Golden Storm: The Epic Rise Of Gold Prices To Uncharted Heights

Image Source: Pixabay

Fundamentals:

On Tuesday, the price of gold went way up, hitting over $2,100 per ounce in New York, a record high. This happened because a lot of big economic things are going on in the world right now that are making investors very interested in gold.

One big reason is that when you adjust for inflation, even though the price is high now, it's still not as high as it was at some points in the past, like in 1980, 2011, and 2020. This shows that people still really like gold when things like prices are going up fast or when the economy seems uncertain.

A big part of why gold is doing so well lately is because people are thinking that the U.S. might lower interest rates soon. When interest rates go down, it becomes less attractive to keep money in things like savings accounts or bonds because they don't pay much interest. So, people turn to things like gold instead, which don't pay interest but are considered safer during uncertain times.

People who trade gold are pretty sure that interest rates might drop by June, which is making them bet more on gold. This confidence is showing up in the futures market, where gold prices are going up because people expect lower interest rates.

But, there's still some uncertainty about what the Federal Reserve, which controls interest rates in the U.S., will actually do. Everyone's watching Jerome Powell, who's in charge of the Federal Reserve, and waiting to see what he says to Congress. Also, they're keeping an eye on important economic reports like the U.S. services PMI and labor numbers, which could also affect gold prices.

All of this isn't just about gold; it affects other things like the stock market, too. When people start thinking about interest rates changing, it can shake up a lot of different parts of the economy. So, whether this is good or bad for gold investors, who are sometimes called gold bugs, isn't totally clear yet. This just goes to show that financial markets can be really unpredictable.

Let's zoom into next month's standard deviation report and see what we can identify as a potential trading opportunity.

GOLD: Monthly Standard Deviation Report

Mar. 05, 2024 8:25 AM ET

Summary

- The monthly trend momentum for gold futures is currently bullish, indicated by market closing above 9 SMA.

- Monthly price momentum is also bullish, confirmed by market closing above VC Monthly Price Momentum Indicator.

- Traders advised to take profits at specific levels for both long and short positions, and monitor cycle due date for potential shifts.

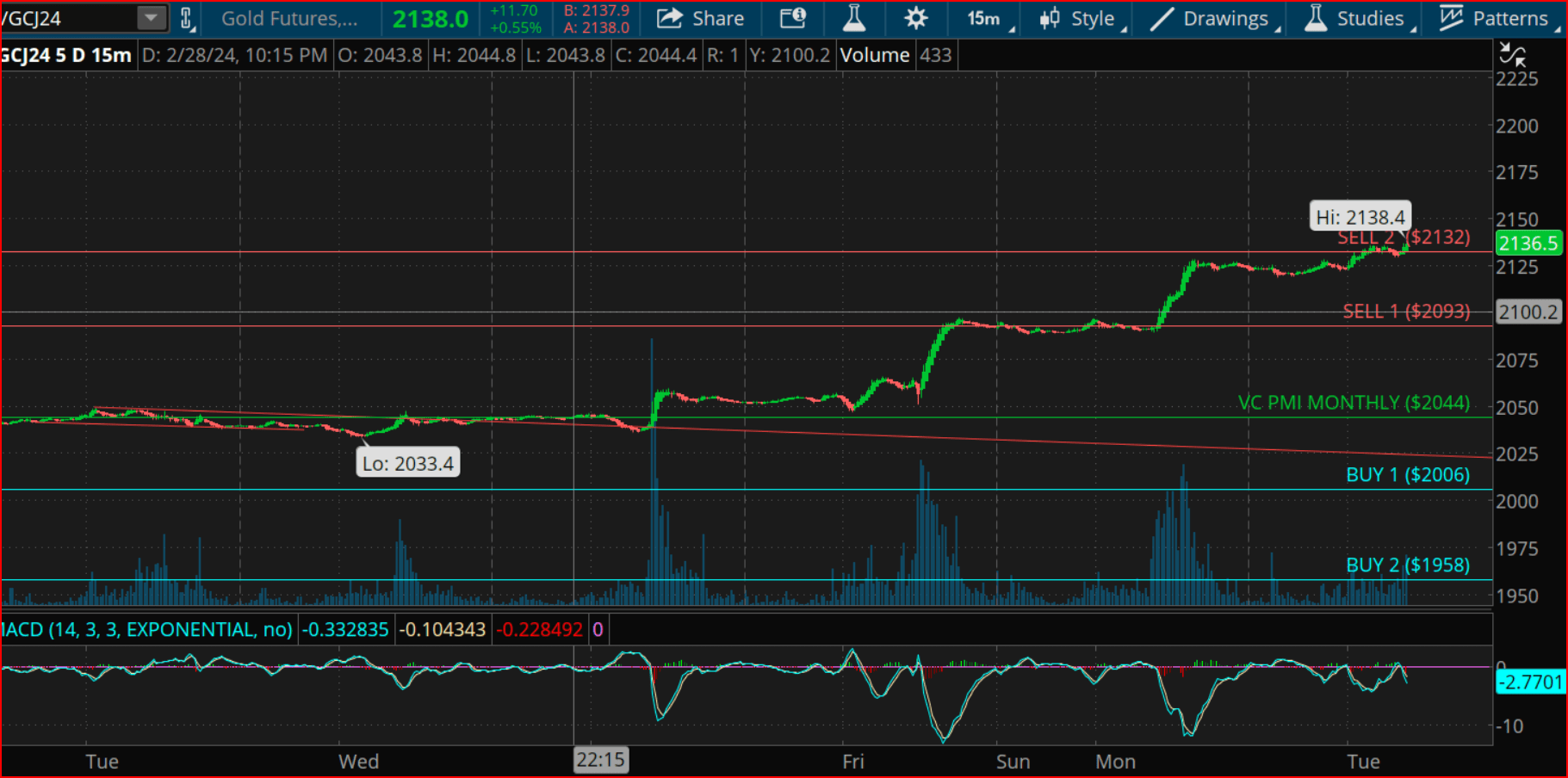

(Click on image to enlarge)

gold monthly (tos)

Monthly Trend Momentum: The monthly trend momentum for gold futures is currently bullish. This is indicated by the market closing at 2055, which is above the 9 SMA (Simple Moving Average) of 2032. The 9 SMA is a commonly used technical indicator that smooths out price data by averaging the closing prices over the last nine periods. When the market closes above this moving average, it suggests upward momentum in the price of gold. However, it's important to note that if the market were to close below the 2032 level, it would negate the bullish trend, shifting it to neutral. Traders should monitor these levels closely to gauge the strength of the trend.

Monthly Price Momentum:

The monthly price momentum for gold futures is also bullish. This is confirmed by the market closing above the VC (Volume Confirmation) Monthly Price Momentum Indicator of 2045. The VC indicator is a technical tool that combines price and volume data to assess the strength and direction of price momentum. When the market closes above this indicator, it suggests strong bullish momentum in the price of gold. However, similar to trend momentum, if the market were to close below the VC Monthly indicator, it would indicate a shift to neutral momentum.

Monthly Price Indicator:

The monthly price indicator provides guidance on potential profit-taking and stop levels for both long and short positions. For short positions, traders are advised to consider taking profits on corrections at the 2006–1958 levels. These levels represent potential areas of support, where the price of gold may temporarily reverse or consolidate. For long positions, traders should use the 1958 level as a Monthly Stop Close Only and Good Till Cancelled order. This means that if the market closes below this level, the stop order will be triggered to limit potential losses. Additionally, traders are advised to take profits on long positions as the market reaches the 2110– 2151 levels during the month. These levels represent potential areas of resistance where the price of gold may encounter selling pressure.

Cycle: The next cycle due date for gold futures is 3.15.24. Cycle analysis involves identifying recurring patterns or cycles in the price of an asset over time. By identifying these cycles, traders can anticipate potential turning points or changes in trend direction. The specified cycle due date provides a reference point for traders to monitor for potential shifts in market dynamics.

Strategy:

The recommended strategy for gold futures trading is to take profits if long positions reach the 2110–2151 levels. This suggests that traders should consider closing out their long positions and locking in profits as the market approaches these levels. This strategy aligns with the expectation that the price of gold may encounter resistance and potentially reverse at these higher price levels.

Create a new in-article marketing unit by entering text and an image here.

If you’d like to update an existing in-article marketing unit, select one from the ‘Edit’ drop-down menu in the upper-right corner of this page.

More By This Author:

Gold Futures Weekly Trend Update: What You Need To Know

Gold Price Fluctuations: A Deep Dive Into Recent Market Trends

Gold's Roller Coaster: Surprises, Signals, And Speculation In The Precious Metal Market

Disclosure: I/we have a beneficial long position in the shares of GDX either through stock ownership, options, or other derivatives.

Disclaimer: The information in the Market Commentaries ...

more