Gold’s Weak Wend Toward Year-End

Image Source: Pixabay

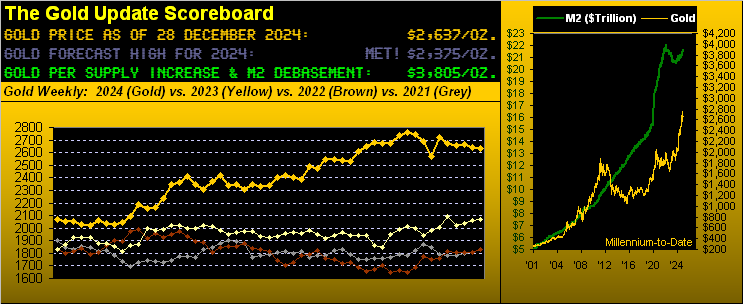

Gold just recorded its seventh down week in the last nine, price settling yesterday (Friday) at 2637 … and yet that is higher than Gold’s settle six weeks ago at 2567 on 15 November.

To be sure, Gold’s 21-day (one month) linear regression trend is negative, and as shown next, the red-dotted weekly parabolic trend remains short, now seven weeks in duration. Across the past nine weeks, Gold’s seven down bars are in red and its two up bars are in green:

“So what you are saying mmb is that price is going down even though it is going up, right?”

In support of Squire, ’tis not an effect of excessive eggnog imbibement. Rather — from a strictly quantitative aspect — we’ve merely a mathematical marvel that makes you go “hmmm…” Yes, the parabolic trend is Short, the price therein having achieved but two up weeks. And yet Gold seems more hesitant rather than in decline. Still, the climb from the present 2637 level to eclipse the ensuing week’s “flip-to-long” level at 2772 is +135 points. Given that Gold’s expected weekly trading range is 85 points, look for this trend to remain short through the New Year, barring any buying extravaganza.

Too, as noted in recent missives, Gold’s weekly MACD (moving average convergence divergence) continues to negatively expand as next displayed. Again, through having measured prior MACD declines, ‘wouldn’t be untoward to see Gold tap the upper 2400s on this run, (our preference of course being that it not so do):

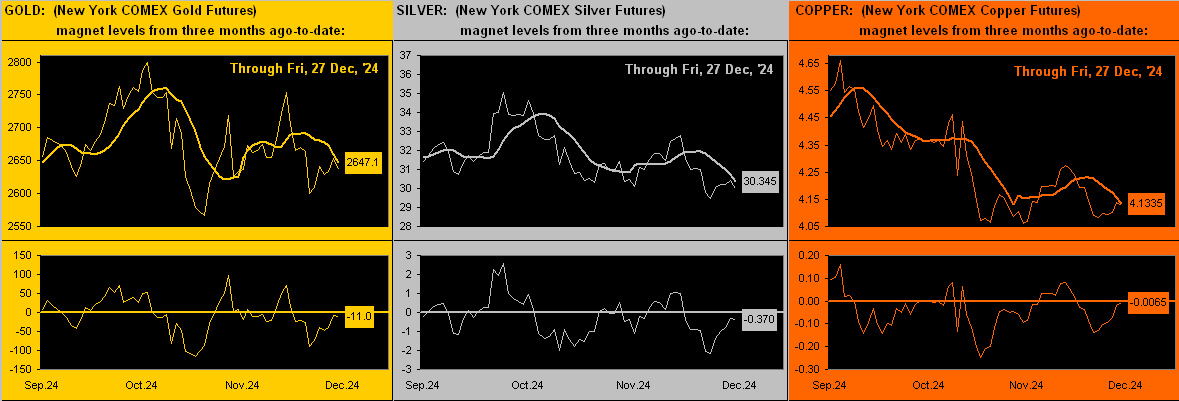

This is our near-term downside Gold view. Now let’s consider the near-term upside view. If for some unconscionable reason, you missed reading yesterday’s Prescient Commentary, from that we’ve this key snippet: “…The Market Magnets of all three elements of the Metals Triumvirate appear poised for penetration to the upside, meaning prices may get a lift into New Year…” Let’s explain.

“You mean for your so-called ‘WestPalmBeachers down there’, mmb?”

‘Twould appear Squire is already getting a giddy dose of New Year’s penetration but to his valid point. The “Metals Triumvirate” simply refers to Gold, Silver, and Copper, each of which maintains a daily, updated page on the website. Our proprietary “Market Magnet” measure is justifiably named as price inevitably is drawn back to its Magnet. Specifically as a trading tool however, upon price penetrating its Magnet, further near-term price follow-through is the expected rule rather than the exception. To wit the following graphic (a tad tight in this display, but viewable as well at the website):

The upper panel for each market tracks its daily closing price (thin line) from three months ago to date; the thick line is the Magnet. The lower panels are the oscillative difference in price compared to the less Magnetic. And what is evident in all three cases is price is now poised to penetrate Magnet to the upside, suggesting a rally for the metals into the New Year. (Again, you can monitor such daily progression at the website).

Meanwhile, struggling for further upside progression — albeit duly holding its own through autumn — is the Economic Barometer. This past week was very muted for the Baro given the wee slate of just four incoming metrics. Therein of note, December’s Consumer Confidence declined on the heels of November’s Durable Orders having shrunk; however, that month’s New Home Sales did increase. So ![]() “When the Econ Baro comes bob-bob-bobbin’ along…”

“When the Econ Baro comes bob-bob-bobbin’ along…”![]() –[hat-tip Harry Woods, ’26], there appears little impetus for the Federal Open Market Committee’s voting to again nudge lower its Bank’s FundsRate come the 29 January Policy Statement. Moreover as herein depicted a week ago, StateSide inflation is still running a bit hot for the Fed’s liking. Either way, here’s the Baro:

–[hat-tip Harry Woods, ’26], there appears little impetus for the Federal Open Market Committee’s voting to again nudge lower its Bank’s FundsRate come the 29 January Policy Statement. Moreover as herein depicted a week ago, StateSide inflation is still running a bit hot for the Fed’s liking. Either way, here’s the Baro:

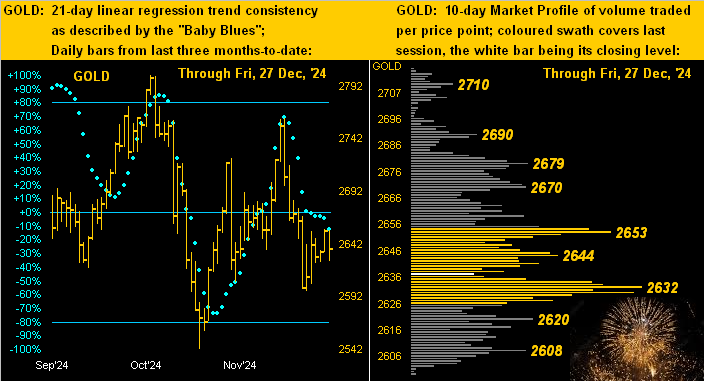

And from the bobbin’ Baro we return to burrowin’ Gold per the following two-panel display of price’s daily bars from three months ago to date on the left and the 10-day Market Profile on the right. Although in this missive’s close, we’ll cite Gold typically having an upside bias for the final two days into year-end, below we’ve the baby blue dots of trend consistency breaking lower. As for the Profile, a bevy of notable support and resistance levels are labeled:

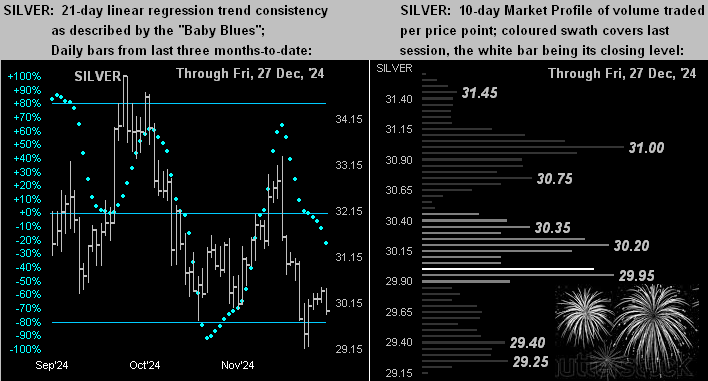

Continuing to be the like case is that for Sister Silver, her “Baby Blues” (at left) accelerating to the downside along with more resistance than support per her Profile (at right):

To close, we’ve two full trading days remaining for 2024. Conventional wisdom presumes “Oh this is gonna happen!” and “Oh that is gonna happen!” as year-end market hysteria unfolds. From our purview, we don’t think much at all is “gonna happen”.

To break it down a bit for those of you scoring at home:

- Notwithstanding Gold’s weak wend toward year-end, century-to-date with just two trading days left in the balance, the price’s median percentage change either way has been 0.7%. The bias is to the upside, with 18 of those 23 yearly finishes being higher for the two days.

- But as to the S&P 500 with just two trading days left in the balance, its median percentage change either way has been 0.6%, the bias being to the downside as 14 of those 23 two-day finishes were lower.

“So mmb, at Monday’s open we go Long Gold and Short the S&P for two days, eh?”

Tempting as ’tis, Squire, the best way always to go is with prudent cash management.

Regardless, as you know, the old saying is “As goes January so goes the year.” And the month’s Main Event commences on 14 January upon U.S. Secretary of the Treasury Janet “Old Yeller” Yellen begging for dough upon which to draw to pay obligations on the nation’s debt. As was so brilliantly scripted in Paramount’s ’64 feature “Paris When It Sizzles”, the Secretary’s performance shall be that “Ultimate and inevitable moment. The final, earth-moving, studio-rent-paying, theatre-filling, popcorn-selling” plea to Congress for “extraordinary measures” to avoid default.

‘Course, the best anti-default asset is Gold!

Next week we’ll have 2024’s final standings of the BEGOS Markets (Bond, Euro/Swiss, Gold/Silver/Copper, Oil, S&P 500) along with your favourite month-end graphics, (plus two trading days into 2025).

More By This Author:

Gold Seeks Charisma ‘Round Inflation’s EnigmaGold Does The Spike And Sink

Gold Boring; S&P Warning

Disclaimer: If ever a contributor needed a disclaimer, it's me. Indeed, your very presence here has already bound you in the Past, Present and Future to this disclaimer and to your acknowledging ...

more