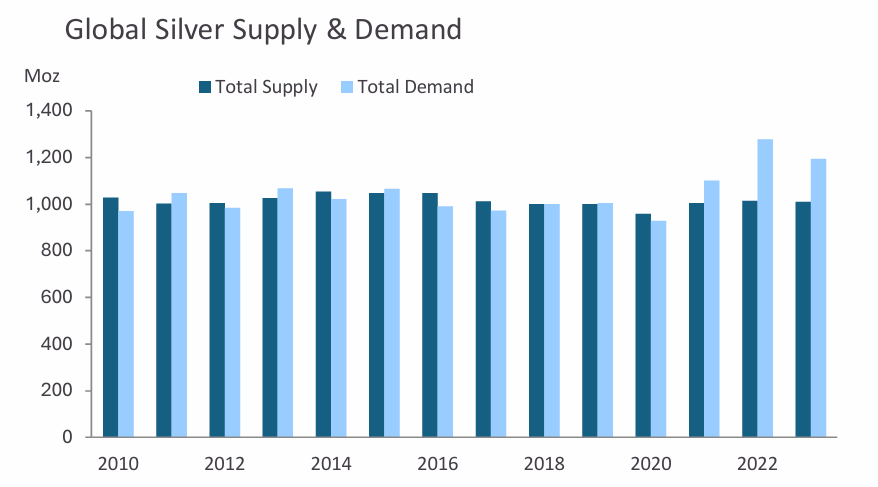

For the third year running, demand for silver metal exceeds supply. This market maladjustment was particularly noticeable in 2022 when 20% of total demand was not supplied! In 2023, the supply deficit narrowed but remained clearly high at 184 million ounces (and 142 million, excluding FTEs). This supply deficit is equivalent to over 5,900 tons of silver not supplied, or 15.5% of all silver demand in 2023. Given this situation, the fundamentals of the silver market remain favorable. Nevertheless, this supply deficit still reflects the inability of prices to adjust effectively to the production shortfall.

For 2024, the Silver Institute anticipates a supply deficit rising to 215 million ounces, and a deficit adjusted for investments in Exchange-traded Products of 265 million ounces. What's more, supply levels have remained stable for over ten years, while demand seems to be rising steadily. For example, silver supply rose steadily from 1990 (at less than 3% per annum) to 2010, before entering a phase of stagnation. It's important to remember that silver metal production is "secondary", i.e. silver is mined as part of the production of other metals (gold, zinc, copper, etc.). The market is therefore more sensitive to potential supply shortages.

Rising demand for photovoltaics

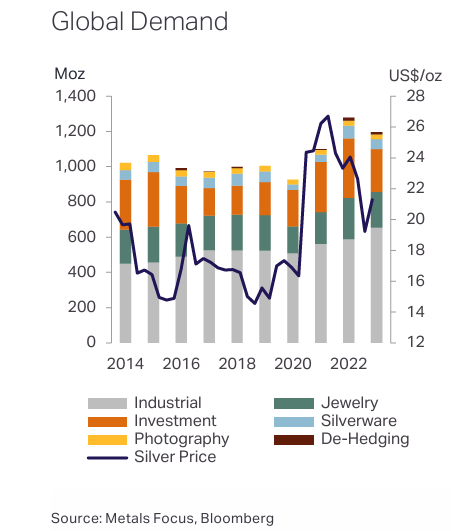

Demand for silver in the photovoltaic industry is rising dramatically. By 2023, demand for silver in this industry had risen by 64%, reaching almost 19% of all silver demand in 2023! In other words, a record one ounce in five is now dedicated to the photovoltaic industry. Clearly, the surge in photovoltaic demand is destabilizing the silver market, which finds itself in a production deficit. Over the last ten years, silver demand for the photovoltaic industry has almost quadrupled!

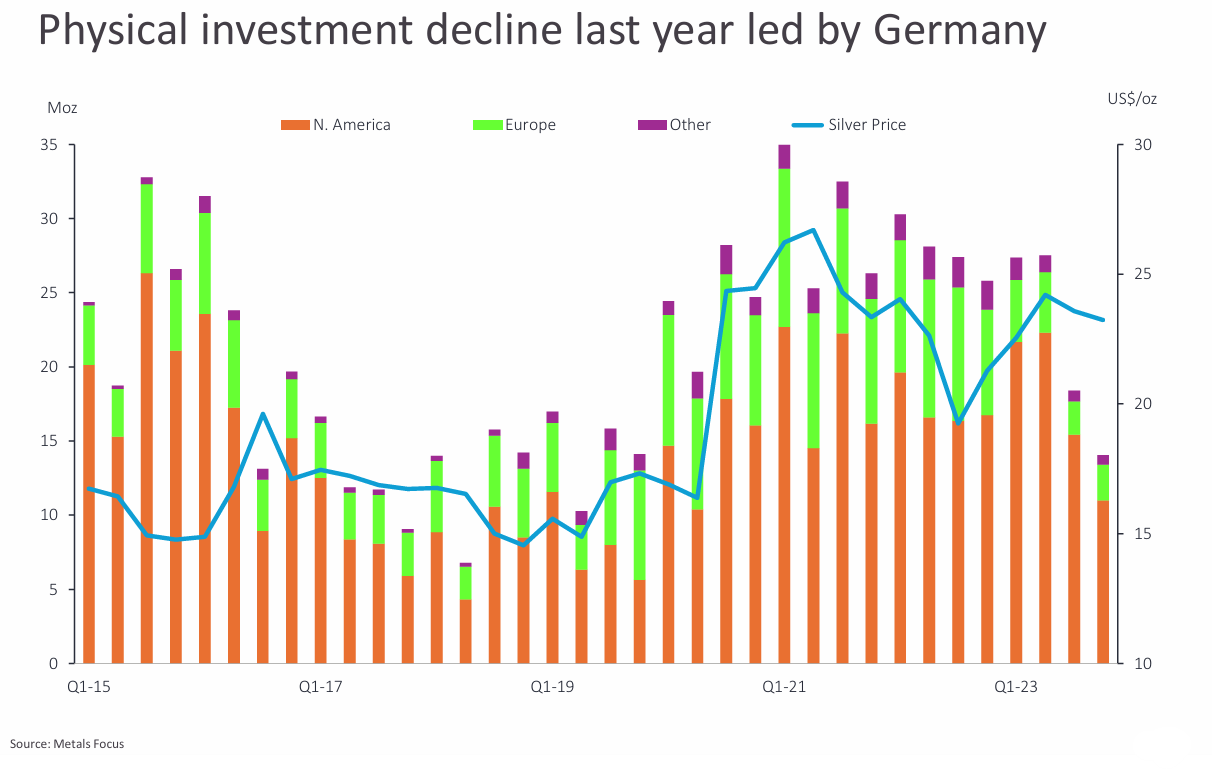

By contrast, demand for investment silver fell sharply in 2023 (-28%!), as did demand for silverware (-25%). On the subject of investment demand, the Silver Institute report states: "While all major markets saw losses, the decline was particularly acute in Germany (-73%) following the VAT increase at the start of 2023." Similarly, demand for jewelry fell by 13% in 2023, mainly due to India, where demand dried up as a result of the high rupee. The year 2023 therefore saw a slowdown in demand for silver for jewelry, silverware and investment purposes, which account for 17%, 4.6% and 20.3% respectively, of total silver metal demand (i.e. a total of almost 42% of demand).

Finally, despite the decline in demand from private individuals, industrial demand is growing (+11%), with a notable increase in electronics and photovoltaics. Overall, silver demand is set to decline by 7% in 2023, following a 16.3% rise in 2022. Demand is expected to rise slightly in 2024. As a result, the silver metal market is slowing in its ascent.

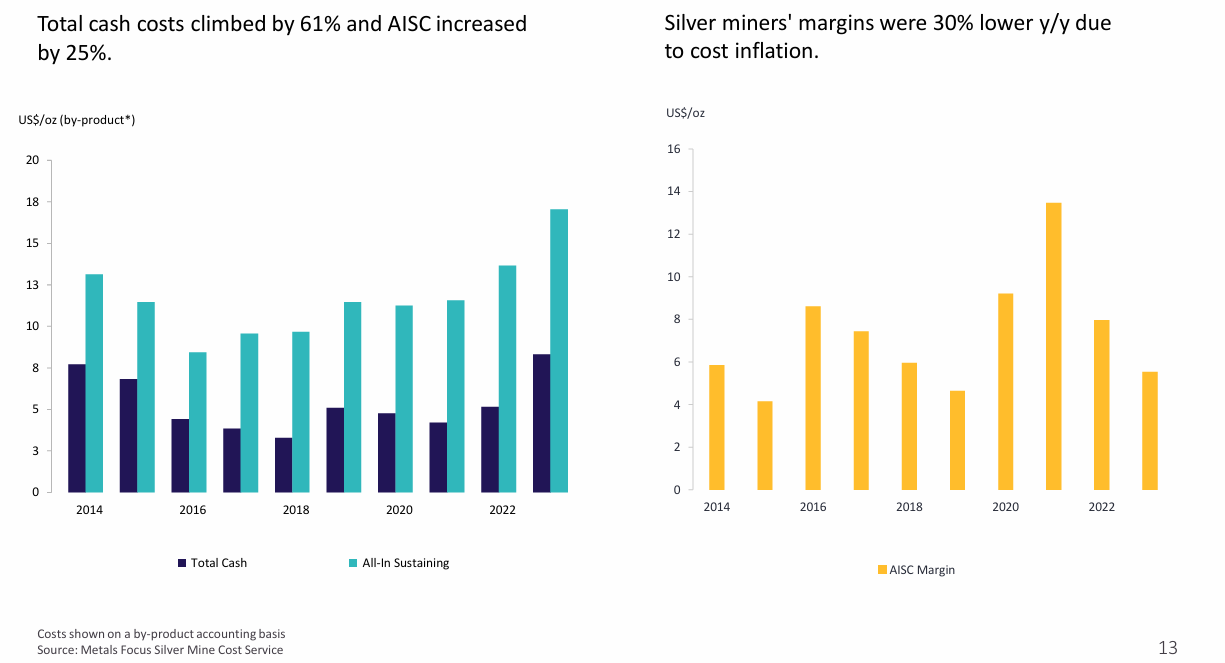

Silver production costs up 25%!

As in the gold market, silver mining companies account for over 75% of physical silver supply. What's more, Mexico, China and Peru together still account for almost 50% of the world's silver mining production. Under these conditions, the price of silver depends to a large extent on the conditions under which silver is produced, and more specifically on the cost of production.

Over one year, the total production cost of an ounce of silver (AISC) climbed 25% to nearly $18. As for total cash costs, they rose by over 60% in 2023! Conversely, the profitability of silver mining companies has plummeted. The margin generated by mining companies in 2023 will barely exceed $5 per ounce of silver... A level almost as low as in 2019 or 2015!... We note that such low margins on the silver market have often preceded a significant upward movement in the price of the grey metal (+17.5% in 2016 and +47% in 2020). Rising production costs are thus characteristic of the future persistence of bull markets in precious metals.

What's more, production costs on the silver market have been rising since 2016. In the space of eight years, silver production costs have more than doubled, while the price of silver metal has only risen by around 50%! Tensions on production are thus increasing as mining companies' margins shrink and costs appear increasingly out of control due to inflation. Based on these costs, what would be the "fundamental price" of silver? Considering a historical spread of 50% to 70% between the cost of production and the final price of silver, we can assume that a price of around $29 per ounce would be fundamentally justified. Without a reduction in production costs, we would have to get used to a silver price closer to $30 per ounce in the future.

Gold still ahead of silver

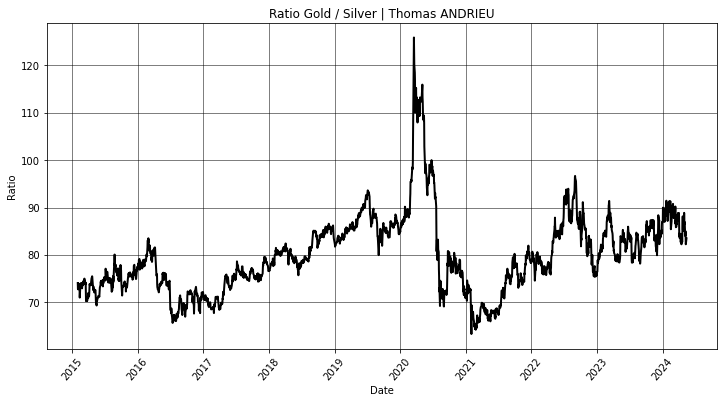

In bullish phases, the silver price generally tends to rise faster than that of gold. But in recent months, silver's rise has been no greater than gold's. The gold/silver ratio has tended to stabilize at around 85 since 2022, with neither really outperforming the other. Nevertheless, gold appears to have outperformed silver since 2021, when the silver price fell more sharply than the yellow metal. What's more, if silver outperforms gold, the gold/silver ratio could fall towards the 70 support level, which would be equivalent to a silver price close to $33.50 at gold's current price of $2,350. But this scenario would still require a few more signals.

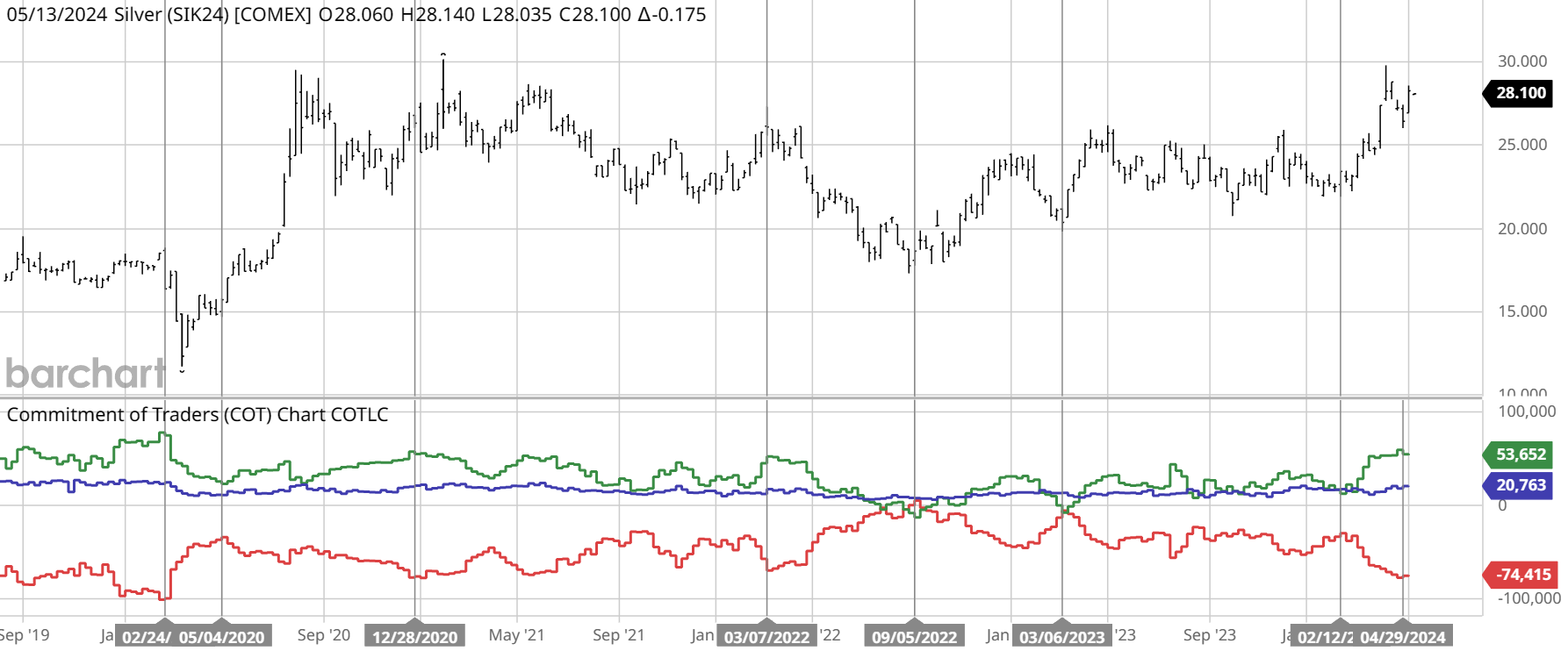

Another indicator of the strength of the silver market is the commitment of traders (COT). The chart below shows the silver price with institutional positions in the silver market (options and futures). The red curve represents the number of contracts held by silver producers and merchants, while the green curve represents the number of contracts held by large non-commercial speculators. The blue curve, often less studied, represents small speculators. In general, major lows in the silver market are seen when open positions are low, and producers reduce their supply as much as possible (the closer the two curves are to each other, the stronger the buy signal, and vice versa).

In this sense, the last major buy signal on silver was observed in February 2024. Since February, producers and buyers have significantly strengthened their positions. This obviously attests to the strength of the uptrend, but also to its exhaustion. The capping of open positions in April and May 2024 attests to the fact that the silver market is now more prey to bearish forces. A potential upside in the price of silver would then be found in the presence of less interest from mining companies and buyers. In other words, at current prices, players would have to find little interest in seeking higher prices. While silver market positions have rapidly plateaued, the gold market is still showing some potential. Given this context, it will probably be a few more months before we can expect the silver price to outperform.

In the report from the Silver Institute, we read: “In the futures market, a lack of investor conviction was highlighted by considerable fluctuations in managed money positions, which at times moved into net short territory. Over-the counter (OTC) buying was also notably weaker, compounded by a pick-up in liquidations later in the year. ETP holdings recorded net outflows for the second year in a row, albeit at a lower pace. Lastly, silver bar and coin sales experienced their first annual decline since 2018, slipping to a three-year low.”

What it would take to see a sharp rise in silver

In its report, the Silver Institute highlights the correlation between manufacturing demand (including demand for jewelry, silverware, photography and industry) and the silver price. Indeed, higher mine production than manufacturing demand will translate into a lower silver price, and vice versa.

Consequently, a rise in the silver price is only conceivable if manufacturing demand sustainably exceeds mine production. Symmetrically, the stagnation of the silver price in 2023 despite the tensions on the market could be partly explained by the reduction in manufacturing demand. Two conditions would appear to be necessary for a sustainable increase in the silver price: firstly, stagnant or falling mining production, and secondly, a further rise in manufacturing demand on the market.

What are the prospects for 2024?

In conclusion, the silver market is experiencing persistent supply deficits. In 2023, 15% of all silver demand was unfilled. The gap between supply and demand is widening, driven in particular by industrial demand, and more specifically by the growing demand from the photovoltaic industry. Added to this is the deterioration in silver mining companies' margins and the significant rise in production costs (+25% by 2023!). Against this backdrop, silver appears to be testing their 2020 highs. For 2024, the Silver Institute anticipates that " the likely easing of US monetary policy is expected to drive a notable rally in precious metal prices, although short-term downside risks persist."

Nevertheless, silver's rise will only be possible if we see a return in demand for investment, silverware and jewelry. This scenario would leave the door open to a price closer to $30, or even $33 if gold outperforms. However, the short-term behavior of market participants is limiting the upside potential, and the silver price ceiling in April 2024 seems to be translating into a rapid exhaustion of positions. All in all, long-term supply conditions make silver structurally attractive for the next few years, despite short- and medium-term effects still being countered.

Finally, a sustained breach of $30, then $33.5, could allow us to consider a return to the 2011 highs of $40/$41, which also corresponds to the technical extension of the last 5 years. However, if such an objective were to be achieved quickly, it would require sustained interest from market players. In any case, the silver trend remains clear, and the bullish upswing during this month of May appears to be a fundamental adjustment in the silver price.

More By This Author:

After Gold, Chinese Are Rushing To Copper And Silver

Gold Vs. Debt Money

Inflation Is Definitely Back In The United States

Disclosure: GoldBroker.com, all rights reserved.