Gold’s Rest Didn’t Give It Strength

Given gold’s recent fall, a relief rally is clearly within the realm of possibility. However, gold may lack the stamina to do even that.

Based on the analogy to 2012, gold was likely to take a breather within the decline that could have taken it as high as the 61.8% Fibonacci retracement. And indeed, we did see a breather, but it took gold only a little higher, and it seems that it’s already nearing its end. Consequently, waiting for gold to rally now would be waiting for something that might have already happened.

To clarify, the size of the move is not that important here as the time that gold took to consolidate.

It’s fine to wait for the broader bottom to be formed, and that seemed to be taking place initially.

That was normal – we saw something like that several times, for example in mid-March 2020 and mid-September 2020. However, gold has been consolidating for over 7 trading days. There was no bottom in recent history that took so long to form.

There were, however, small consolidations that took even a bit longer. And we saw them after gold declined particularly profoundly. I marked those cases with red rectangles – they took place in November 2020 and January 2021. And we see the same thing now. In both previous cases, gold continued to decline, and it declined profoundly once again.

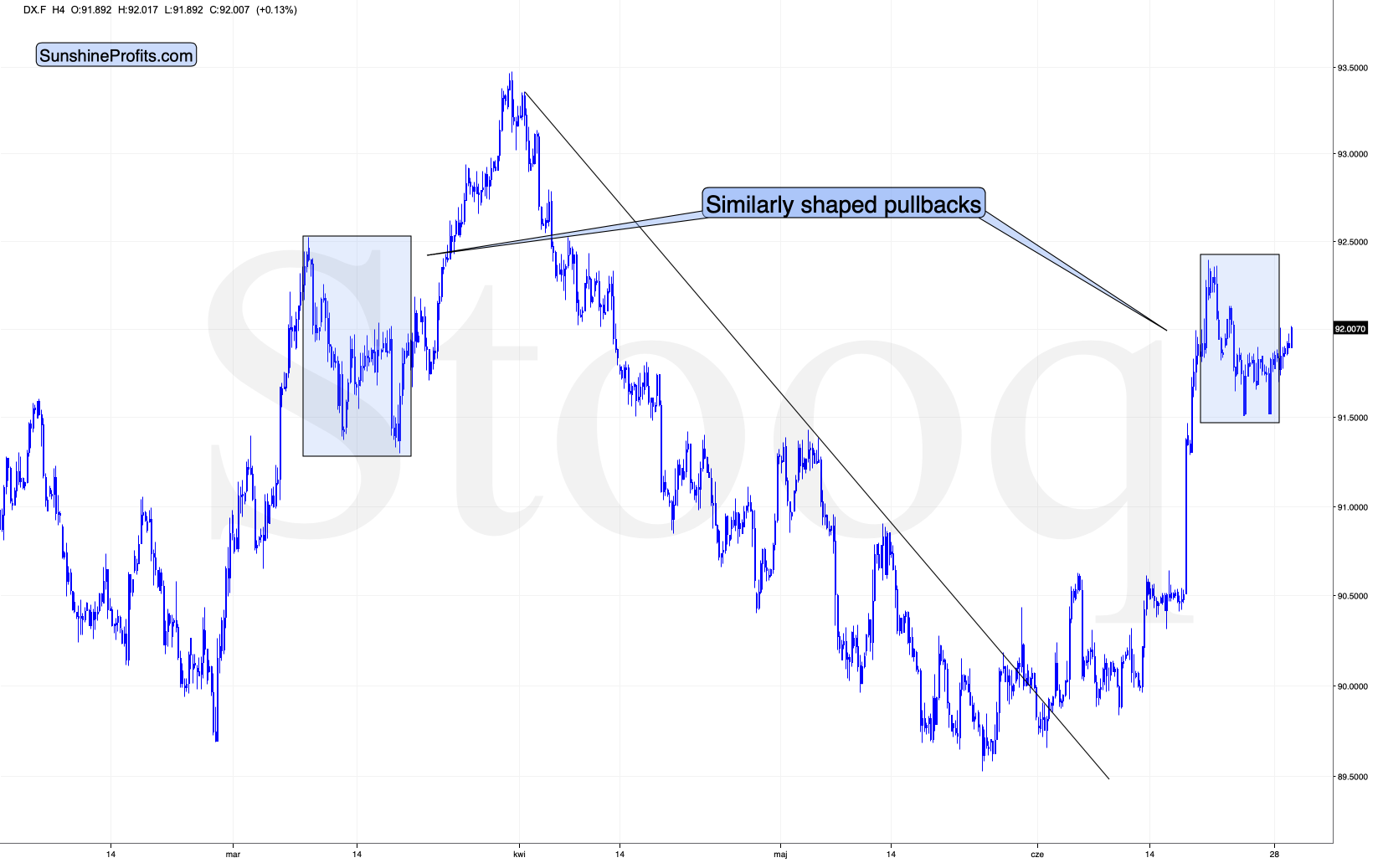

Now, if the USD Index was about to decline significantly, gold would likely rally anyway, but…

The USD Index shaped its corrective downswing very similarly to what it did in late March and early April. And since history rhymes, this could mean that a similar action will follow. And back in April, the USDX simply rallied.

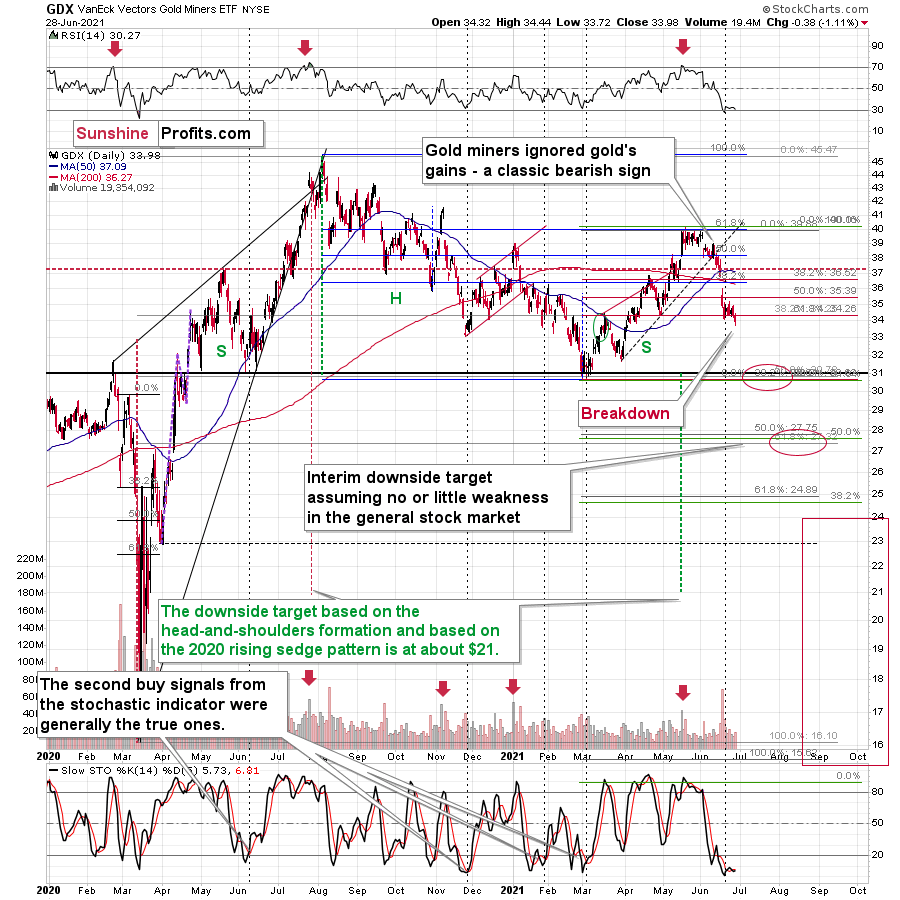

Moreover, gold stocks’ relative performance not only hasn’t stopped indicating the bearish outlook recently but also provided a screaming sell sign once again yesterday.

Namely, the GDX ETF declined and closed below its previous monthly lows as well as below the late-April lows. This breakdown took place without gold’s help, which makes it particularly bearish.

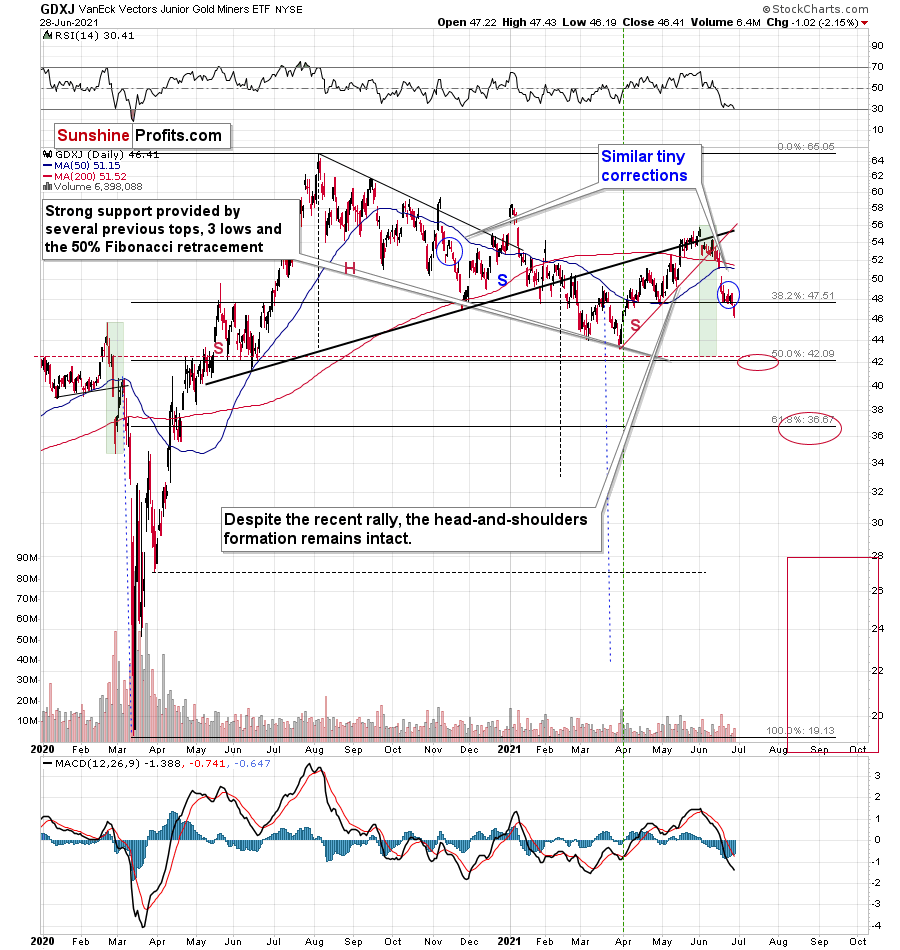

The breakdown was even more profound in the case of the GDXJ – a proxy for junior mining stocks.

The size of the recent “upswing” was comparable to the mid-November 2020 one, so it confirms the analogy to this period that I mentioned while discussing the gold’s chart.

The next short-term downside target is at about $42 – a bit below the previous lows as that’s where the 50% Fibonacci retracement line coincides with the previous highs and lows (and also with the 2019 highs that are not visible on the above chart).

All in all, it seems that the outlook for the precious metals market –especially for the junior gold miners – is very bearish for the following weeks and months.

Disclaimer: All essays, research and information found on the Website represent the analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong ...

more